Asian Futures:

- Australia's ASX 200 closed at 7,058.60

- Japan's Nikkei 225 futures are up 140 points (0.47%), the cash market is currently estimated to open at 29,782.69

- Hong Kong's Hang Seng futures are up 120 points (0.42%), the cash market is currently estimated to open at 28,913.14

UK and Europe:

- The UK's FTSE 100 futures are up 65 points (0.94%)

- Euro STOXX 50 futures are up 22 points (0.56%)

- Germany's DAX futures are up 73 points (0.48%)

Thursday US Close:

- The Dow Jones Industrial rose 305.1 points (0.9%) to close at 34,035.99

- The S&P 500 index rose 45.76 points (1.11%) to close at 4,170.42

- The Nasdaq 100 index rose 222.281 points (1.61%) to close at 14,026.20

US Data Continues to Excel

The US cannot complain on the data front – it was a fine set indeed. Initial jobless claims fell, NY manufacturing rose to its highest level since October 2017, industrial production hit a seven-month high, and retail sales absolutely smashed it, rising 9.8% in March versus 5.9% expected (8.4% excluding autos). Well done shoppers! (Even if it was with free money… which likely explains the lack of market reaction at time of release).

Usually this would see a rise in expectation for the Fed to tighten. But the Fed have clearly done their job at convincing the markets they won’t budge, given expectations for them to raise rates remain almost on-existent this year, according to the Fed CME tool.

Bond yields moved lower, counter to logic which suggests they should rise. But with markets not expecting a hawkish Fed any time soon (and bond prices rallying from key support levels) then there could indeed be further downside for yields over the coming week/s.

ASX 200 to Reach 7100?

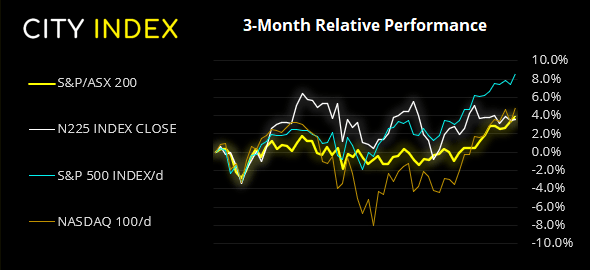

It’s certainly not impossible, and it could even happen today if recent bullish momentum is anything to go by. Sentiment is strong heading into the session and Australian data is also firmer than expected overall, with yesterday’s employment set being the latest of a strong bunch.

The ASX 200 closed to its highest level since February’s 2020 peak (and dramatic selloff) and has enjoyed two session above 7,000. Our bias remains bullish above the 7000/12 zone, with 7,100 set as its next target and for an eventual re-test of its 7197 high.

The Dow Jones hit a new milestone, closing above 34,00 for its first time on record and the S&P 500 also hit a new all-time high, led by technology stocks. On that note the Nasdaq 100 erased the prior days losses to close at a record high. We had flagged its potential to retrace, given the large bearish engulfing candle on Wednesday yet it made no attempt to test Wednesday’s low before screaming higher.

Learn how to trade indices

Forex: EUR/USD stops pips away from 1.2000

The US dollar index (DXY) touched a fresh one-month low overnight although bearish momentum is waning, and the session closed with a small indecision candle (Doji) beneath the 50-day eMA. Given its low stopped just shy of our 91.30/40 target zone we are now on guard for a potential bonce on the dollar.

- Conversely, EUR/USD stopped just 7 pips below 1.20 so, given the significance of this round number resistance level, profit-taking and a minor retracement (at the least) would not come as a surprise.

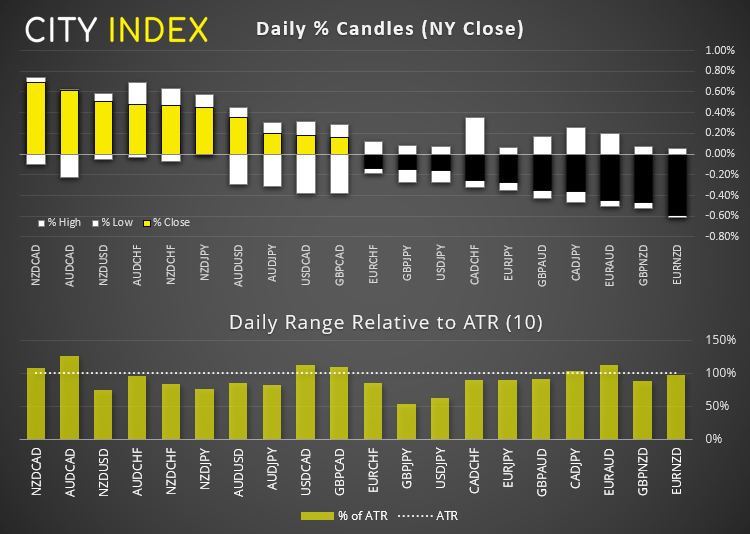

- NZD and AUD were the strongest majors whilst CAD was the weakest, placing NZD/CAD and AUD/CAD at the top of the leader-board.

- Despite oil prices hitting new highs overnight, lower factory sales weighed on the Canadian dollar, which resulted in a false break below 1.2500 on USD/CAD. Given the lack of a divergent theme on tis pair, it’s a step aside for now.

- AUD/JPY nudged its way to a new high in line with yesterday’s bias, but we really need to see prices break above 84.50 sooner than later. Perhaps a strong set of data from China today could help it on its way.

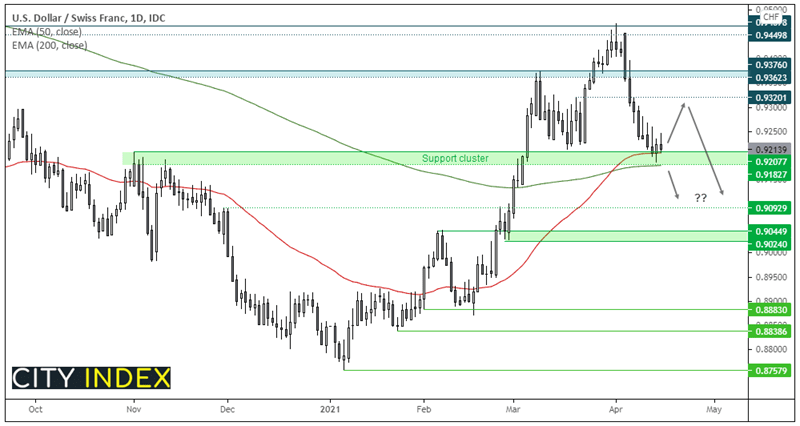

USD/CHF is still trying to form a base around 0.9200, having found support at its 50 and 200-day eMAs and November high. Furthermore, an inverted hammer with two indecision candles printed above support over show bearish momentum is waning. It may not be a screaming ‘buy’ just yet, but we would not be looking to short around current levels, given the extended nature of the down leg and strong support nearby.

- The bias is for a bounce from current levels, although the core view is for an eventual break lower.

- 0.9300 is a potential bullish target, but we want to see more evidence of bullish momentum returning first.

- We may be interested in shorts if or when prices break below its 200-day eMA / 0.9183 support.

Learn how to trade forex

Metals - Copper load of that

Copper prices rose to their highest level since February overnight, and rising 2.2% for its second consecutive day. Bullish range expansion is clearly underway as its retracement held above a cluster of support around $4.00 last week and now trades at $4.22. WHY????

Palladium closed to a 14-month high after breaking above 2700 to confirm its inverted head and shoulders pattern, which projects a target around 2895, although another technical target resides at 2840, projected from its sideways range.

Gold futures hit a six-week high of 1769.37 before settling the day above its 50-day eMA at 1763.81. Whilst we didn’t get the close we sought above 1765, it does confirm the double bottom pattern which formed around 1680 in March. Silver also broke above the 50-day eMA and to a ew cycle high and reached our initial 26.00 target with 26.50 now in focus whilst prices remain above yesterday’s low (25.64).

Oil prices were a touch higher overnight, with WTI trading just below $64 and brent briefly toughing $67. Whilst bullish momentum is clearly wavering, its trend remains bullish so we are on the look out for small retracements or periods of consolidation to consider longs, since breaking out of their ranges. If the US dollar is to recover from tis lows, it could help oil perform these minor retracements.

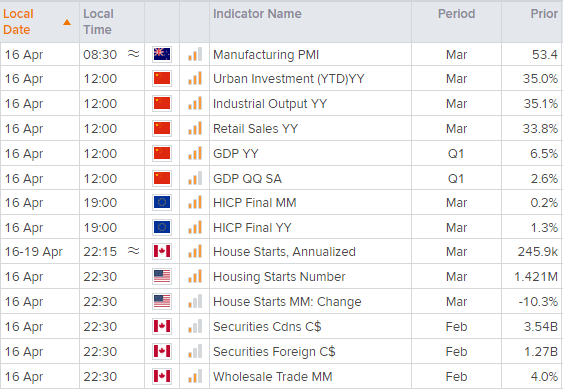

Up Next (Times in AEST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.