As traders already know, inflation has been running hot these last few months! Recent inflation data from the US and the UK both beat already high expectations. The Canadian October CPI headline print was hot as well, at 4.7% YoY vs 4.4% YoY in September. This was the highest reading since February 2003! In addition, the Core CPI YoY for October was 3.8% vs 3.7% in September, the highest level in 30 years! As a result, one would expect USD/CAD to be tanking, as stronger inflation in Canada should lead to a stronger Canadian Dollar, especially with the BOC ending their bond buying program at their last meeting. However, expectations were for the headline CPI to be 4.7% and the Core CPI to be 3.8%, therefore there was no “beat” of expectations as in the US and UK. As a result, the Canadian Dollar actually sold off vs the US Dollar on the release of the data.

Trade USD/CAD now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

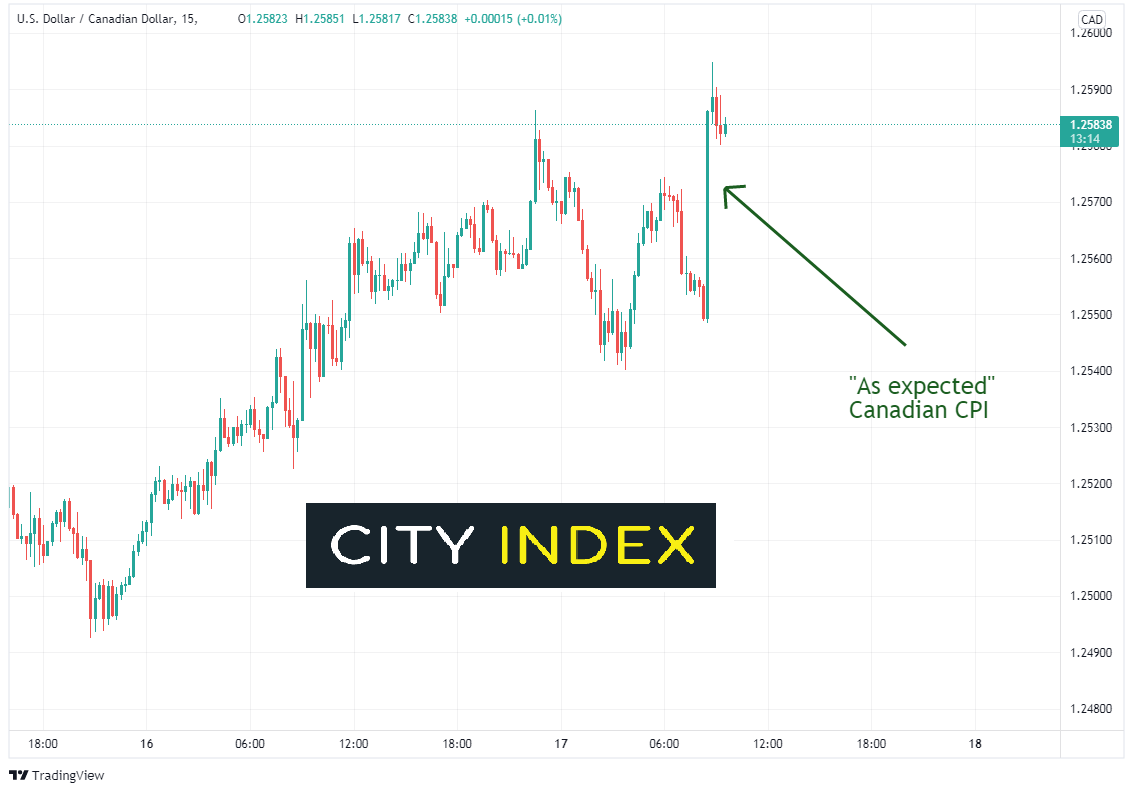

On a 15-minute chart, USD/CAD immediately moved higher on the release of the data. Price moved from 1.2549 to 1.2595 within a few minutes, a move to 46 pips!

Source: Tradingview, Stone X

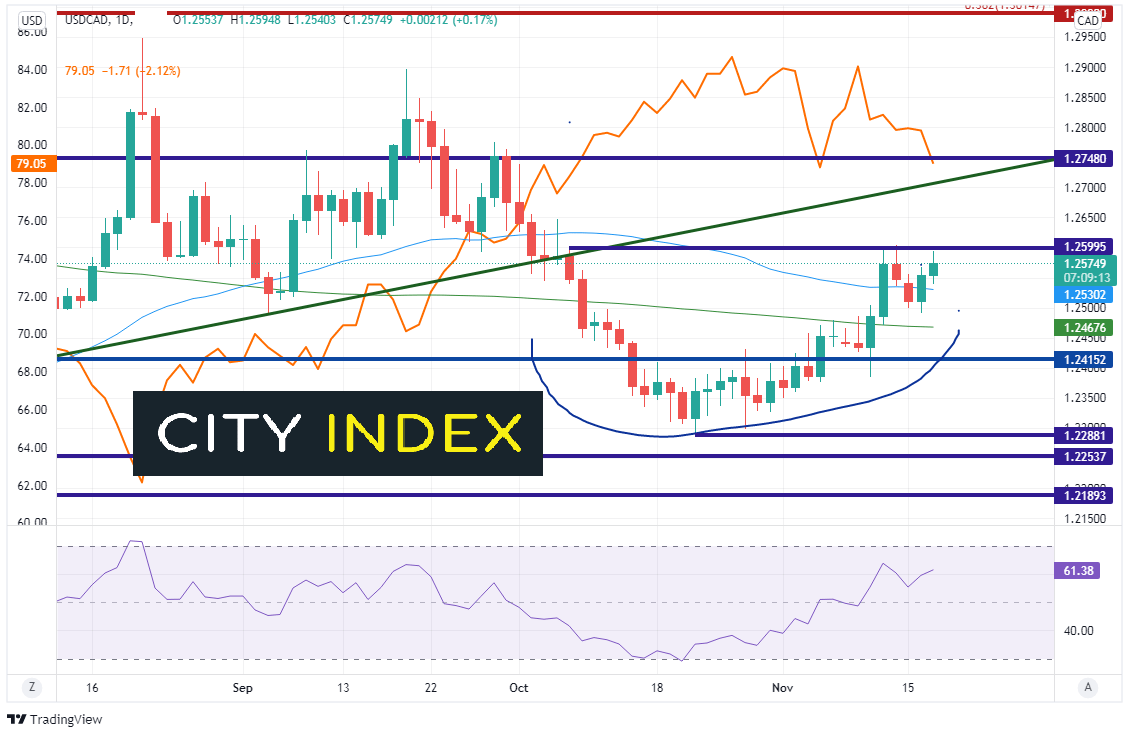

USD/CAD had already been moving higher since price pulled back to the to 1.2288 in late October as Crude Oil (orange line) was making new highs near $85. The pair paused near the 200 Day Moving Average and horizontal resistance between 1.2530 and 1.2599, respectively. However yesterday, USD/CAD formed a bullish engulfing candlestick on the daily timeframe, indicating higher prices could be ahead.

Source: Tradingview, Stone X

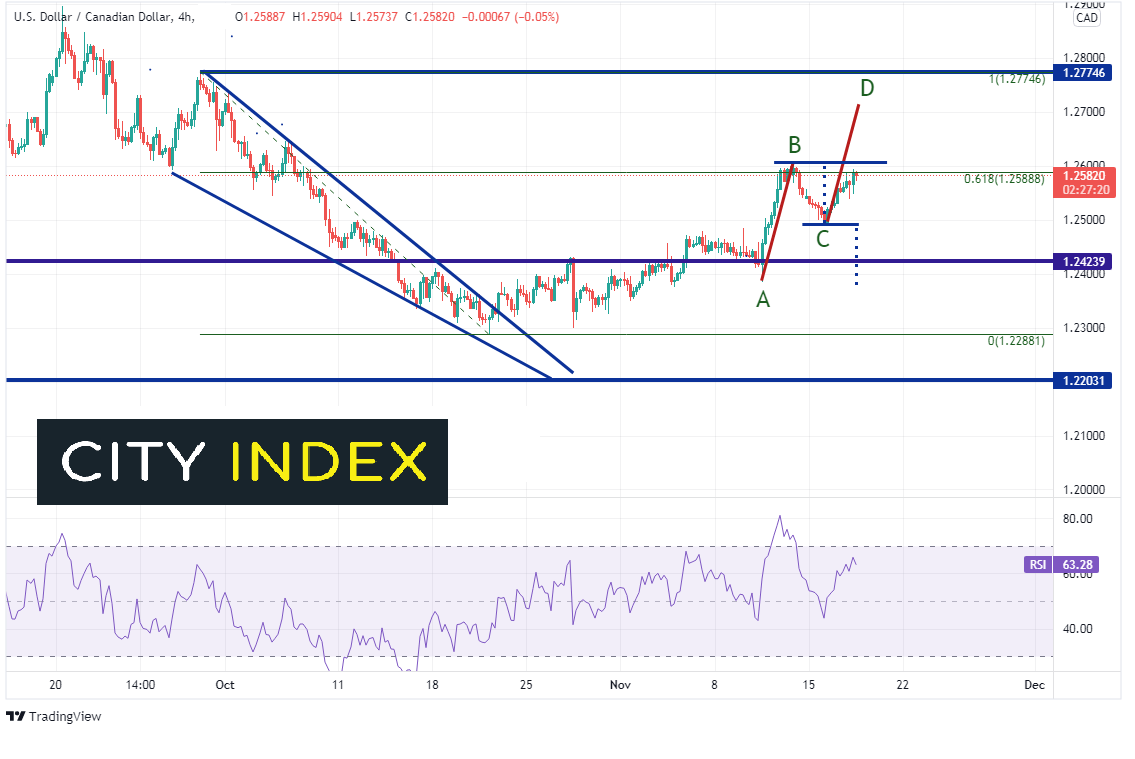

On a 240-minute timeframe, not only was there horizontal resistance at the recent highs, but it was also the 61.8% Fibonacci retracement from the highs on September 29th to the lows on October 21st, near 1.2589. Notice too, that on October 21st price broke higher out of a descending wedge. The target for a descending wedge is a 100% retracement. In this case the target is 1.2775. If price closes above 1.2604 on a daily timeframe, there is little standing in the way from price moving to the target. However, the first target should be 1.2715, which is the target for the AB=CD pattern.

Source: Tradingview, Stone X

If price holds the 1.2604 level (negating the bullish engulfing candle) and breaks below 1.2492, it will have formed a double top on a short-term timeframe. The target would be near 1.2380. Horizontal support ahead of the target is 1.24324. Below there, price can retrace to the October 21st lows at 1.2288.

Higher CPI from Canada may result in an increase in interest rates sooner than expected, as Canada has already ended it bond buying program. However, “as expected” CPI from Canada resulted in a selloff in the Loonie today, as traders were hoping for more!

Learn more about forex trading opportunities.