UK housebuilders hammered in 2022

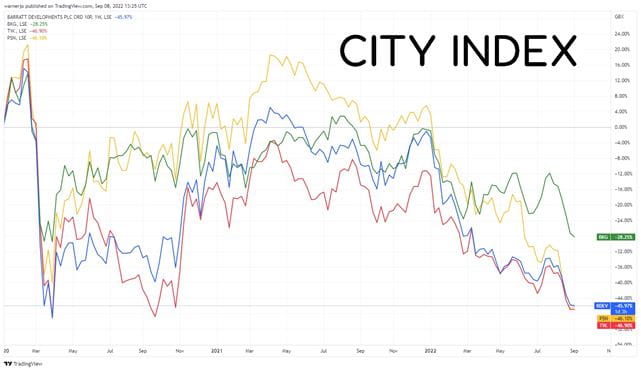

The FTSE 100’s housebuilders have seen their valuations decimated this year. Persimmon has led the charge and lost almost half of its value since the beginning of 2022, Barratt Developments shares have plunged 45%, the Taylor Wimpey share price is down 40%, and Berkeley Group has fallen over 28%.

All four have all collapsed to trade close to the lows seen when the Covid-19 crisis erupted and derailed financial markets back in March 2021.

FTSE 100: Are housebuilders cheap?

The selloff has seen housebuilder valuations slump to new lows. Today, all four stocks trade at between 5.0x and 9.0x their forecasted adjusted earnings for their respective current financial year. This makes them look cheap compared to the price-to-earnings (PE) ratios they have earned in the past, and makes them one of the cheapest sectors within the blue-chip index right now considering the FTSE 100 currently trades at a ratio of around 14.0x.

|

Stock |

PE Ratio |

2-Yr Av |

5-Yr Av |

10-Yr Av |

|

Barratt |

5.5x |

12.5x |

10.3x |

14.6x |

|

Taylor Wimpey |

5.6x |

15.0x |

11.6x |

12.2x |

|

Persimmon |

6.0x |

11.4x |

10.1x |

12.1x |

|

Berkeley Group |

8.5x |

12.5x |

10.2x |

10.4x |

(Source: Bloomberg)

PE ratios at this level suggests two things. One, markets are undervaluing UK housebuilders or, two, the group has suffered because investors are worried about their prospects and expect slower growth.

At first glance, it would appear to be the former. The continued imbalance between supply and demand has supported pricing. The average house price is some 8% higher now than it was a year ago and almost 25% higher than before Covid-19 hit. This has been more than enough to cover the impact of rampant inflation that has pushed up costs by some 5% to 10% as everything from labour to building materials becomes more expensive. The result has been bumper profits. Barratt reported record annual profits just this week and its peers in the FTSE 100 are also on course to report their highest earnings in years.

However, there is little doubt that the outlook for housebuilders is more clouded now than it was at the start of the year, and that growth could become harder to deliver going forward.

Is the UK housing market suffering from a slowdown?

It is becoming more expensive to buy a home, not just because house prices have continued to soar but also because interest rates have climbed to their highest level since the financial crisis erupted in 2008, making mortgages pricier for house hunters. That comes at a time when pay packets are being stretched and putting money aside becomes all the more difficult thanks to the cost-of-living crisis, with the UK possibly heading into a recession before the year is out.

HSBC warned in early September that this will lead to a 20% slump in demand over the next year starting this autumn, and there are signs that this has already started. Fewer people are making enquiries about buying a new home. Barratt said net private reservations per outlet fell to 0.60 during July and August from 0.82 the year before and dropping below the 0.70 delivered before the pandemic. CEO David Thomas said the trading environment had become more challenging since the start of July, adding ‘we recognise that consumer confidence is low’. Persimmon also said reservations had dropped 11% in the first seven weeks of the second half of 2022, although they remain elevated compared to 2019-levels.

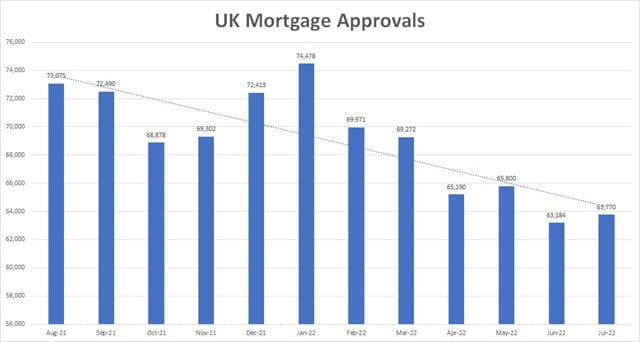

The more pessimistic view is supported by the fact mortgage approval rates have been on the slide since January. Demand exploded during lockdown as people yearned for their own space, but this has continued to unwind this year, enough to push approval rates back below pre-pandemic levels for the first time in recent months.

(Source: Bank of England)

Housebuilders to pivot to shareholder returns

It isn’t just fears of a slowdown in demand that is at play. Several housebuilders have flagged that competition for new land is intensifying, making it more difficult to find new potential plots that can deliver sufficient returns. Plus, it is taking longer to secure planning permission. UBS warned earlier this year that a slowdown in the planning system, which ‘appears to be slow due to resource constraints and Covid-19 backlogs’, is increasing risks for housebuilders and delaying their ability to open sales outlets and launch new sites.

Berkeley Group, which stands out by selling premium homes to wealthier people across London and the South East, has said it is ‘increasingly difficult to find new land that can accommodate today’s costs of development and generate appropriate returns’. Barratt, which builds a more diverse set of housing over a wider geographic area, has also said it is more challenging to source land that meets its ‘disciplined’ hurdle rates.

Notably, new prime minister Liz Truss has previously shown frustration with the current planning system and has called it ‘too bureaucratic, too slow and too complex’ while calling for reform, providing hopes that the current planning problems could be addressed with a new leader at the helm.

The good news is that investors are set to reap rewards from this. Housebuilders, which are known for delivering steady cashflow, are set to return more money to shareholders if there are fewer investment opportunities. All four already boast sizeable land banks that could keep them busy for years even if the shortage in land persists for a prolonged period of time.

Barratt has said it will return any excess capital that can’t be deployed to generate future growth, having launched a new £200 million share buyback this week. That echoed a similar tone from Berkeley, which said ‘the focus will shift to returning surplus capital, over and above the current annual scheduled payments to shareholders’.

Are UK housebuilders undervalued?

The collapse in valuations this year reflects an increasingly tough outlook for the rest of 2022 and 2023. Risks have risen. Rampant inflation, rising rates and the threat that the cost-of-living crisis they have fuelled will lead to a recession paints a bleaker picture for the industry.

That has slammed the brakes on growth expectations. Revenue growth is expected to slow going forward. Barratt and Persimmon are both expected to see profits start to fall from recent highs in 2023, and while Taylor Wimpey and Berkeley are forecast to keep increasing their bottom-lines this will be at a significantly slower rate than what investors have become accustomed to in recent years.

However, the fundamentals remain strong. Supply and demand are as imbalanced as ever and there are no signs that this will change anytime soon. The UK government has long been pursuing a target of building 300,000 new homes each year by the mid-2020s but ministers have been slowly edging away from this goal in recent years. It is still far short of that considering the industry has failed to build over 250,000 homes a year for decades, and analysts have suggested 300,000 annual builds would have only just started to scratch the imbalance. New prime minister Liz Truss has said she is in favour of scrapping the goal and turning to a bottom-up system from the current ‘Soviet top-down’ system.

Supply is therefore set to remain limited, pushing the focus on demand. Forward sales books remain strong, the number of outlets is growing despite the slow planning process, and housebuilders are proving one of the few sectors immune from inflation. For now, demand is holding up as unemployment remains at near 50-year lows and job vacancies remain at record highs, which in turn is also supporting wages (although this continues to lag inflation). The fear is that this could change amid widespread expectations that the economy will falter toward the end of this year, with house price growth already starting to cool. It is worth noting that the unwinding of pandemic-induced growth is contributing to this as things continue to normalise following an unprecedented couple of years.

We may see the pressure persist on share prices this year and into next based on the current outlook but the potential for increased shareholder returns, combined with strong long-term fundamentals, suggests that UK housebuilders are currently hot value stocks to consider for those focused on the long-term.

With that in mind, dividend yields remain buoyant and support the view that most housebuilders offer good value at present. Barratt and Taylor Wimpey currently boast a 12-month dividend yield of around 8%, according to data from Bloomberg, while Persimmon is yielding at over 15%. Housebuilders remain cash-generative and are happy to return this to shareholders if they can’t invest it suitably. It is worth noting that most are likely to return the vast majority of excess cash not through dividends but via share buybacks.

While markets may have fallen out of love with housebuilders this year, brokers remain largely bullish. Still, we have seen brokers scale back their expectations in recent months and average target prices have been falling, with the most recent upgrades suggesting there is more limited upside potential over the next 12 months than the average targets suggest.

|

Stock |

Average Rating |

Target Price |

Potential Upside |

|

Barratt |

BUY |

704.50p |

69% |

|

Taylor Wimpey |

BUY |

171.30p |

61% |

|

Persimmon |

BUY |

2,406.40p |

64% |

|

Berkeley Group |

BUY |

4,637.70p |

32% |

(Source: Refinitiv)

How to trade FTSE 100 stocks

You can trade a variety of housebuilding stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the stock you want in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can try out your trading strategy risk-free by signing up for our Demo Trading Account.