Yesterday in New Zealand, the unemployment rate fell to an 11-year low of 3.9%. Just 24 hours later, the Reserve Bank of New Zealand (RBNZ) surprised the market and cut the Official Cash Rate (OCR) by 50bp to 1.00%.

In the lead up to today’s meeting, a 25bp cut was fully priced and expected by most economists. However, with an eye to the headwinds buffeting the global economy “Global economic activity continues to weaken, easing demand for New Zealand’s goods and services. Heightened uncertainty and declining international trade have contributed to lower trading-partner growth.” the RBNZ elected to meet these challenges head-on.

The larger than expected cut designed to help the RBNZ meet employment and inflation objectives. "Our actions today demonstrate our ongoing commitment to ensure inflation increases to the mid-point of the target range, and employment remains around its maximum sustainable level."

In response, the NZD/USD has fallen from 0.6546 to below 0.6400. The AUD/NZD cross rate rallied from 1.0350 to 1.0480, over 200 points higher than where it traded 24 hours earlier. Not to be outdone the AUDUSD is making fresh multi-year lows after breaking below .6725, the flash crash low from earlier this year.

What does this mean for the Antipodean currencies?

The escalation in the U.S.- China trade war reflects a determination by both sides to dig their heels in, and a protracted trade war has become the base case going forward. Equities are likely to remain under pressure, and more rate cuts are expected to come from both the RBNZ and RBA – none of which is good news for the Antipodeans.

Turning to the longer-term charts, there is little in the way of downside support for the AUDUSD now until some congestion that occurred during the GFC around .6500c. For those that remember the GFC, once this level broke, it was all one-way traffic until the GFC .6007 low.

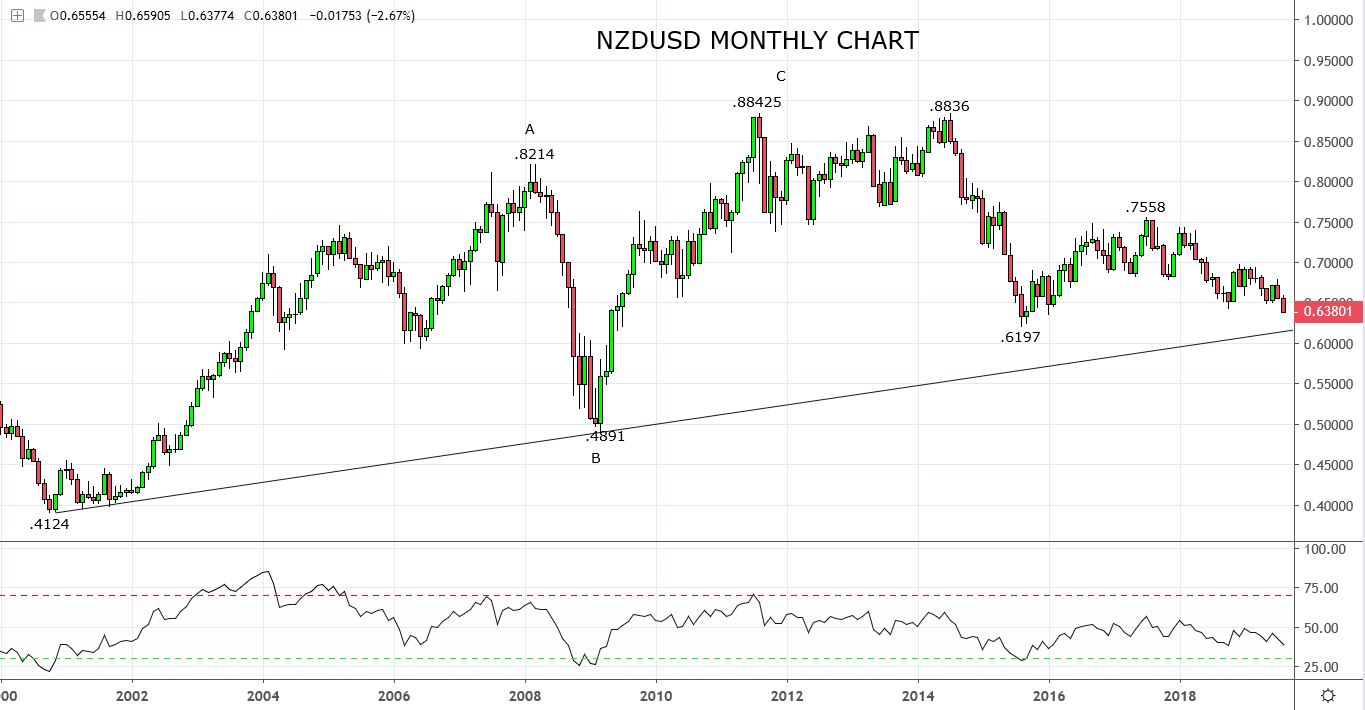

For the NZDUSD, the next key downside support level is not until .6200/6150, which comes from the August 2015 low and the uptrend support from the .4124 low from 2000.

Source Tradingview. The figures stated are as of the 6th of August 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.