Earlier this week, we outlined some of the key economic factors that we thought the RBNZ would consider in its interest rate meeting yesterday. Based on the available evidence our conclusion was the RBNZ would surprise the market and elect to keep interest rates on hold, which proved to be correct.

When asked what the deciding factor was, Governor Orr conveniently ignored Tuesdays drop in 2 year inflation expectations (which is the time frame monetary policy matters most) and instead noted that 5 year and 10 year inflation expectations remained well anchored at the midpoint of the RBNZ's target band.

While this may be true, it offers a convenient alibi to a subject we canvassed in this article https://www.cityindex.com.au/market-analysis/central-banker-chit-chat-and-the-nzd/. It is acknowledged that central bankers do talk amongst themselves, and perhaps its no coincidence that the FOMC, RBA, and RBNZ all delivered interest rate cuts totalling 75bp in 2019 and then showed a reluctance to ease further.

Which brings me to the subject of today’s note. Have the RBA mistaken not cutting interest rates for a fourth time in 2019 considering today’s weak Australian jobs data for October?

The -19k fall in employment was the first fall since May 2018 and the largest fall since August 2016. Weakness was broad-based with both full time (-10.3k) and part-time employment (-8.7k) falling. Both the unemployment rate and the underemployment rate ticked higher to 5.3% and 8.5% respectively, despite a small drop in the participation rate.

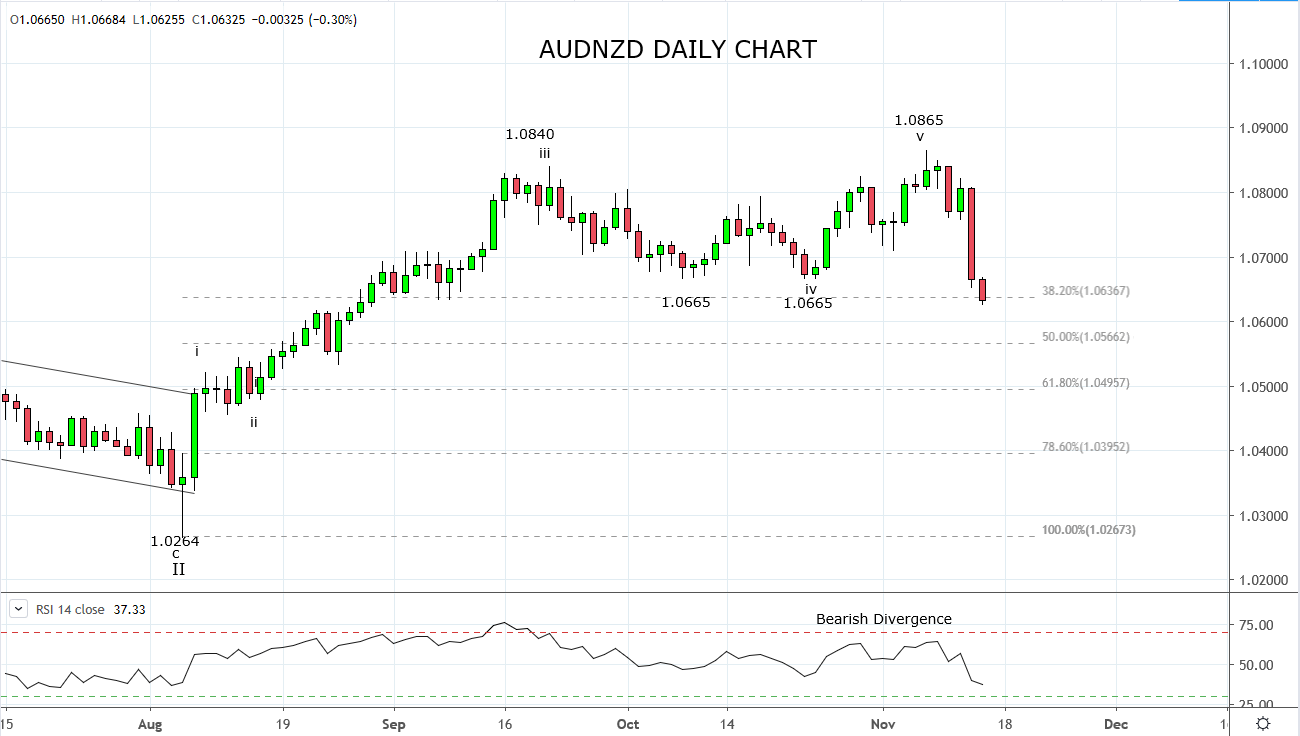

As a result, AUDNZD has fallen into the 1.0640/1.0570 support zone that includes the 50% Fibonacci retracement of the rally from the August 1.0264 low to the recent 1.0865 high. However, the impulsive nature of the selloff over the past 48 hours has created a degree of technical damage that is likely to keep buyers on the sidelines in the near term.

For now, the sensible course of action in AUDNZD is to allow the market time to stabilise and look for signs of a base to form over the coming weeks.

Source Tradingview. The figures stated areas of the 14th of November 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.