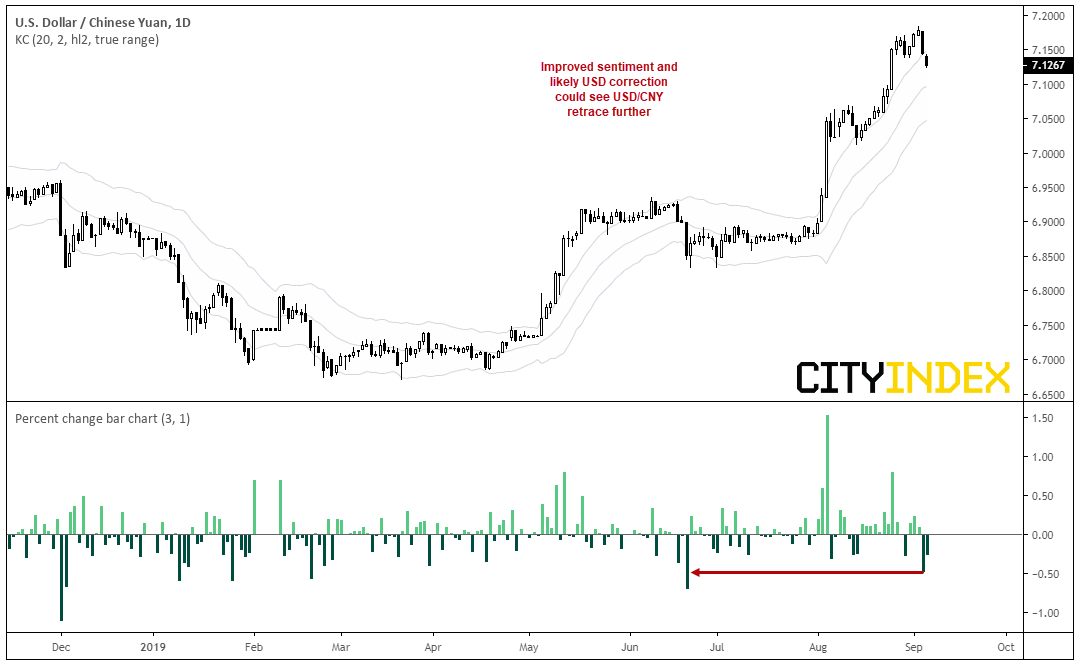

In-light of a weaker USD and lift in sentiment, we could see pairs such as USD/CNH and USD/SGD extend their corrections

It’s early days, but we’ve seen a slight lift in global sentiment, resulting in the Chinese Yuan being allowed to appreciate against the USD at its fastest daily pace in 2-months yesterday. Considering that multiple USD majors and crosses displayed bearish reversal candles on Tuesday, before extending losses yesterday suggests it’s likely the USD correction is truly underway. So, in-light of improved sentiment, USD/CNY (and therefor USD/CNH also) could also retrace against their parabolic moves seen since May. Or we could consider trading ASEAN trade partner such as USD/SGD, as there are loose correlations among such trading partners.

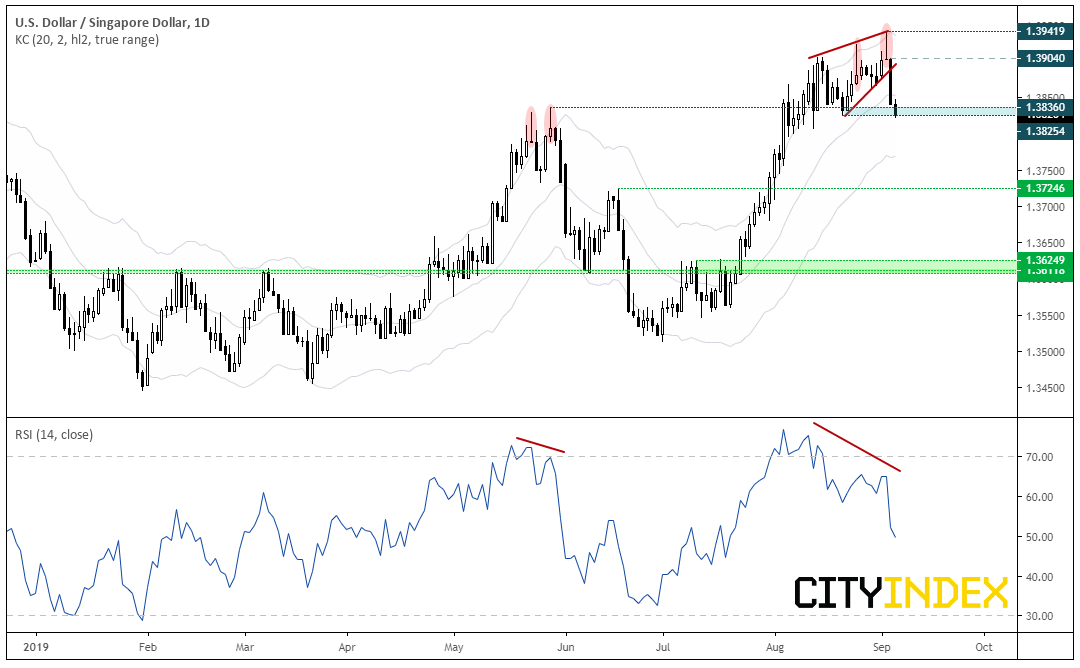

We can see on the daily chart that USD/SGD had printed a bearish pinbar and hammer as part of a bearish wedge pattern. Moreover, the hammers have coincided with a bearish RSI divergence, in similar vein to the prior top in May. Yesterday’s sell-off was it’s most bearish session in two months (just like USD/CNY..) and has broken key support at time of writing.

- It appears USD/SGD has topped and today’s break of support opens up a run towards 1.3725

- The prior counter-trend move saw it shed -315 pips. If a similar move is to be repeated over the coming weeks, it could be headed towards 0.6325 support

- A break above 1.3942 assume bullish continuation, although for trade management purposes, yesterday’s high around 1.3904 could be considered ot ‘step aside’ if it breaks higher.

Keep in mind that SGD is partially pegged to a basket of (undisclosed) currencies, and MAX (Monetary Authority Of Singapore) limit the volatility. But, with the correct theme and trend, remains a viable instrument to consider trading.

Related analysis:

Rand Bid as Monetary Policy Still Accommodative

The Closer You Look At ISM's PMI, The Uglier It Gets | EUR/USD, USD/CHF