U.S Futures rising - Watch MRNA, ULTA, COO

The S&P 500 Futures are on the upside after they closed mixed yesterday ahead of major North American jobs reports.

Later today, the U.S. Labor Department will release nonfarm payrolls report for November (+0.48 million jobs, jobless rate at 6.8% expected). The Commerce Department will report October factory orders (+0.8% on month expected) and trade balance (64.8 billion dollars deficit expected).

European indices are on the upside. Research firm Markit has published November U.K. Construction PMI at 54.7 (vs 52.0 expected). The German Federal Statistical Office has posted October factory orders at +2.9% (vs +1.5% on month expected).

Asian indices closed in the green except the Japanese Nikkei.

WTI Crude Oil is on the upside. Bloomberg reported that OPEC+ members agreed to increase oil production by 0.5 million barrels per day in January and gradually ease output cuts. This level is significantly below the expected 1.9 million barrels per day increase scheduled to happen on January 1st.

U.S indices closed mixed on Thursday with the Dow Jones (+0.29%) and Nasdaq (+0.23%) closing up, while the S&P 500 (-0.06%) closed down. Consumer Durables & Apparel (+2.03%), Consumer Services (+1.39%) and Energy (+1.07%) sectors were the best performers on the day, while Utilities (-1.1%), Food & Staples Retailing (-0.82%) and Materials (-0.68%) sectors were the worst performers.

Approximately 93% of stocks in the S&P 500 Index were trading above their 200-day moving average and 75% were trading above their 20-day moving average. The VIX Index gained 0.28pt (+1.32%) to 21.45 at the close.

On the U.S economic data front, Initial Jobless Claims declined to 712K for the week ending November 28th (775K expected), from a revised 787K in the week before. Finally, Continuing Claims dropped to 5,520K for the week ending November 21st (5,800K expected), from a revised 6,089K in the prior week.

Gold is set for weekly gain as the U.S dollar struggles on U.S stimulus hopes.

Gold rose 1.67 dollar (+0.09%) to 1842.75 dollars.

The dollar index fell 0.15pt to 90.564.

U.S. Equity Snapshot

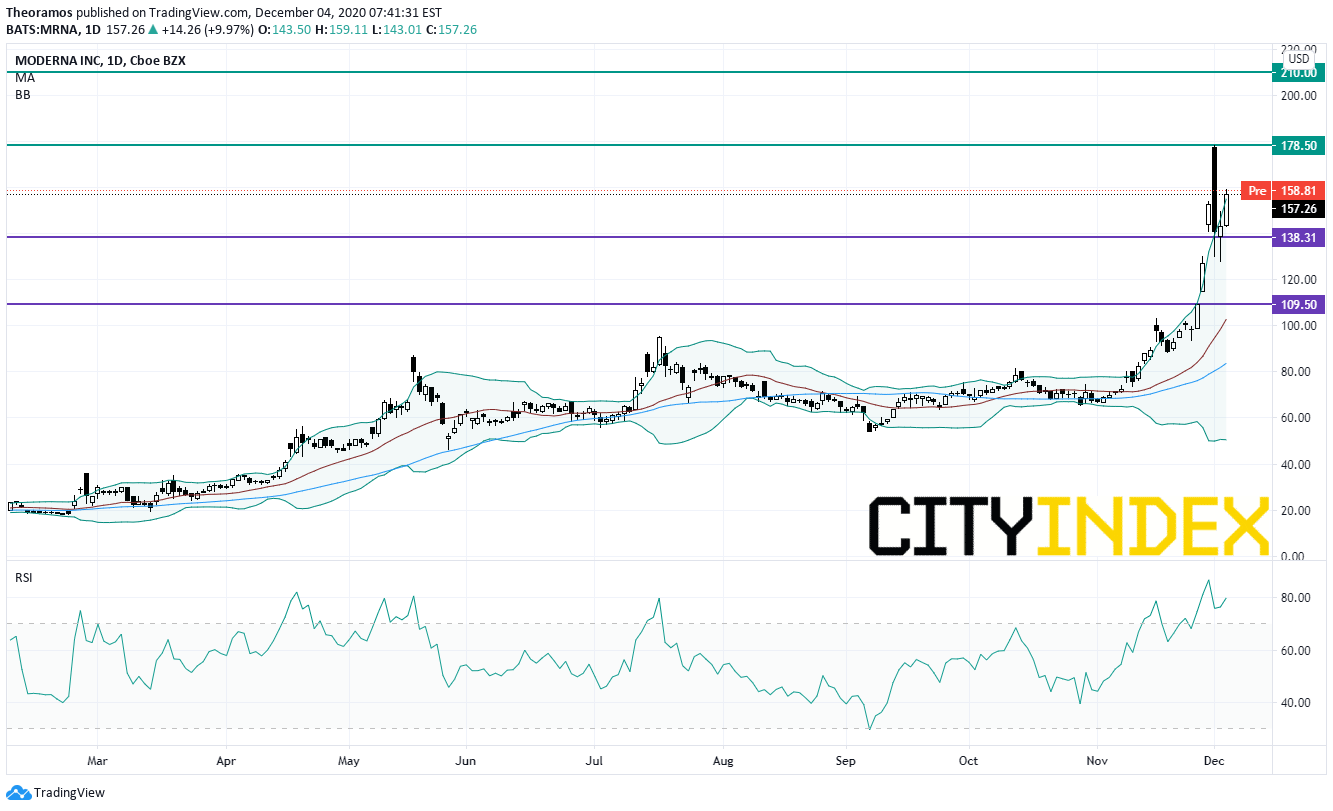

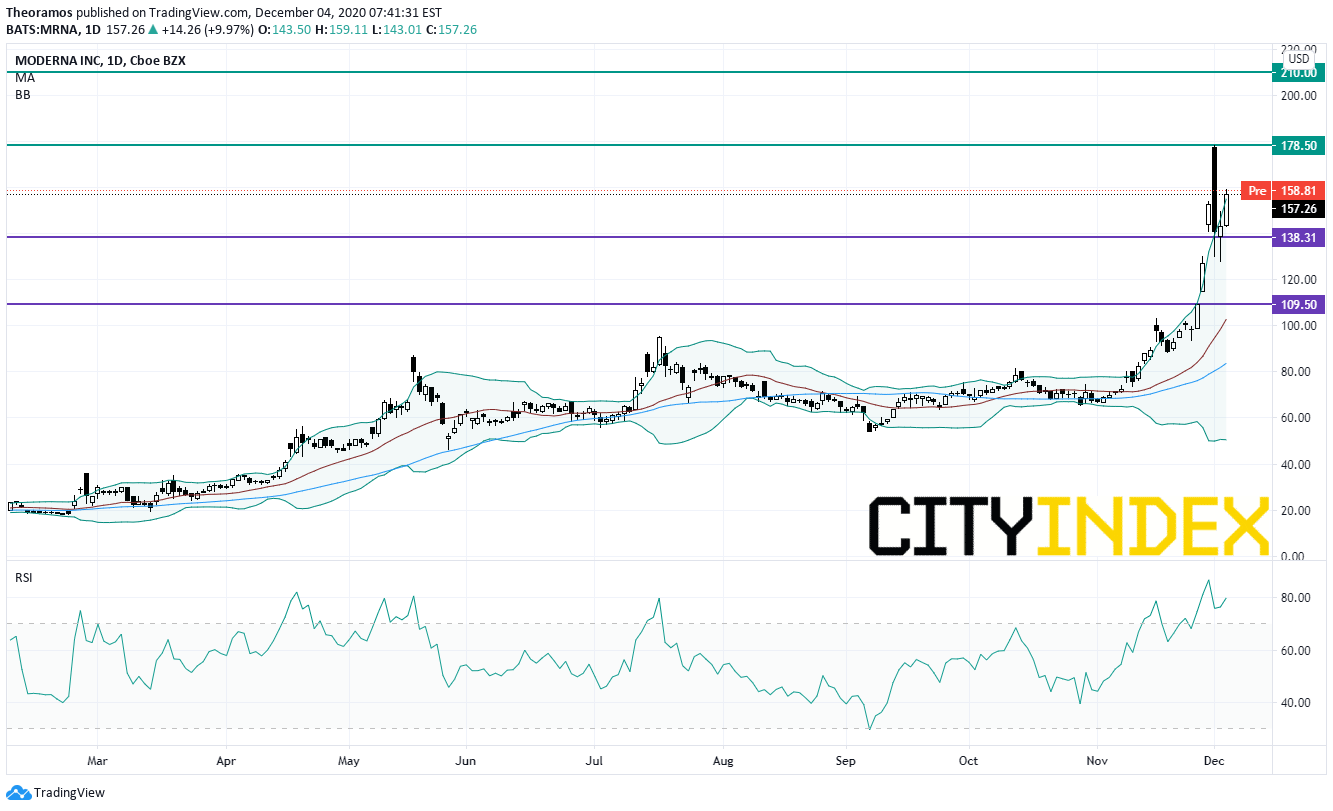

Moderna (MRNA), the biotech, reported "that participants in the Phase 1 study of mRNA-1273, its COVID-19 vaccine candidate, retained high levels of neutralizing antibodies through 119 days following first vaccination."

Source: TradingView, GAIN Capital

Ulta Beauty (ULTA), an operator of a chain of beauty retailers, dived after hours after releasing third quarter sales of 1.6 billion dollars, missing estimates, down from 1.7 billion dollars a year ago. Adjusted EPS was 1.64 dollar, exceeding forecasts, down from 2.25 dollars a year earlier.

Cooper (COO), a medical device company, announced fourth quarter adjusted EPS of 3.16 dollars, just above estimates, down from 3.30 dollars a year ago on net sales of 681.6 million dollars, also just ahead of the consensus, down from 691.6 million dollars a year earlier. The company expects first quarter adjusted EPS of 2.66-2.86 dollars, missing expectations.

Later today, the U.S. Labor Department will release nonfarm payrolls report for November (+0.48 million jobs, jobless rate at 6.8% expected). The Commerce Department will report October factory orders (+0.8% on month expected) and trade balance (64.8 billion dollars deficit expected).

European indices are on the upside. Research firm Markit has published November U.K. Construction PMI at 54.7 (vs 52.0 expected). The German Federal Statistical Office has posted October factory orders at +2.9% (vs +1.5% on month expected).

Asian indices closed in the green except the Japanese Nikkei.

WTI Crude Oil is on the upside. Bloomberg reported that OPEC+ members agreed to increase oil production by 0.5 million barrels per day in January and gradually ease output cuts. This level is significantly below the expected 1.9 million barrels per day increase scheduled to happen on January 1st.

U.S indices closed mixed on Thursday with the Dow Jones (+0.29%) and Nasdaq (+0.23%) closing up, while the S&P 500 (-0.06%) closed down. Consumer Durables & Apparel (+2.03%), Consumer Services (+1.39%) and Energy (+1.07%) sectors were the best performers on the day, while Utilities (-1.1%), Food & Staples Retailing (-0.82%) and Materials (-0.68%) sectors were the worst performers.

Approximately 93% of stocks in the S&P 500 Index were trading above their 200-day moving average and 75% were trading above their 20-day moving average. The VIX Index gained 0.28pt (+1.32%) to 21.45 at the close.

On the U.S economic data front, Initial Jobless Claims declined to 712K for the week ending November 28th (775K expected), from a revised 787K in the week before. Finally, Continuing Claims dropped to 5,520K for the week ending November 21st (5,800K expected), from a revised 6,089K in the prior week.

Gold is set for weekly gain as the U.S dollar struggles on U.S stimulus hopes.

Gold rose 1.67 dollar (+0.09%) to 1842.75 dollars.

The dollar index fell 0.15pt to 90.564.

U.S. Equity Snapshot

Moderna (MRNA), the biotech, reported "that participants in the Phase 1 study of mRNA-1273, its COVID-19 vaccine candidate, retained high levels of neutralizing antibodies through 119 days following first vaccination."

Source: TradingView, GAIN Capital

Ulta Beauty (ULTA), an operator of a chain of beauty retailers, dived after hours after releasing third quarter sales of 1.6 billion dollars, missing estimates, down from 1.7 billion dollars a year ago. Adjusted EPS was 1.64 dollar, exceeding forecasts, down from 2.25 dollars a year earlier.

Cooper (COO), a medical device company, announced fourth quarter adjusted EPS of 3.16 dollars, just above estimates, down from 3.30 dollars a year ago on net sales of 681.6 million dollars, also just ahead of the consensus, down from 691.6 million dollars a year earlier. The company expects first quarter adjusted EPS of 2.66-2.86 dollars, missing expectations.

Latest market news

Yesterday 08:33 AM