Trade all US shares with 100% commission cashback

Join over a million traders with a limited-time sign up offer – get 100% commission cashback on all US shares until 31 May. Discover your potential with a multi-award-winning broker with over 40 years’ history of success.

Choose from over 84 currency pairs for leveraged trading in a highly liquid market.

StoneX Bullion, our associate entity, offers investing in gold, silver, platinum and palladium on their platforms

Extract more value from your trades with spot gold, offering a raw spread at just 0.15pts.

Choose from over 84 currency pairs for leveraged trading in a highly liquid market.

StoneX Bullion, our associate entity, offers investing in gold, silver, platinum and palladium on their platforms

Extract more value from your trades with spot gold, offering a raw spread at just 0.15pts.

Over one million account holders* use us to trade the financial markets. Here's why.

*StoneX retail trading live and demo account holders globally since Q4 2020.

Over 99% of trades using our award-winning trading platforms are executed in less than a second.

99.99% of all valid trades are executed by our market-leading trading technology and trading platforms.

We’re backed by Nasdaq-listed StoneX, a Fortune 100 company with over a century in the financial markets. Combined with our four decades of heritage, you’re in good hands.

From personalised Performance Analytics to AI-powered SMART Signals, you have a wealth of exclusive trading tools at your disposal to maximise your trading potential.

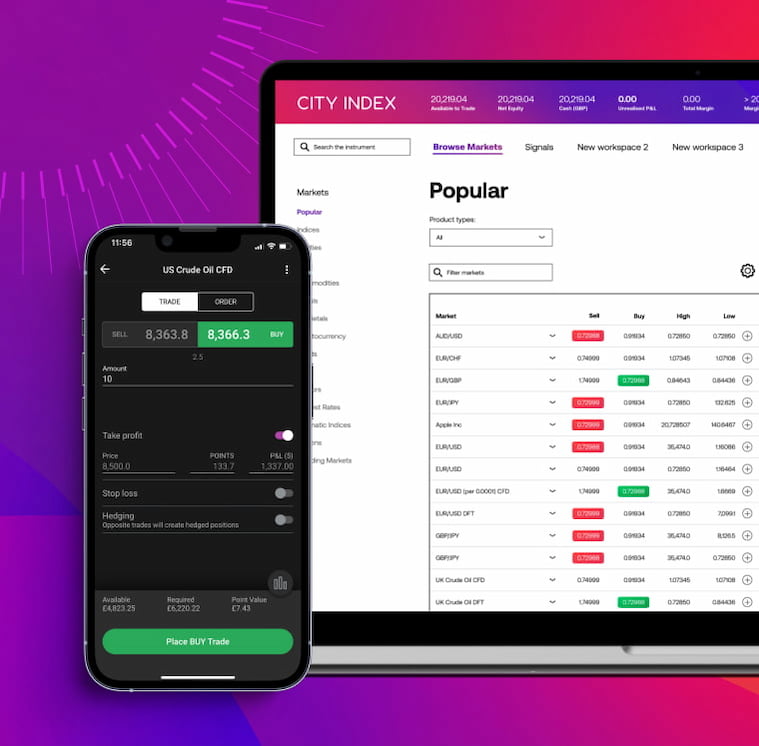

A suite of award-winning trading platforms and apps

Mobile trading app

Our powerful mobile platform doesn’t compromise on performance. Enjoy all the same trading features and full control of your trading account on the move.

Web Trader platform

Trade over 6,000 global markets with our browser-based web trading platform that’s compatible on any device and comes complete with a range of intelligent tools.

TradingView

Access an unparalleled trading experience with the help of TradingView’s supercharged charting tools across browser and desktop apps.

MetaTrader 4 (MT4) trading platform

Harness the power of the world’s most popular forex (FX) trading platform, MT4, now with added asset classes – including FX, commodities and indices.

Open an account today

-

Registeran account

-

Depositand fund securely

-

Start tradingon 6,000+ markets

Open an account today

Competitive pricing on over 6,000 global markets

CFD and forex trading education

-

a new trader

-

an experienced trader

Our performance in numbers

*StoneX retail trading live and demo account holders globally since Q4 2020.

Trade with a regulated broker you can trust

Almost 40 years’ experience

City Index has been helping our clients navigate financial markets since 1983 and is a world-leading provider of financial services.

Authorised and regulated

We are fully licensed in multiple jurisdictions worldwide, including by the Monetary Authority of Singapore (MAS), holding us to the highest industry standards of accountability and transparency.

Financial strength and security

City Index is part of the StoneX Group, a Nasdaq-listed Fortune 100 company with a proven track record in providing retail and institutional traders with trading services.