Technical analysis

Trading with trends

One of the terms you’ll hear again and again in technical analysis is the idea of following a trend, or trending markets. In this lesson, we’ll take a look at what that means and how you can identify a trend.

What is a trend?

A trend is the general direction of an asset’s price.

Ever heard the old adage ‘the trend is your friend’? Well, it’s not just a saying, it’s a popular strategy. It involves opening a position when the price starts moving in a particular direction and closing it before that movement is over.

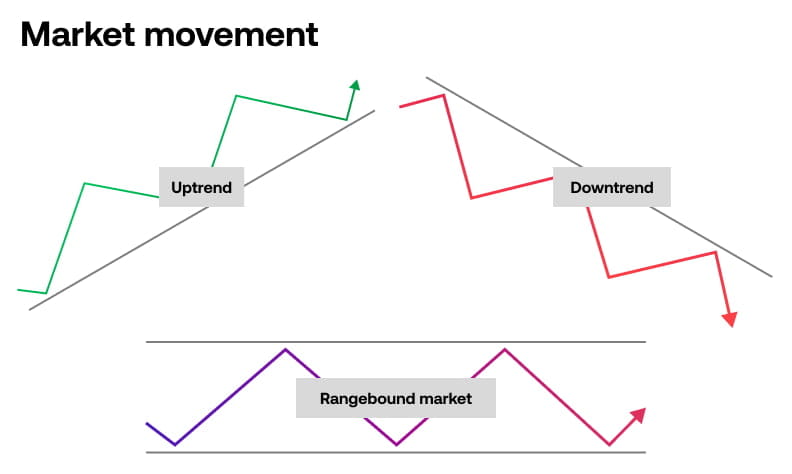

A trend can move in any of three directions:

- Upwards – you might know it as an uptrend or bullish move

- Downwards – commonly known as a downtrend or bearish move

- Sideways – this is usually referred to as a rangebound market

As well as varying based on direction, market trends are also differentiated based on the length of time they last. There are three categories of duration:

- Major – this is the primary trend, or the main trend over a longer period of time. It’s the dominant direction of a market movement that can continue over weeks, months and years.

- Intermediate – this is the secondary trend that occurs within the major trend. It can last from days to weeks.

- Minor – this refers to smaller movements which tend to last for very short periods of time, from just seconds to days.

While investors and longer-term traders will attempt to capture profits from the primary trend, intermediate-term traders seek to capture secondary trends. Short-term traders, like day traders, will focus on the minor trends that are even shorter in duration.

Want to learn more about styles of trading? Take a look at our guide to strategies.

How to trade with trends

When entering a trade, it’s important to know which direction the markets are currently trending in. Although this sounds simple it can be difficult – especially for beginners – to enter a trade at the right time.

There are three steps to trading a trend:

- Identify the trend

- Watch for a pullback

- Find the end of a trend

1. Identify the trend

The first step is to identify a trend over a period of time using a chart as this will indicate whether there is momentum is behind the market.

Some say that trends start without warning and can end abruptly. But others believe that by using technical analysis, a trader will – at the very least – be able to take an educated guess.

The most common tools to use for identifying market direction are trend lines. Chartists define trends on charts by drawing lines onto price points to form patterns.

When the market is moving up or in an uptrend, the trend line will have a rising slope. This is achieved by joining two low points of a chart. The second low must be higher than the first low. Investors will consider trading on the bullish or long side of the market until the uptrend comes to an end.

In a downtrend, the trend line would have a negative slope. By joining two highs together where the second high must be lower than the first high, we would have a falling market. In this phase, traders would consider trading on the short side of the market or selling.

At times when markets are stuck within a range, we can also apply horizontal trend lines to both the highs and lows. This would create a channel and the market would appear to be stuck within a box. Here, you could go both long and short to take advantage of the minor movements between the two lines.

Using indicators can also assist a trader in trading with the trend. Popular indicators for trends include moving averages, Fibonacci retracements and momentum indicators. If used correctly, these indicators can offer some good results when markets trend.

We’ll take a look at chart patterns and indicators in more depth later on.

2. Watch for a pullback

Once you have identified the trend, the next step is to work out the best time, and price, to enter the market at. Usually that’s at a pullback.

A pullback occurs when a market has been moving in one direction but temporarily moves in the opposite direction. For example, if an asset price moves lower when the trend has previously been upward or bullish.

Entering at a pullback gives you a more advantageous price. You could use an entry order to automate opening a trade.

Find out more about trade entry in our ‘Tips for trading successfully’ course.

Before placing a trade, you might want to look for an indication that the price is recovering, and turning back to the upside. This is known as a confirmation signal and can be provided by a number of technical indicators.

3. Find the end of a trend

Finding the end of a trend can be just as difficult as finding the start. The most obvious way of knowing when a trend ends is if there’s a reversal. This is when the asset’s price starts to move in the opposite direction for a sustained period of time. It usually occurs at a point of support or resistance, which we’re going to cover in the next lesson.

Naturally, you want to close your position before this happens to avoid taking on loss. To do this, you’d look at price patterns or trend lines, just as you did for entering the position.

You might also want to consider attaching an exit order to your position – such as a take profit or stop loss – that would automatically close your position once a set level of profit or loss has been met.

Learn more about stop losses in our ‘How to trade’ course.