Trading strategies

Running profits

Learn how to run your profits and you’ll have mastered one of the key aspects of successful trading. Without the ability to run profits, a good risk-management plan can be meaningless.

If a trader is able to cut risk well but can only achieve very small relative profits, it’s extremely difficult to get ahead and become net profitable.

Using a risk/reward ratio

Generally speaking, you should keep your reward/risk ratio at least at 1:1, or even higher. The only instance where a ratio of less than 1:1 can be used is when your winning trade ratio is extremely high.

When trying to run profits, it’s not always necessary to be excessive, especially when trading short-term time frames. Keep in mind that the further that profits are run, the lower the overall win ratio tends to be if all other factors are kept constant.

In other words, when you’re targeting greater profits you may hit your stop loss more often. This is simply due to the element of probability. Achieving a close profit target is more likely than hitting a distant profit target before the stop loss is hit. So, a 3:1 or 4:1 reward/risk ratio will generally result in substantially fewer winning trades than a 1:1 or 2:1 ratio.

Actively managing open trades

One method of dealing with this probability element and to take some guesswork out of profit-targeting is to actively manage open trades. This is a more hands on approach and differs from the non-management of trades, where the entry, stop loss and profit target are all pre-determined and set according to the trading plan.

If you choose to actively manage your open trades, there are several methods you can use, including moving (or trailing) stop losses and scaling-in and scaling-out.

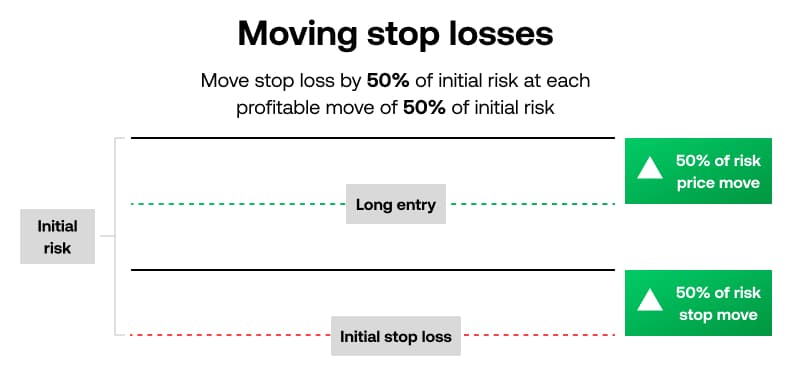

Moving stop losses

Moving, or trailing, stop losses involve shifting the initial stop-loss after a certain profit level is reached. This is to help decrease potential losses and ultimately lock-in gains if the position moves into further profit.

Stop losses should be moved in the direction of the trade, and not in the opposite direction of the trade. For example, after opening a long position, the stop loss should only be moved to higher prices to lock-in any gains and never to lower prices in an attempt to allow the position ‘more room’. Trying to do this can open you up to large losses.

The first stop loss move is often to the break-even trade entry level after a certain profit is reached.

Some traders only move stop losses for specific reasons – for example, the price has reached another plateau, or a new support/resistance level, or a consolidation pattern. It’s not usually a good idea to simply trail the stop loss by a random number of points or pips, as this introduces a level of unpredictability into the trade.

Here is one possible approach for moving a stop loss:

Scaling-in

Scaling-in, or adding additional positions as price moves in your favour, progressively increases directional commitment as a trend develops. This technique is one of several tools used by longer-term trend-followers, but might not be as suitable for very short-term trading. You should generally only scale-in in conjunction with protecting profits on earlier positions and during strongly trending markets.

Scaling-out

Scaling-out, or progressively closing out portions of an open position in order to realise profits, protects gains as price progresses in the trade’s favour.

To scale-out, you should consider entering a full trade at a certain price level according to your chosen trading plan and strategy. Then, portions of the position can be closed for profit at increasingly greater profit levels in order to potentially lock-in your gains.

If you use this strategy, two or three profit levels might be enough. The negative aspect of scaling-out is that it can reduce your overall profit when you compare it to having just one take-profit level for the entire position.