Trading with City Index

Corporate actions and dividends

What is a corporate action?

Sometimes companies can make announcements that have little to do with fundamentals – but which still have the power to move share prices. In this lesson, we’re going to look at the main types of corporate action, and how they’ll affect your CFD positions.

Understanding corporate actions

A corporate action is an announcement or activity from a company that has a material impact on its shareholders. Some, such as name changes, won’t necessarily affect its share price. Others, such as dividends, will.

There are lots of reasons why a company might choose to begin a corporate action:

- Returning income to investors (e.g. through dividends)

- Influencing the share price (e.g. stock splits, intended to make the price lower)

- Corporate restructuring

At City Index, we’ll aim to reflect the circumstances affecting the share in the public market in your trading account.

Types of corporate actions

Here’s a guide to the types of corporate actions you might encounter when trading shares.

1. Dividends

Dividends are probably the best-known corporate action of all and are prized by investors. Why? Because in a dividend, the company pays back a portion of its profits to shareholders – meaning you get paid for owning stock.

Dividends are paid on a per-outstanding-share basis, so you’ll get paid a set amount for each share that you own. There are a few dates you’ll need to be aware of:

- The announcement date is when the company declares that it is paying a dividend

- The ex-dividend date (ex-date) is the final day on which you’ll be eligible for the dividend. If you buy stock after this date, you won’t receive anything

- The payment date is when you receive the dividend

The share price of a company will drop on the ex-dividend date to compensate for the fact that the company is now worth less – after all, it just parted with a large pool of cash.

How dividends work in CFDs

2. Rights issues

A rights issue is when a company offers existing shareholders the chance to buy more stock, usually at a discount to the current market price. You may also see them referred to as secondary offerings.

As with dividends, rights issues usually cause a company’s share price to fall. This time, it’s because they are creating more shares, increasing supply and lowering their price. Rights issues tend to be used by companies that need to raise capital quickly – say, because they need to pay off debt.

A rights issue usually comes with a date on which the new shares can be purchased. Up until that date, you can trade the rights as if they were ordinary shares, which helps compensate shareholders for the drop in the value of their investments.

How rights issues work in CFDs

Because the market price will tend to drop as a consequence of a rights issue, City Index will book a rights issue at zero to your account, giving you a number of choices.

|

Long traders can:

|

Short traders can:

|

Please note: short customers cannot take up the rights issue.

Open offers vs rights issues

Open offers work in a similar way to rights issues – with one crucial difference. You can’t trade an open offer, while you can trade a rights issue.

3. Mergers and acquisitions

Mergers, takeovers and acquisitions are three terms that all describe two separate stocks becoming one market. JPMorgan Chase, for example, is the result of a merger between JP Morgan and Chase Manhattan.

A takeover can take months and years to go through and sometimes may not happen if terms cannot be agreed. During this period, shares in both companies will continue to trade. But then once the deal is complete, one or both of the stocks will no longer be available to buy or sell.

How mergers and acquisitions work in CFDs

Once a deal is complete – and the actual stock stops trading – any positions you have on the existing company will be closed according to the takeover terms. Your trade value will remain the same before and after the takeover.

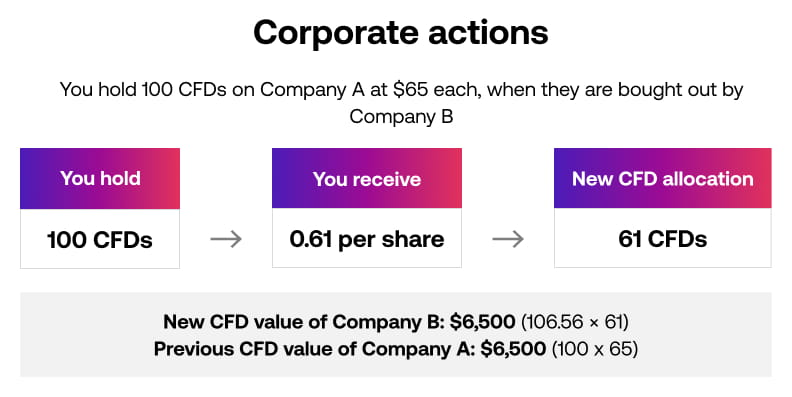

Say, for example, that you hold 100 CFDs on Company A at $65, giving your position a total size of $6,500.

Company A is then bought by Company B, and shareholders of A are offered 0.61 shares in B for every share in A they hold. This number is based on the price that B has bought A for.

You will receive (0.61 * 100) 61 Company B CFDs. City Index will calculate the value of these CFDs to ensure that your position value remains the same. In this case, $106.6 per CFD, as 106.56 * 61 = $6,500.

4. Stock splits and consolidations

Stock splits and consolidations are two ways in which a company can attempt to increase or decrease its share price. If a stock is priced too high or too low, then its liquidity may suffer. Stocks that get too expensive will not be attractive to investors, while those that get too cheap will face the threat of being delisted.

- A stock split is used to lower the share price, by increasing supply

- A consolidation, or reverse stock split, is used to raise the share price, by lowering supply

How splits and consolidations work in CFDs

In a stock split, your City Index position will be closed, then reopened to reflect the terms of the split. The objective is to reflect exactly the circumstances affecting the share in the public market.

In a consolidation, as the number of shares is being reduced in the physical market, holders of a position in that stock will be compensated with a cash dividend for an amount they are losing as a consequence.