Technical analysis

Support and resistance

When markets bounce off a price level, they’re said to have reached a line of support or resistance. This is another concept that will crop up again and again throughout this course. So, before we go any further, let’s look at what support and resistance are.

What is support?

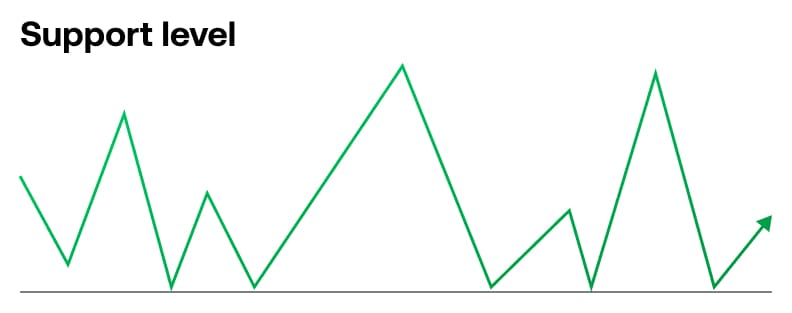

A support level is a price at which a market fails to move lower. At this point, sellers are no longer able to drive prices down, and buyers start to take over and drive prices higher again.

Support levels can be tested several times before traders become confident that prices will hold at this level before moving higher. They can also last from a short-term timeframe to a longer-term timeframe and are sometimes referred to as a base or floor.

During a bull market, support levels become higher as each decline or corrective price move takes place.

What is resistance?

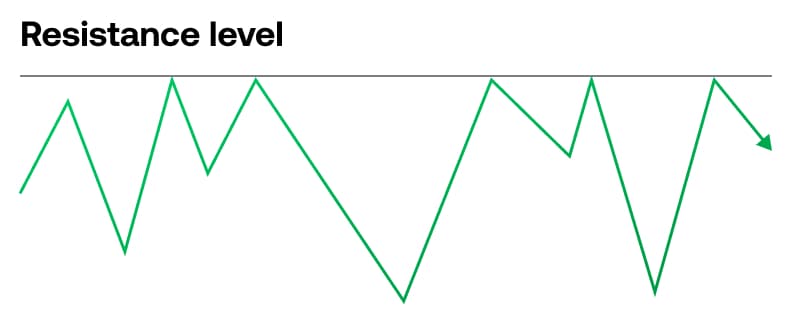

A resistance level is a price at which a market is unable to move any higher. Buyers feel that the market may have reached a point of exhaustion and decide to take profits. With more sellers at hand, the price reverses and moves lower.

Like support levels, resistance levels may be tested several times over a period of time. The resistance level is sometimes referred to as the ceiling.

In a bear market where prices fall and attempt to rally, the resistance levels would be lower on each attempt to move higher.

Trading support and resistance levels

Traders often use support and resistance levels as points of entry and exit.

When a market reaches a price level that it struggles to drop below, a trader may look to buy. And when a market is attempting to move higher but fails each time it reaches the same price level, traders may step in and short the market near that area, expecting markets to fall lower.

A buyer at support may use higher resistance levels to exit their trade and a seller at resistance levels may use lower support levels to exit their short positions.

Remember, this is not guaranteed, and markets can be affected by a variety of factors. It’s important to ensure a point of exhaustion has been met.

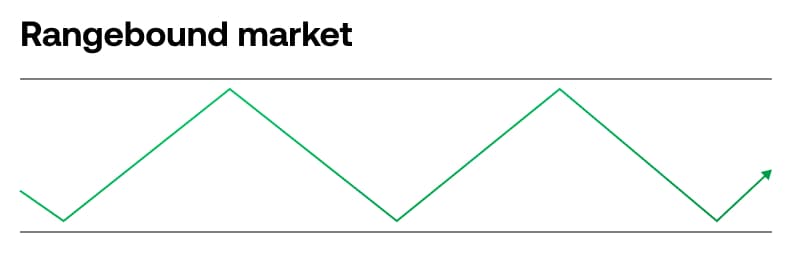

When a market is rangebound, its price moves consistently between support and resistance levels. Some traders will still enter and exit at these levels, taking advantage of the smaller movements between them. Remember, with CFDs you can open short positions to speculate on falling prices too.