CFD trading

What is CFD trading?

Put simply, CFD trading lets you speculate on the price movement of a whole host of financial markets such as indices, shares, currencies, commodities and bonds, regardless of whether prices are rising or falling. When you trade CFDs you are speculating on the price movement of your chosen asset rather than actually owning the underlying instrument.

Why is CFD trading popular with investors?

CFDs are a popular way for investors to actively trade financial markets. This is because CFDs are:

-

Flexible – you can trade on rising as well as falling markets

Trade on falling markets (going short) as well as rising markets (going long) -

Leveraged products

Use a small amount of money to control a much larger value position -

Hedging tools

You can use CFDs to offset any potential loss in value of your physical investments by going short

How does CFD trading work?

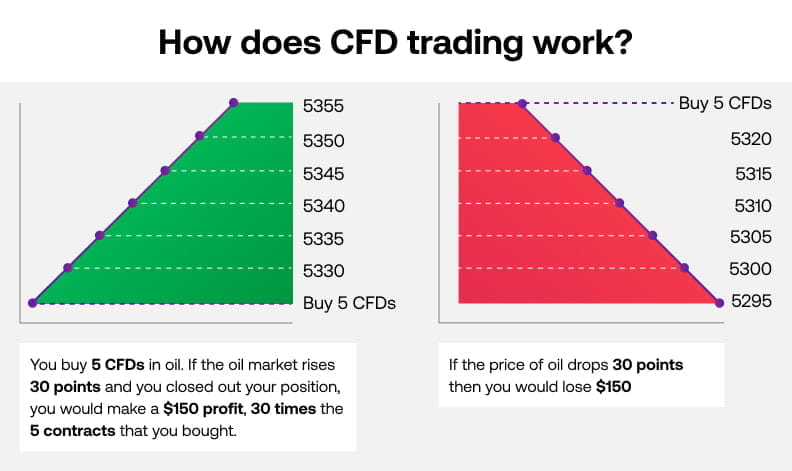

When you open a CFD position you select the amount of CFDs you would like to trade and your profit will rise in line with each point the market moves in your favour.

If you think the price of your chosen market will go up, you click buy and your profits will rise in line with any increase in that price.

However, if the price falls, then you will make a loss for every point it moves against you.

For example, if you think the price of oil is going to go up then you could place a buy trade of 5 CFDs at the price of 5325. If the market rose 30 points to 5350 and you closed out your position, you would make a $150 profit, 30 times the 5 contracts that you bought.

However, if the market moves against you and the price of oil falls 30 points to 5300 then you would lose $150.

Trading on falling markets

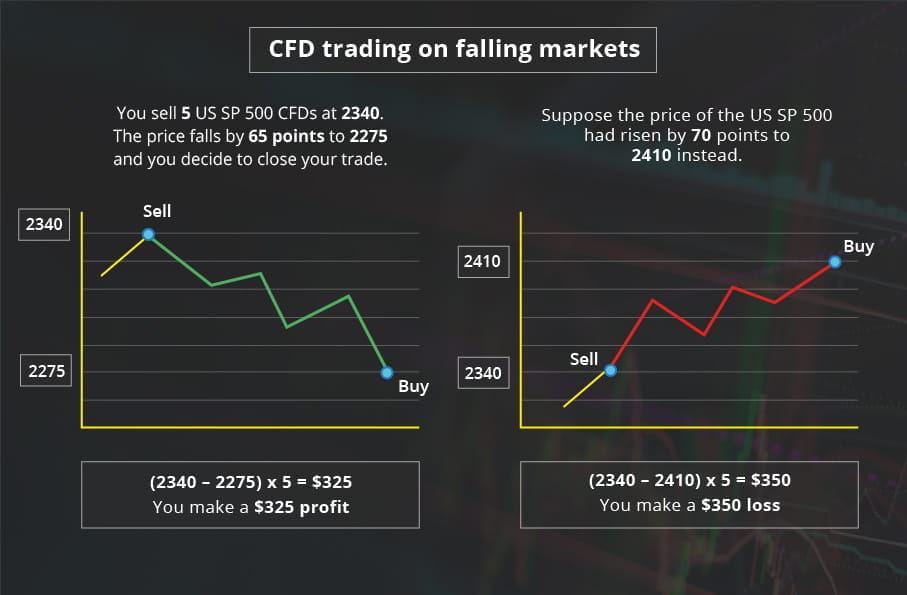

Unlike traditional share dealing, if you believe a market will fall in value, with CFD trading you can sell a market – known as going short – and make a potential profit from falling prices.

Example

The US 500 is trading at 2340. You believe the US 500 will fall as you expect the forthcoming US earning season to disappoint.

You open a sell position of 5 US 500 CFDs at 2340.

The US 500 falls by 65 points to 2275 and you decide to close your trade.

Hedging

As CFDs allow you to short sell and therefore make a potential profit from falling market prices, they can be used as a tool by investors as ‘insurance’ to offset losses made in their physical portfolios.

For example, if you hold $5,000 of OCBC Bank shares and you concerned that they are due for an imminent sell-off, you can help protect your share portfolio by short selling $5,000 of OCBC Bank CFDs.

Should OCBC Bank share prices fall by 5% in the underlying market, the loss in value of your share portfolio would be offset by a gain in your short sell CFD trade. In this way, you can protect yourself without going through the expense and inconvenience of liquidating your stock holdings.

CFD trading is a margined product

This means you trade by paying just a small fraction of the total value of the contract.

Remember that with leveraged trading, there is a potential for your losses to exceed deposits.

In other words you can put up a small amount of money to control a much larger amount potentially magnifying your return on investment. Remember, however, that your losses will be magnified as well, so you should manage your risk accordingly.

Which CFD markets can I trade on?

City Index offers a choice of over 6,000 CFD markets, including:

- Indices such as Wall St and UK 100

- FX such as AUD/USD, GBP/EUR and USD/JPY currency pairs

- Shares such as Commonwealth Bank, BHP Billiton and Telstra

- Commodities such as oil, gold and cocoa

Is CFD trading right for me?

CFD trading is ideal for investors who want the opportunity to try and make a better return for their money.

However, it contains significant risks to your money and is not suitable for everyone. We strongly suggest trading on a demo account before you try it with your own money.

CFD trading may be ideal for people:

-

Looking for short term opportunities

CFDs are typically held open for a few days or weeks, rather than over the longer term -

Who want to make their own decisions on what to invest in

City Index provides an execution only service. We will not advise you on what to trade or trade on your behalf -

Looking to diversify their portfolio

City Index offers over 6,000 global markets to trade on including shares, commodities, FX and indices -

Be as active or passive as they want

You can trade as little or as often as you want