So, the ECB was not as hawkish as some had feared, and we saw the euro give back gains across the board. Interestingly, European stocks also declined, which suggests the ECB was unable to address recession fears. As the euro started to head lower, so too did the Swiss franc – although to a lesser degree. While at the time of writing the EUR/CHF was still lower on the session, other franc pairs had made back a big chunk of their earlier losses. The GBP/CHF was now higher on the day, while the USD/CHF had turned flat, recovering sharply from earlier weakness.

The franc’s positive correlation with the euro has been a strong one. This is because the Swiss National Bank has made it crystal clear that it wouldn’t tighten its policy before the ECB does. With the ECB evidently being less hawkish, this has increased the probability of the SNB providing a similar dovish policy statement next week.

One reason why central banks in Europe are likely to proceed cautiously is because of the war in Ukraine, hurting economic growth. Reflecting those fears, we have seen a sharp sell-off in peripheral government bond prices. Peripheral bond yields were on the rise anyway with ECB ending PEPP. But the fact that they have risen faster than some of the core member states, this is a cause for concern.

ECB President Christine Lagarde said that the central bank needs to “make sure there is no fragmentation” and that "within our mandate we are committed to preventing fragmentation risks within the euro area." Her comments suggests that if the situation gets worse, there might be some kind of asset purchase scheme for peripherals, while interest rates rise for the Eurozone as a whole. That’s one possible reason why we saw the euro and stocks drop during her press conference.

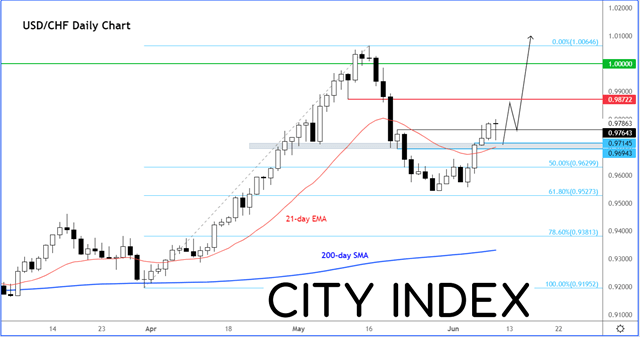

Anyway, the net result insofar as the franc is concerned is that it has fallen. The USD/CHF will remain in focus on Friday when the US government releases its latest consumer inflation estimate. If CPI remains at 8.3% as expected or climbs higher, then this should keep the USD/CHF bid.

The USD/CHF faces some potential resistance around 0.9870 to 0.9900 area, but I can’t imagine it reversing sharply from there. Consequently, I expect it to break through parity in the coming days as the divergence in US and Swiss monetary policy grows ever larger. The Fed should hike interest rates by another 50 basis points next week, while the SNB is likely to hold its policy unchanged.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade