S&P 500 on course for worst year since 2008

The S&P 500 has seen trillions of dollars wiped off its value in 2022, having fallen by over one-fifth since the start of the year. The current state of play means the index is on course to book its biggest annual loss since the financial crisis rocked markets back in 2008, and there are plenty of reasons to think US stocks have further to fall before hitting the bottom as we approach the third quarter earnings season.

The S&P 500 now trades at a price-to-earnings ratio of 18.9x, below the 10-year average of 20.3x and also down from the second quarter, reflecting expectations for slower growth and a more cautious view on the economy. It is worth noting that the index still trades over 13% above where it sat before the pandemic hit back in early 2020.

Read more: S&P 500 Trading Guide: How to Trade the Index

US economic outlook looks bleak

The US economy is performing better than most, but the outlook is still shaky and confidence low thanks to rampant inflation, aggressive rate hikes from central banks, escalating geopolitical tensions and recession fears. The current strength of the US dollar, with the dollar index recently hitting its highest level in two decades, shows that there is little appetite for risk at present, with the greenback emerging as one of the only safe havens investors feel comfortable with in the current climate.

Inflation is the biggest problem. Although it has started to cool, it is not easing as fast as many had hoped and looks set to remain elevated for the rest of this year and into 2023. That has turned up the heat on the Federal Reserve, which is now raising interest rates at a more aggressive rate. The central bank is trying to stifle consumer spending and encourage people to save more in the hopes of reducing demand and bringing prices back down.

Read more: Inflation Stocks: What to Trade When Inflation is Rising

The Fed hiked interest rates by 75 basis points for the third consecutive time this week and signalled they will continue to increase at the next meeting in November. Fed Chair Jerome Powell made it clear that the US central bank is willing to risk economic weakness to get inflation back under control as the central bank also updated its economic forecasts to reflect slower growth, higher unemployment, and higher inflation than previously anticipated. Ultimately, interest rates look set to continue rising with the Fed not expecting to pivot toward cutting rates again until 2024.

The environment is now starting to have an impact on demand as consumers are forced to stretch their pay cheques and spend more on necessities such as food and bills. Retail sales growth was sluggish in August at just 0.3% and, while this rebounded from the decline seen in July, it is still the slowest growth on record this year. Meanwhile, the recent warning from bellwether FedEx that global demand is slowing more than it had anticipated has also sent shockwaves through the markets. More warnings could follow this earnings season.

The US economy has contracted for two consecutive quarters. GDP declined 1.6% in the first quarter of 2022 and then another 0.6% in the second. Until recently, two consecutive quarters of lower GDP would be enough to declare a recession. And yet, even with three out of five Americans believing they are in one according to a recent YouGov poll, officials at the National Bureau of Economics (the committee responsible for deciding the status of the US economy) have refrained from uttering the ‘R’ word.

Read more: How to Trade During a Recession

One of the reasons there has been resistance to declaring a recession is that some areas of the economy remain strong to provide hope that there can still be a soft landing from what officials would prefer to call a downturn. For example, the jobs market is still buoyant. Jobless claims have continued to decline, and at a faster rate than expected, and unemployment remains at a 50-year low. However, this could be the next pillar to fall. A recent report from PricewaterhouseCoopers shows 50% of surveyed US executives have said they plan to cut jobs over the next 12 months, although they are also struggling to find and retain the talent they need.

We have already seen a number of companies cut jobs in 2022. Many such as Robinhood, Netflix and Peloton went on hiring sprees as demand boomed during the pandemic before starting to reverse those expansions as things cooled this year, but there have been others, including the largest companies in the S&P 500 such as Meta and Tesla, that have also become more cautious on recruitment as they brace for slower growth and tougher times. Reports surfaced just this week that Meta is planning to cut costs by 10% and that this will be primarily achieved through job cuts, with existing layoffs set to prelude a larger cull. New job openings will be an important indicator to watch going forward.

Read more: What are Economic Indicators and Why Are They Important?

That suggests even more challenging times are on the horizon and that we are not yet at the bottom. The outlook beyond this year also looks gloomy considering economists continue to sharply cut their growth expectations for 2023. A recent survey of economists from Bloomberg shows they currently believe the US economy will grow by a tepid 0.9% in 2023, down from rosier hopes for 2.5% growth at the start of the year.

Q3 earnings growth to hit slowest rate in two years

The economic landscape has prompted markets to curtail their earnings expectations for the S&P 500, casting a cloud over the upcoming third quarter earnings season. A few months ago, markets were hoping that the second quarter would be the trough for earnings this year, but it is now clear that things will deteriorate further in the third.

Read more: Everything You Need to Know About Earnings Season

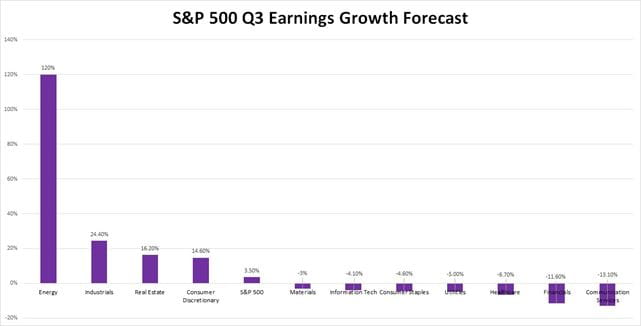

The index is expected to deliver earnings growth of just 3.5% in the third quarter, which would mark the slowest growth in two years, according to data from FactSet. We have seen far more companies cut their outlook for the current quarter than have raised them, particularly in the tech sector.

Sentiment and confidence have both taken a huge knock in recent months considering markets were far more optimistic about the third quarter back in June, when they were pencilling-in earnings growth of 9.8%. US business confidence has also fallen for nine consecutive months, according to CEIC.

Markets are hoping that the third quarter will mark the tipping point and expect earnings growth will accelerate to 4.7% in the fourth quarter before speeding up once again in early 2023. However, markets got it wrong by believing the second quarter was going to be the low point before quickly discovering that the situation would remain bleak in the third.

The energy sector is set to deliver the bulk of earnings growth for the S&P 500 in the quarter as it continues to benefit from elevated oil, gas and power prices. In fact, earnings in the S&P 500 are set to drop this season when the energy sector is stripped-out. Industrials, real estate and consumer discretionary are the three other industries expected to outperform the wider market in the quarter, while communication services and financials are set to suffer the steepest declines.

(Source: FactSet)

Where next for the S&P 500?

The S&P 500 has lost over 21%% since the start of 2022 and has formed a series of lower highs since peaking at all-time highs at the start of the year. It is currently trading at its lowest level in over two months.

The index is still trading higher than it was when it hit fresh post-pandemic lows in June, and that was when markets expected third quarter earnings to grow almost three times faster than they do now. That implies, along with the bearish RSI, that we should see the index come under further pressure this earnings season unless the outlook for the fourth quarter is much better than anticipated.

We could see the index continue to slip back toward the 32-month low seen in June if this proves true, first to 3,732 and then the low of 3,637. If this fails to hold then that would turn the series of lower highs into a firm downtrend accompanied with a consistent series of lower lows to present another new bearish signal.

In terms of near-term upside, the index needs to climb back to 3,810 and then above 3,900 to rediscover the tentative sign of rising support since hitting those lows in June. From there, it can look to recapture the 100-day and then the 50-day moving average. Over the longer-term, the index needs to break above the 200-day moving average to eradicate the series of lower-highs.

How to trade US stocks

You can trade US stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the stock you want in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can try out your trading strategy risk-free by signing up for our Demo Trading Account.