When will Dunelm release full year results?

Dunelm will release preliminary full year results on the morning of Wednesday September 8.

Dunelm FY earnings preview: what to expect from the results

Dunelm has proven to be one of the most resilient retailers over the last 18 months. The strength of its online and click-and-collect offerings helped Dunelm continue to grow despite the fact stores were closed for around one-third of the year.

Dunelm revealed in July that annual sales grew to £1.33 billion from £1.05 billion the year before and that pretax profit will be around £158 million compared to the £109.1 million profit booked last year. That was ahead of analyst expectations at the time and also marks an improvement from the £1.10 billion in revenue and £125.9 million profit delivered in 2019, before the pandemic hit.

In the fourth quarter – the first to fully benefit since stores reopened in April – sales came in almost 44% higher than pre-pandemic levels, setting the stage going forward. Although its online operation has lost some steam since it started welcoming customers back in store, Dunelm still made 37% of sales online in the final quarter compared to just 22% before the pandemic hit and Dunelm has said its omnichannel offering has remained popular in recent months.

With business now getting back to normal, Dunelm is on a mission to reclaim market share lost to the competitors that were able to stay open during lockdown. The outlook will be under the spotlight after Dunelm said it would reveal detailed investment plans this week after stating it would be raising investment in everything from its digital operations and data to its stores and supply chain this year. That, combined with tough comparatives in the first quarter and more sale events planned over the next 12 months, could pressure margins in the new financial year.

Momentum could also be interrupted by the widespread problems plaguing industries across the UK, namely a shortage of workers and cost price inflation hitting its supply chain – both of which also have the potential to erode margins. Inventory levels returned to more normalised levels during the first six months of 2021 but are expected to rise again as it tries to mitigate any potential supply issues, which will also push up costs.

With that in mind, investors will be looking for any updates to its plans to open two new distribution facilities, comprised of one hooked up to a rail freight terminal in Daventry and another standalone unit in Stoke. Both sites are due to become operational in the current financial year.

Where next for the Dunelm share price?

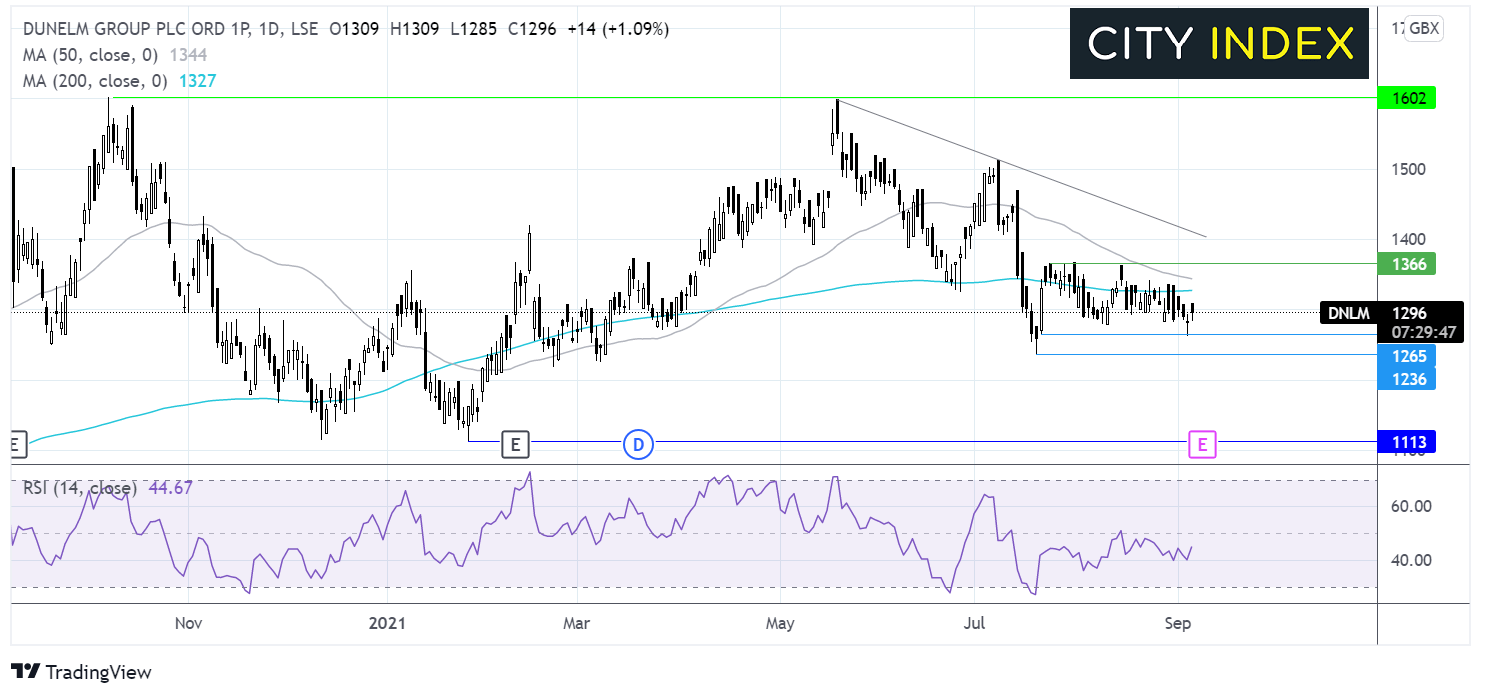

After once again finding resistance at 1600p the all-time high on May 20, the Dunelm share price has been trending lower. It trades below its multi-month descending trendline indicating a bearish bias.

More recently the share price has been trading in a holding pattern capped in the upside by 1365p and on the lower band by 1265p. It trades towards the lower end of this horizontal channel, below its 50 sma and 200 sma.

The RSI is not providing any strong directional clues, it is just below neutral and pointing higher.

Sellers could be looking for a breakout trade below 1265p which could open the door to 1235p the July low before 1123p.

On the upside. Solid results and an upbeat outlook could see buyers waiting for a move above 1365p to take on 1405p the descending trendline resistance.

How to trade Dunelm shares

You can trade Dunelm shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Dunelm’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade