As of Tuesday 2nd February 2022:

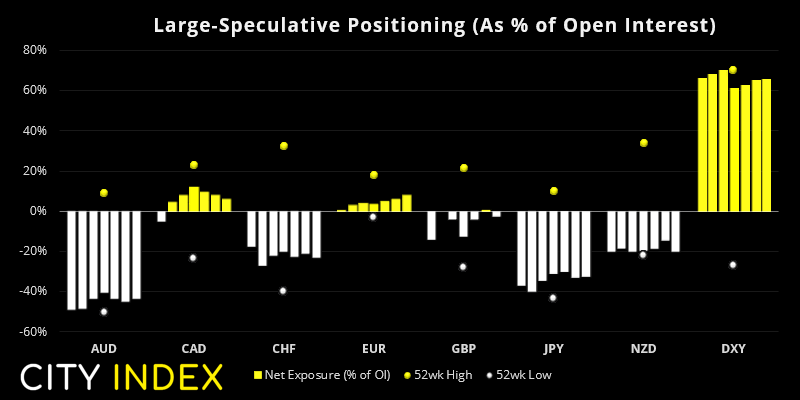

- Net-long exposure to the US dollar fell for a sixth week of $5.06 billion, according to data compiled by IMM.

- Large speculators flipped to net-long exposure on GBP futures.

- Traders were their most bullish on euro futures in 32 weeks.

- The euro was the only currency which saw a weekly change above 10k contracts, which saw net-long exposure increase by 11.7k contract.

Read our guide on how to interpret the weekly COT report

Read our guide on how to interpret the weekly COT report

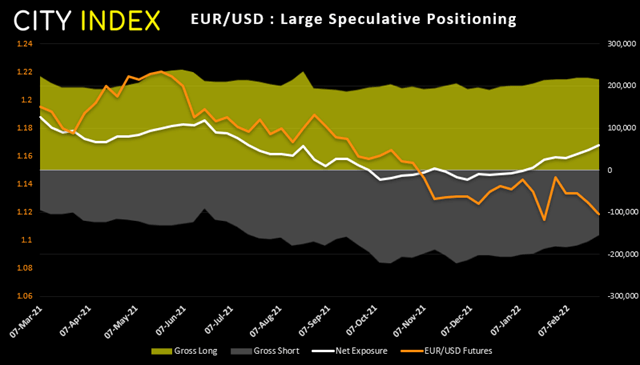

EUR futures:

Net-long exposure to euro futures rose tot their most bullish level in over six months (32 week to be exact). However, price action is not currently justifying the bullish positioning having sunk to its lowest level since May 2020 on Friday. Furthermore, longs were trimmed over the past two weeks. Over the past 13-weeks short contracts have trended lower, so the rise in net-bullish exposure has been down to short-covering as opposed initiative bulls buying.

As of Tuesday 2nd February 2022:

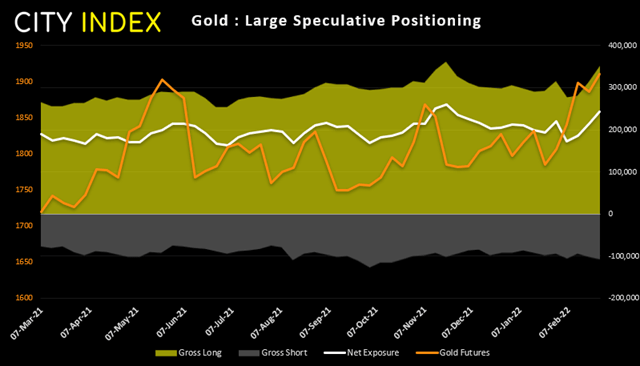

- Investors flocked to gold last week net-long exposure rise to a 14-week high.

- Platinum, a key export for Russia, also saw et-long exposure rise to a 14-week high.

- Whilst oil prices rose, net-long exposure to crude fell to a 7-week low.

Gold futures:

Gold rose over 5% last week. Admittedly it then handed back those gains during a volatile day when Russia invaded Ukraine, although today’s gap higher shows the metal remains in demand. Both large speculators and managed funds increased net-long exposure to a 14-week high, although large speculators saw longs and shorts rise whilst managed funds only rally increased their gross long exposure. It is difficult to tell how many of these longs were liquidated then gold fell from its 16-month high during an extremely volatile session, but it does suggest that if they were not stopped out they were potentially closed to attend margin calls in other markets.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade