US futures

Dow futures +0.64% at 32340

S&P futures +0.6% at 4000

Nasdaq futures +0.028% at 11976

In Europe

FTSE +0.05% at 7536

Dax +0.65% at 14127

Euro Stoxx +0.86% at 3707

Learn more about trading indices

GDP was revised lower

US futures are set to open modestly higher, adding to gains in the previous session and after a mixed bag on data.

The leading indices on Wall Street closed higher yesterday after the minutes of the May FOMC meeting brought few surprises and were even a little less hawkish than the market had expected. Two 50 basis point rate hikes are expected in the June and July meetings, which policymakers also judged appropriate.

Today the economic data was a mixed bag. Q1 GDP was downwardly revised to -1.5%, from the preliminary reading of -1.4%, and defied an upwards revision forecast to 1.3%. Concerns over the US economy tipping into recession have been haunting the market recently. However, today’s downward revision hasn’t caused any concern.

US jobless claims actually improved slightly, falling for the first time in weeks. Initial jobless claims slipped to 210k, down from 218k. The slight improvement seems to have been sufficient to help buoy the mood and calm concerns that any economic weakness was starting to manifest in the labour market.

In corporate news:

Nvidia is falling 4% pre-market after the chipmaker warned that it lost $500 million in sales in China and Russia in the current quarter as gaming slowed.

Baidu is rising pre-market after the Chinese search engine posted a net loss of 885 million yuan amid the economic downturn in China; this was down from a profit of 25.65 billion yuan a year earlier. Revenue rose 1%, marking the slowest growth in six quarters.

More insight on the stocks to watch pre-market

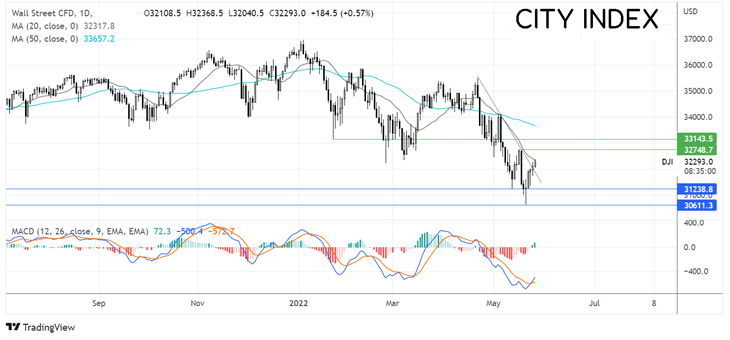

Where next for the Dow Jones?

The Dow Jones is extending its rebound from the 2022 low of 30630 on May 20. The price has recaptured the falling trendline resistance, which, combined with the bullish crossover on the MACD, keeps buyers hopeful of further upside. Buyers will need to rise above the 20 sma at 32360, which would be significant given that the price has traded below the 20 sma for over a month. A break above here could bring 32750, the May 17 high, into play to create a higher high. On the flip side, a move below the trend line support at 31700 could open the door to 31225, the 12 May low.

FX markets – USD falls, EUR rises

USD is holding steady in quiet trade after a few surprises from the FOMC minutes in the previous session. Hawkish Fed bets have been reined in amid fears of a recession.

GBP/USD is edging higher as the pound awaits an announcement from Chancellor Rishi Sunak over the cost-of-living crisis support package to help households with soaring energy bills. The package is expected to come in at around £10 billion.

EUR/USD is rising supported by hawkish comments from ECB’S Klaas Knot, who said that a 50 basis point rate hike is on the table, echoing Christine Lagarde’s comments earlier in the week.

GBP/USD -0.06% at 1.2507

EUR/USD +0.12% at 1.0675

Oil edges higher

Oil prices are rising, continuing a cautious rally across the week, supported by expectations of tighter supply. The wild roller coaster swings of previous weeks appear to have settled as the EU continues to negotiate with Hungary in order to approve its proposal to ban Russian oil imports.

Even without a formal ban being agreed Russia’s oil is being shunned by market buyers with output from Russia expected to decline to 480-500 million tonnes this year down from 524 million tonnes in 2021.

A larger than expected drawdown in oil inventories is keeping the price buoyant, particularly given that peak US driving season is upon us. The demand outlook is also improving as Shanghai is set to end a two month lockdown next month.

WTI crude trades +0.6% at $110.50

Brent trades +0.57% at $112.04

Learn more about trading oil here.

Looking ahead

15:00 Pending home sales

19:00 FOMC minutes

21:30 API oil inventories

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade