US futures

Dow futures +0.08% at 34590

S&P futures +0.23% at 4088

Nasdaq futures +0.23% at 12053

In Europe

FTSE -0.14% at 7579

Dax +0.7% at 14510

Learn more about trading indices

Personal spending rises, jobless claims fall

US stocks are set for a stronger start adding to impressive gains from the previous session. A less hawkish stance from Federal Reserve Chair Powell, combined with cooling core PCE has lifted stocks to significant levels.

The Dow Jones trades in a bull market, up 20% from its September low, while the S&P500 has pushed over the 200 sma moving average.

Yesterday Fed Chair Powell signaled that the US central bank would raise interest rates at a slower pace moving forwards, cementing expectations for a 50-basis point hike in December. Powell also said that the terminal rate would likely be above where it was forecast in September. The market didn’t pay much attention to this warning, it seems, as the Nasdaq soared 4%.

Today’s data is enough to keep the market happy that inflation is moving in the right direction. However, it is a small decline, highlighting that this is likely to be a long journey. Personal spending was also solid at 0.8%

Separately jobless claims were slightly lower than expected at 225k, down from 240k in the previous week.

Overall, the data is upbeat, showing that the economy is still holding up while inflation is cooling. If it continues like this, then a soft landing for the US economy could be likely.

US ISM manufacturing data is due shortly.

Elsewhere China is easing some lockdown restrictions, which is adding to the supportive mood towards equities.

Corporate news:

Kroger rises 3.2% pre-market after the supermarket chain raised the annual same-store sales forecast thanks to a steady demand for groceries and essentials.

Salesforce trades 7.1% lower pre-market after announcing that the co-chief executive would step down in January, raising uncertainty over future direction.

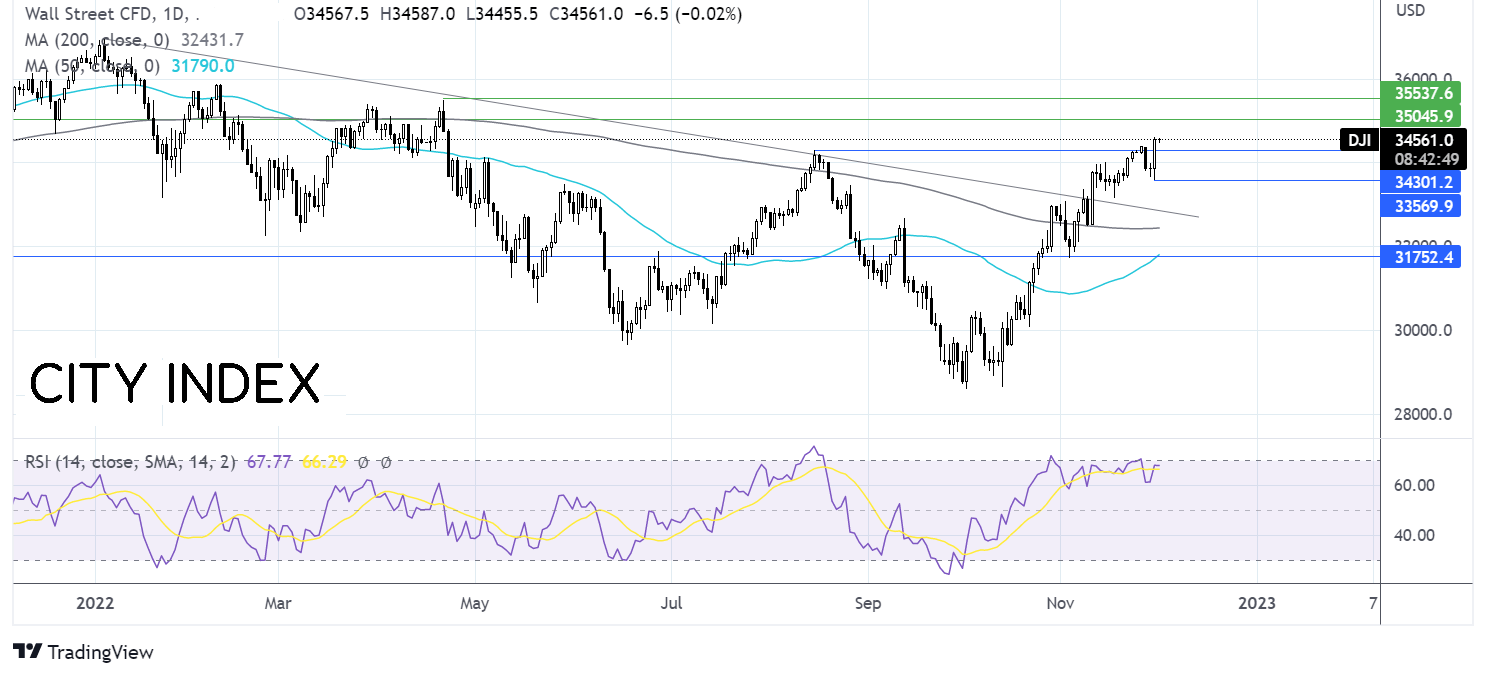

Where next for the Dow Jones?

The Dow Jones rallied over 20% from its September low, rising above the 200 sma and resistance at 34300 the August high. The RSI supports further upside while it remains out of overbought territory. Buyers will be looking ahead to 35000 round number to extend gains to 35500 the April peak. On the downside, immediate support can be seen at 34300, with a break below here opening the door to 33570 the weekly low and 33000 round number.

FX markets – USD falls, EUR rises.

The USD is falling as inflation cools, supporting the Fed’s less hawkish stance.

EURUSD is rising, capitalizing on the weaker USD, despite disappointing data. German retail sales fell by more than forecast -2.8% MoM as surging energy costs reduce disposable income. Eurozone manufacturing PMI was also revised lower to 47.1.

GBP/USD is rallying hard across the board as it continues to stage an impressive recovery from the 1.0340 all time low in September. UK manufacturing OMI was upwardly revised to 46.5 in November. The pound trades at a 16-week high, boosted by Powell’s remarks, which appear to be driving flows out of the USD towards GBP. The pound his rising versus all its crosses

GBP/USD +1% at 1.2190

EUR/USD +0.39% at 1.0444

Oil rallies 7% so far this week

Oil prices are rising for a fourth straight day, trading up 7% so far this week. The latest leg higher comes as China eases lockdown restrictions in several major cities, raising the demand outlook, Fed Chair Powell talks down the US dollar, and as investors look ahead to the OPEC meeting this weekend.

There are some suggestions that as the OPEC meeting is now taking place virtually that another production cut is unlikely. “Sources “ also say that no cuts are expected. However, a further cut can’t be completely ruled out. OPEC+ has surprised the market in the past, and some of this recent rally could be explained by expectations of further cuts.

The prospect of a lower oil price cap is also supporting the market. The EU is slowly progressing towards a deal which is due to begin on Monday.

WTI crude trades +1.4% at $81.68

Brent trades at +1.3% at $88.05

Learn more about trading oil here.

Looking ahead

14:00 ISM Manufacturing PMI

15:45 ECB Lane speech