US futures

Dow futures +0.65% at 30312

S&P futures +0.35% at 3747

Nasdaq futures +0.3% at 11613

In Europe

FTSE +0.7% at 7070

Dax 1.5% at 12590

Euro Stoxx +0.7% at 3411

Learn more about trading indices

Sales rise despite surging inflation

US stocks are heading for a stronger open as investors digest more banks’ earnings and stronger than expected retail sales data.

Yesterday saw a disappointing start to the earnings season yesterday after JPMorgan and Morgan Stanley saw net income fall around 30%, missing forecasts. The fact that the banks are setting aside large sums for potential bad loans suggests that they are concerned about a possible recession.

Helping stocks higher today have been less hawkish comments from known Federal Reserve hawkish, which have helped the market pare back aggressive Fed hike bets. With hawks Christopher Waller and James Bullard both supporting hiking rates by 75 basis points, not 100 bps that the market priced in after Wednesday’s red hot inflation.

Retail sales data has also lifted the market mood. US retail sales rose by a larger than forecast 1%, rebounding from -0.3% decline yesterday. The data suggests that consumers are not reining in spending as inflation rises and consumer sentiment falls.

Looking ahead, US consumer confidence could paint a more depressing picture, with the Michigan consumer sentiment index expected to fall to 49.9, down from 50.00, a record low.

In corporate news:

Wells Fargo is falling pre-market after missing the earnings forecast owing to larger bad loan provisions and falling mortgage demand. The bank set aside 580 million for bad loans after releasing $1.26 billion last year.

Alphabet is trading higher as it prepares for its 20 for 1 stock split, which will happen after the close today. This is the second time in history that the stock is being split, with the share price splitting in 2014.

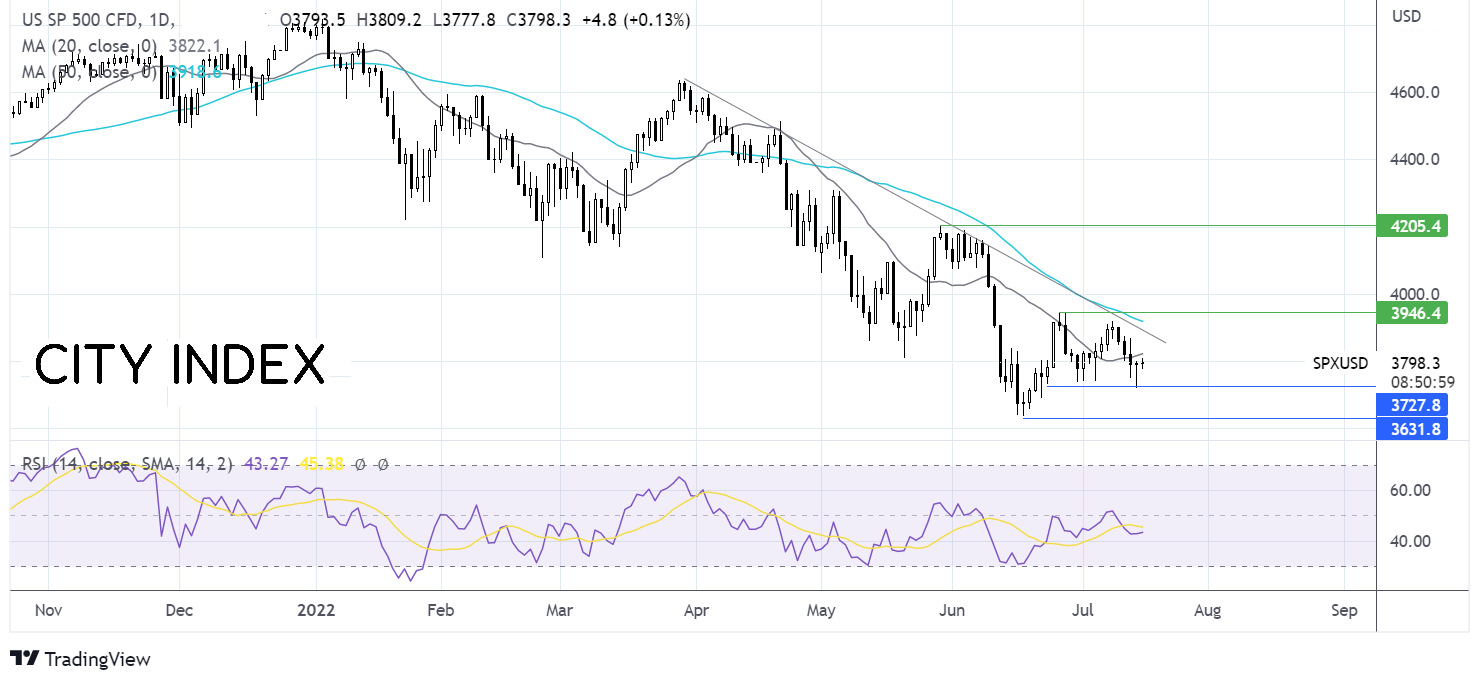

Where next for the S&P500?

The S&P500 rebounded lower from resistance at 3940, breaking below the 20 sma and dropping to a low of 3720. The long lower wick on the candle suggests that there wasn’t much acceptance at the lower price before buyers pushed the price higher. Any recovery will need to rise above the 20 sma at 3825, ahead of the falling trendline at 3900 and the 3940 horizontal resistance. A break above here would create a higher high. Sellers will look to take out support at 3720 to open the door to 3635, the 2022 low.

FX markets – USD falls, EUR climbs

USD is edging lower after known Federal Reserve hawkish comments were less hawkish than expected. Both Waller and Bullard supported a 75 bps hike rather than the 100bps hike the market was pricing in. The paring back of Fed hikes is helping the USD lower

EURUSD is rising on the back of USD weakness. The outlook for the region remains weak, and the ECB is expected to hike rates by 25bp next week.

GBP/USD is holding steady in quiet trade but is set to lose 1.6% across the week amid rising concerns over the outlook for the UK economy.

GBP/USD +0.07% at 1.1830

EUR/USD +0.4% at 1.0055

Oil rises but down across the week

Oil prices are rising but are on track to fall across the week. Oil dropped sharply at the beginning of the week, pulled lower by concerns over the demand outlook as recession fears rose.

The prospect of higher interest rates tipping the US economy into recession saw oil prices fall to a 4-month low before clawing back some of the lost ground.

However, the paring back of aggressive Fed rate hike bets is helping recession fears ease, booting oil prices higher. Also, lifting the oil price is a playing down of expectations of additional Saudi oil output by US officials.

This playing down comes at a time when the capacity for additional production from OPEC+ countries is running low.

Baker Hughes rig count numbers are due later.

WTI crude trades +1.7% at $94.70

Brent trades +2% at $98.5

Learn more about trading oil here.

Looking ahead

14:15 Industrial production

15:00 Michigan consumer sentiment

18:00 Baker Hughes rig count