US futures

Dow futures +0.3% at 34104

S&P futures +0.5% at 4133

Nasdaq futures +0.9% at 13222

In Europe

FTSE +0.7% at 7008

Dax +0.7% at 15291

Euro Stoxx +0.7% at 3984

Learn more about trading indices

Stocks set to rebound, Nasdaq outperforms

US futures are pointing to a stronger open, extending gains from the previous session as the recovery from Wednesday’s inflation inspired selloff continues.

The Fed have been out in force to calm the markets this week after both consumer and factory gate inflation shot to multi-year highs. Given the fact that treasury yields are falling, the US Dollar trades lower and equities are pointing higher, it seems that the Fed’s message has been taken on board for now.

Much weaker than expected retail sales support validate the Federal Reserve’s position. Retail sales printed flat in April at 0%, short of the 1% increase forecast, although March’s numbers were upwardly revised to 10.7% from 9.8% compensating for the weakness in April.

After such strong numbers in March some softness in April isn’t any great surprise. Where retail sales go from here will be more telling.

Stocks are set to advance with the Nasdaq to outperform its peers after experiencing the deepest selloff this week. Investors have been willing to buy the dip which suggests that there is still more room to run in this bull trend.

Earnings

Some big names will be in focus in the session today with earnings from:

Disney trades -4% pre-market after following in Netflix footsteps are reporting disappointing subscriber growth for its streaming business.

Airbnb trades -1.2% pre-market despite reporting recovering booking volumes as lockdown restrictions continue to ease.

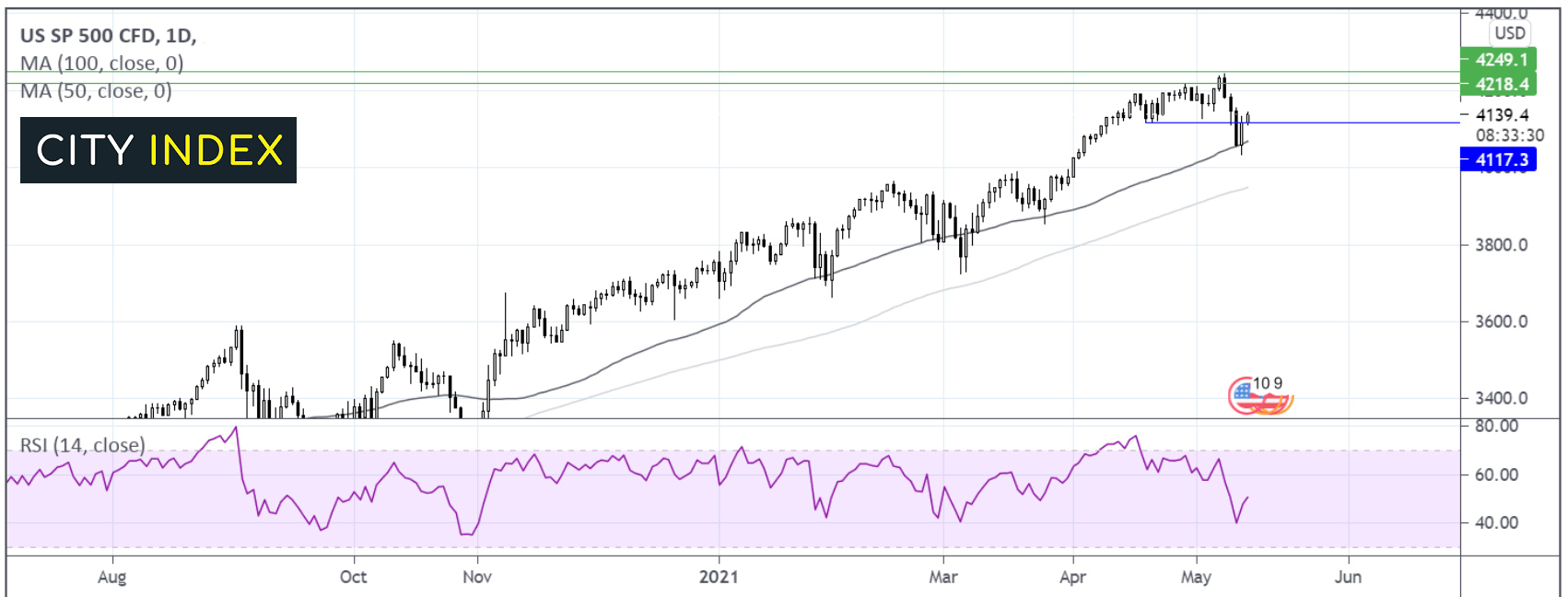

Where next for the S&P500?

The S&P bounced off its 50 day sma and is extending gains heading towards the open. A move above resistance at 4115 and north pointing RSI keeps the buyers optimistic of a move back towards 4220 the April high ahead of 4250 the all time high. A move below 4120 could see the sellers pick up pace. However the 50 sma is proving to be a tough nut to crack on the downside. Sellers would be looking for a break below 4040 the 50 sma to confirm a deeper selloff.

FX – USD weakens, EUR rises on upbeat ECB minutes

The US Dollar heads lower extending losses from the previous session. The US Dollar Index is still set for a weekly gain after Wednesday’s inflation data induced spike.

EURUSD – The Euro is being supported by upbeat minutes from the latest ECB meeting. The central bank said that the incoming data points to resumption of growth in Q2. However, the near-term outlook remains cloudy owing the resurgence of covid.

GBP/USD +0.21% at 1.4082

EUR/USD +0.37% at 1.2122

Oil rises but set for weekly declines

Oil rising paring some of the steep losses from the previous session. Oil prices dropped over 3% on Thursday as Colonial Pipeline restarted operations and after the draw on oil stockpiles was lower than expected.

Prices are being supported by the weaker US Dollar and as the demand outlook remains solid for H2. Earlier in the week OPEC upgraded its demand forecast for the second part of the year.

Near term surging covid cases in India, the world’s third largest importer of oil, could cap gains.

US crude trades +1.2% at $64.58

Brent trades +1.2% at $67.75

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

15:00 Michigan consumer sentiment

18:00 Baker Hughes rig count

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.