US futures

Dow futures -0.35 % at 34707

S&P futures -0.62% at 4513

Nasdaq futures -1% at 14562

In Europe

FTSE -0.5% at 7635

Dax -0.4% at 14250

Euro Stoxx -0.7 % at 3856

Learn more about trading indices

Fed bets hit the Nasdaq

US stocks are heading for a softer start to the week as expectations for a more hawkish Fed continue to weigh on sentiment.

Last week, the March Fed meeting minutes signaled that the Fed was looking to adopt a more aggressive stance on monetary policy tightening. Those fears persist this week, with the market now pricing in an 81% probability of a 50 basis point rate hike in May.

High growth tech stocks are once again bearing the brunt of the selloff, as higher yields accelerate the rotation out of tech.

Concerns over China are also central as COVID cases continue rising and the lockdown continues. While this is helping oil prices fall, worries over rising inflation in the world’s second-largest economy and factories closing are hurting risk sentiment.

There is no high-impacting US data due for release today. Instead, Fed speakers will be in focus, with more hawkish rhetoric potentially hitting stocks harder.

In corporate news:

Twitter trades lower pre-market on the news that Elon Musk would not take a seat on the board, despite disclosing a 9.2% stake in the company. The share price had surged 25% last week on the disclosure as investors hoped that Musk could help reverse the stock’s recent underperformance.

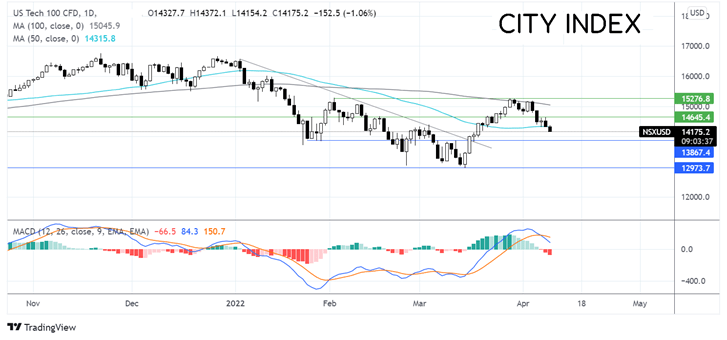

The latest news on stocksWhere next for the Nasdaq?

The Nasdaq failed to rise above the 100 SMA, rebounding lower. The falling through the 50 sma plus the bearish crossover on the MACD keeps sellers hopeful of further downside. Immediate support could be seen at 13850 with a break below here, opening the door to 12950, the 2022 low. Any recovery would need to retake the 50 sma at 14300 to open the door to 14650 and expose the 100 SMA at 15045.

FX markets USD rises, EUR rises

USD is rising as it continues to be boosted by hawkish Fed expectations. According to the CME Fed Funds, a 50-basis point rate hike in May is 81.6% priced in. There is no data due today, but Fed speakers will remain in focus and more hawkish rhetoric could lift the USD.

EUR/USD is rising after booking steep losses last week. The euro is strengthening following the French elections over the weekend. Macron and far-right nationalist Le Pen have qualified for the runoffs on April 24th. The market is breathing a sigh of relief that Macron still holds the majority, albeit by a tight margin.

GBP/USD trades steadily above 1.30 after picking up from the session low. UK GDP data showed that the UK economy grew slower in February than expected at just 0.1%, down from 0.8% in January and short of the 0.4% forecast.

GBP/USD -0.1% at 1.3022

EUR/USD +0.24% at 1.0902

Oil falls steeply

Oil fell over 1% last week and is extending those losses at the start of the week. Oil prices continue to fall lower after more oil supply was announced last week and as the lockdown in Shanghai continues.

The release of strategic reserves is expected to amount to around 1 to 1.3 million barrels per day and has calmed the market significantly, plugging at least some of the oil supply absent from Russia. The idea of the reserves being released into the market in a steady drip over the coming six months has dampened the rally, which sent stocks to $130 per barrel at the start of the war.

Separately, COVID cases continue to rise in China, and the lockdown in Shanghai, of 26 million inhabitants, continues, impacting the demand outlook.

WTI crude trades -3.7% at $94.10

Brent trades -3.2% at $99.02

Learn more about trading oil here.

Looking ahead

17:00 Fed Williams

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.