US futures

Dow futures -0.03 % at 33066

S&P futures -0.01% at 4157

Nasdaq futures -0.05% at 13075

In Europe

FTSE +1.2% at 7516

Dax +0.5% at 13970

Euro Stoxx +0.34% at 3740

Learn more about trading indices

Stocks edge lower

US stocks are pointing to a milder weaker start on Tuesday following a strong start to the new month yesterday and as investors eye the start of the Federal Reserve’s two-day monetary policy meeting later on.

Yesterday the NASDAQ led the rally higher, closing up 1.6% after booking 13% losses across the month of April on fears of surging inflation and a more aggressive Fed.

The Fed is due to announce its interest rate decision tomorrow and is broadly expected to hike rates by 50 basis points. This movie is pretty much priced in. Thew markets will be more focused on what comes next? Are we looking at more outsized hikes, possibly in June and again in the summer?

The Fed’s next moves are what could see spark movement in the stocks markets. Any fears in the market that the Fed will be hiking rates too quickly could see stocks, particularly high-growth tech stocks come under pressure again.

Today, investors will look ahead to the release of US factory orders and JOLTS jobs openings, which are expected to confirm that there are still over 11 million job vacancies underscoring just how tight the labour market is.

In corporate news:

Earnings continue to come in thick and fast with Pfizer reporting before the open and the likes of Starbucks, Airbnb and AMD reporting after the close

More news on the stocks to watch

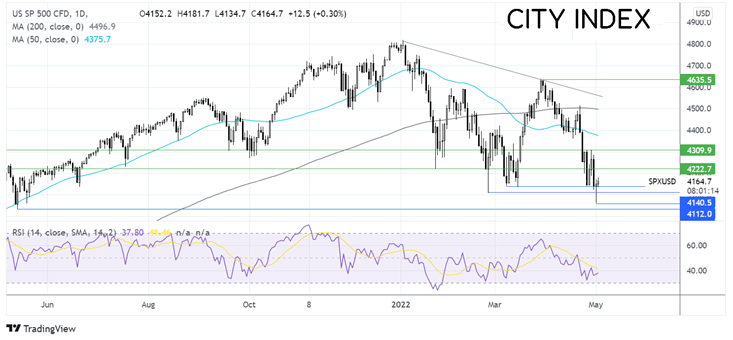

Where next for the S&P500?

The S&P500 has been trending lower, it trades below its falling trendline, below its 50 & 100sma. The price fell to a 2022 low yesterday at 4060 before rebounding back over 4150. The RSI points to further losses. Immediate support can be seen at 4140 the March 11 low, ahead of 4115 the February low ahead of 4060 the 2022 low. A break below here could see sellers gain traction. On the flip side, buyers would be looking for a move over 4220 the January low and 4300 the late April high to expose the 50 sma.

FX markets USD falls, EUR rises

USD is pausing for a breath after rising to an almost 20 year high in the previous session. Expectations of a hawkish Fed have lifted the greenback as the two-day FOMC meeting begins today.

GBP/USD has risen back over 1.2550 as the pound capitalizes on the weaker USD after manufacturing PMI was upwardly revised for April to 55.8, up from 55.5 preliminary read and well ahead of the 55.3 forecast.

EUR/USD is rebounding higher from 1.05 after record higher PPI inflation data. Producer prices rose to 36.8% YoY up from 31.5% and also a record high. The data comes ahead of a speech by ECB governor Christine Lagarde, who could be prevented from sounding too hawkish amid fears of a recession in Europe.

GBP/USD +0.4% at 1.2540

EUR/USD +0.2% at 1.0540

Oil falls on demand concerns

Oil prices are edging lower on Tuesday as concerns over the demand outlook in China amid rising COVID cases and tighter lockdown restrictions, overshadowed a possible European oil embargo on Russia.

With Beijing reporting an increasing number of new cases and mass testing, concerns are rising over the demand outlook for the world’s largest oil importer. Authorities in China are showing no signs of letting up on the strict zero-COVID policy. It’s looking increasingly likely that Beijing will see a similar fate to Shanghai.

Meanwhile, on the supply side, a potential EU embargo on Russian oil will keep oil prices supported. Russian oil is already absent from the market and as long as the threat of a ban on Russian oil exists, oil will remain supported at around $100.

API inventory data is due later. Expectations are for crude inventories to fall by 1.2 million barrels.

WTI crude trades -0.3% at $101.20

Brent trades -0.4% at $104.52

Learn more about trading oil here.

Looking ahead

15:00 US JOLTS job openings

15:00 US Factory orders

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.