US futures

Dow futures -0.3% at 33604

S&P futures -0.49% at 4060

Nasdaq futures -0.78% at 12296

In Europe

FTSE -0.6% at 7866

Dax -1.2% at 15327

Learn more about trading indices

Michigan consumer sentiment due

US stocks are extending losses from the previous session as investors digest more hawkish commentary from Federal Reserve officials under session fears mounted. Stocks are heading for the first weekly decline in three weeks.

Across the week and following last Friday’s very strong jobs report, Federal Reserve policymakers, including Jerome Powell, have reiterated the need to keep raising interest rates in order to rein in inflation, which remains over three times the Fed’s 2% target. The more hawkish tone and expectations of further rate hikes have dampened the optimism that drove a powerful rally in January and has heightened recession fears.

The 2 to 10-year treasury yield inverted by 85 basis points, marking the deepest inversion since the early 1980s. However, the strong labour market almost contradicts these concerns. That said the US jobless claims data yesterday, which rose for the first time in 6 weeks, suggests that there is some weakness now starting to seep in.

Attention now turns to US Michigan consumer confidence index for February which is expected to tick higher to 65, up from 64.9 in January, which was the highest level since April. Improving consumer sentiment could be considered inflationary and could help to drive stocks lower and the USD higher.

Beyond the consumer sentiment report, attention is firmly on US inflation data which is due on Tuesday.

Corporate news

Lyft falls 30% pre-market after the ride-hailing app reported an unexpected Q4 loss and disappointing guidance. Lyft reported a loss per share of $0.74 below the EPS of $0.15 forecast. Revenue came in stronger at $1.18B above $1.15B.

PayPal rises after posting better than expected earnings and lifting Q1 forecasts. The payment giant posted EPS of $1.24 ahead of the $1.20 expected. Revenue was $7.4 billion, ahead of $7.39 billion forecast.

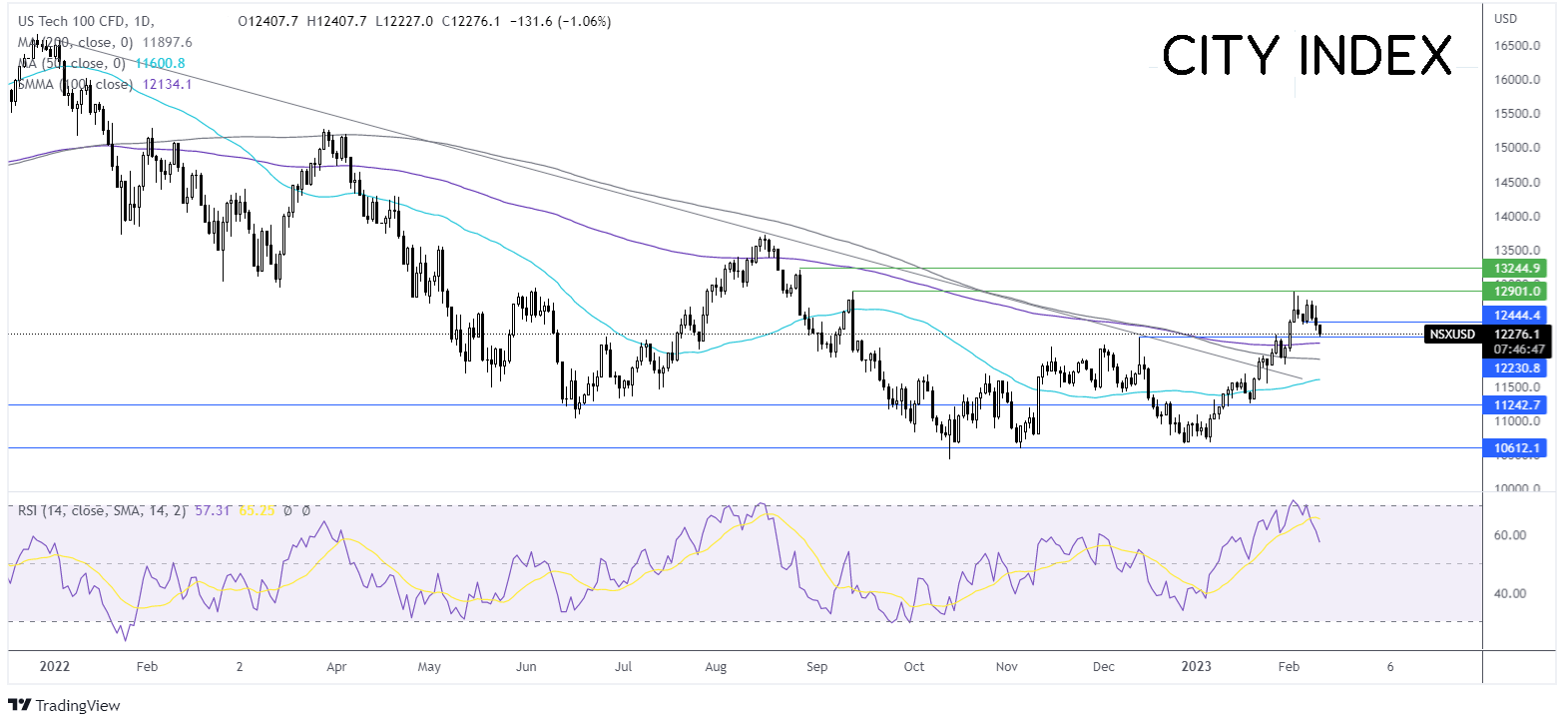

Where next for the Nasdaq?

After a strong rally from the 10685 low, the price rose to resistance 12900 before falling lower. The rise above the 50, 100 & 200 sma & the multi-month falling trendline, combined with the RSI above 50, supports further upside. Buyers will look for a rise over 12900 to extend the bullish run towards 13200, the August 26 high. On the flip side, immediate support can be seen at 12225 the daily low and December high, ahead of the 200 sma at 11900.

FX markets – USD rises, yen falls

The USD is rising after three days of losses in risk-off trade. The USD is still set to rise across the week, a week which has seen Fed speakers reiterate its hawkish message, saying that more rate hikes are needed to rein in inflation.

GBP/USD is falling after GDP data showed that the UK economy narrowly avoided a recession in Q4 with the economy stalling at 0% growth QoQ. However, GDP in December fell -0.3% MoM, below forecasts amid industrial action across the country. This, combined with recession fears and Brexit worries, could keep the pound depressed.

USD/JPY is falling on yen strength as Kazuo Ueda is reportedly set to become the next BoJ governor. However, strong gains were pared back when he said that the central bank’s current policy was appropriate.

GBP/USD -0.14% at 1.2100

USD/JPY -0.5% at 130.80

Oil rises after Russia announced a production cut

Oil prices are rising, rebounding from losses yesterday and are set to rise over 8.5% across the week.

Oil prices are rising after Russia announced plans to limit oil production next month in retaliation for the West imposing a price cap on the country’s oil and oil products. Russia said that it plans to reduce output in March by 500,000 barrels per day or about 5% of output.

The announcement overshadows rising recession fears which haunted the market on Thursday and continue to weigh on risk sentiment today.

WTI crude trades +1.8% at $79.66

Brent trades at +1.9% at $85.87

Learn more about trading oil here.

Looking ahead

15:00 US Michigan consumer confidence

17:30 Fed Williams to speak