US futures

Dow futures -0.07% at 32418

S&P futures -0.05% at 3975

Nasdaq futures -0.03% at 12667

In Europe

FTSE 1.4% at 7477

Dax +0.09% at 15156

- Bank worries ease, Fed rate hike concerns rise

- US consumer confidence data is due

- GBP/USD rises after UK food inflation hits a record high

- Oil extends gains for a second day

Learn more about trading indices

Bank worries fade further

US stocks are set to open modestly lower as confidence remains fragile even as investors believe that the banking crisis has been contained at least for now.

The mood towards the banks has cautiously improved after the news yesterday that First Citizens Bank will buy the assets of failed SVB and after US authorities pledged more help to support regional banks.

If the banking turmoil is contained then that could mean that the Federal Reserve will need to hike rates further rather than rely on a banking crisis recession to do some of the heavy lifting. US treasury yields rise.

Federal Reserve Governor Philip Jefferson reiterated the Fed commitment to rein in inflation but also noted that it could take some time as some areas of inflation, such as services are proving to be persistent.

US core PCE, the Fed’s preferred inflation gauge is due to be released on Friday and will provide more clues as to how the fight against inflation is faring.

Today US consumer confidence is the main release and is expected to show that consumer confidence slipped for a third straight month to 101 in March down from 102.9. Cooling confidence could help fuel less aggressive Fed bets, which would be good news for stocks.

Corporate news

Walgreens Boots Alliance rises pre-market after beating quarterly estimates. EPS was $1.16 ahead of $1.10 and revenue came in at $33.53B, higher than estimates.

Alibaba ADR’s rise pre-market on reports that the company could split into six business units that could each pursue an IPO.

Meta is falling pre-market on news that the social media platform is set to cut bonuses for some executives, in the latest efforts to cut costs and restore profitability.

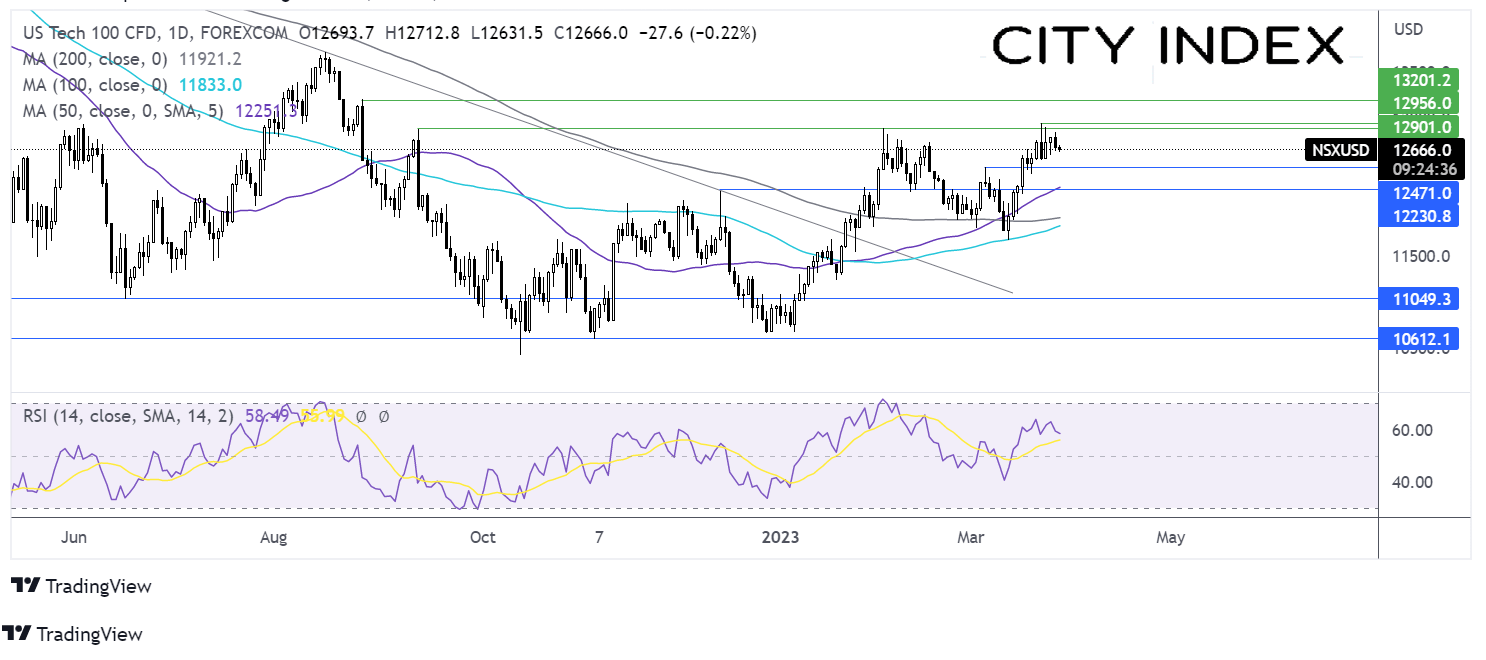

Where next for the Nasdaq?

After failing at 12950 the Nasdaq has eased lower consolidating after a strong rally from 11680 the 100 sma hit on March 13. The bullish RSI and the 50 sma crossing above the 200 sma keeps bulls hopeful of further gains. Buyers will look for a rise over 12950 to extend the bullish run to 13200 the September high. On the flip side, sellers could look for a fall below below 12470 the March 6 high to expose the 50 sma at 12250.

FX markets – USD falls, GBP rises

The USD is is falling as forex markets remain convinced that the Federal Reserve will keep interest rates on hold in the next meeting even though the mood surrounding the banking sector has improved. Attention turns to US consumer confidence data for further clues.

EUR/USD is rising thanks in part to the improved market mood and the broadly weaker U.S. dollar. ECB policymakers have reiterated their willingness to remain focused on fighting inflation. Mario Centeno said the size of the next rate hike will depend on data while Isabel Schnabel highlighted that there were no signs of weakening in the labour market which could keep wage pressure elevated.

GBP/USD is Rising after a food inflation in the UK rose to a record high 15% and after encouraging comments from Bank of England governor Bailey who insists that the UK banking sector is resilient and that inflation remains the top focus for the bank. The market is pricing in a 5050 possibility that the BoE will keep rates on hold and the May meeting.

EUR/USD +0.16% at 1.0818

GBP/USD +0.19% at 1.2309

Oil rises on supply concerns & easing bank fears

Oil prices are rising adding to 5% gains from yesterday amid a supply disruption from Kurdistan and amid hopes that the turmoil in the banking sector has been contained.

oil jumps over 5% yesterday after supply disruptions from Iraq’s Kurdistan affecting just shy of 500,000 barrels per day.

Their supply concerns come at the same time that demand worries eased as banking fears fade. News that First Citizens’ Bank will buy up SVB’s deposits and bad loans appears to have drawn a line under the crisis for now, meaning recession risks are easing.

WTI crude trades +0.12% at $72.92

Brent trades at +0.16% at $77.80

Learn more about trading oil here.

Looking ahead

14:15 ECB Lagarde speech

15:00 US consumer confidence