US futures

Dow futures +0.3% at 34470

S&P futures +0.4% at 4474

Nasdaq futures +0.5% at 14523

In Europe

FTSE +0.1% at 7460

Dax -0.1% at 14350

Euro Stoxx -0.2% at 3864

Learn more about trading indices

Are more sanctions coming?

US stocks are set to rise cautiously higher on the open as President Biden meets with European leaders to discuss further measures to put economic pressure on Russia.

President Biden will be meeting with NATO, the G7, and European leaders later in the day, which could result in more sanctions being imposed on Russia.

The oil market is holding steady, suggesting that the general expectation is that Russian oil will be left out of any news restrictions.

The meeting comes a month after the war started and soaring commodity prices. Inflation, which was already a problem at the start of the year, has become a massive headache for central banks amid fears of slowing growth. Fed speakers this week have been banging the hawkish drum, which is expected to continue.

Data was a mixed bag; durable goods fell a much larger than expected 2.3% YoY in February, after rising 1.6% in January.

Meanwhile, jobless claims showed that the labour market recovery was on track, dropping below 200k to 187k.

In corporate news:

GameGroup trades lower before the bell after Boston Consulting Group sued it in an attempt to reclaim $30 million in unpaid fees.

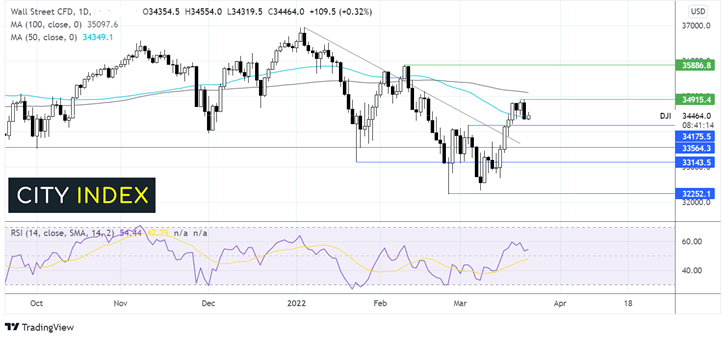

Where next for the Dow Jones?

The Dow Jones rebounded lower from resistance at 34900 yesterday before finding support at 34350 the 50 SMA, which continues to hold today. The RSI suggests that there is still more upside to come. However, buyers will need to break above resistance at 34900 to expose the 100 sma at 35100, also the February 16 high. Sellers will look for a move below the 50 SMA to test 34200, with a move below here negating the near-term uptrend.

FX markets USD rises, GBP holds steady.

USD is heading higher, boosted by growing hawkish expectations. This week, Fed speakers have been out in force, speaking of the need to hike interest rates more aggressively. The CME FedWatch tool now prices in a 68.3% probability of a 50-basis point rate hike in May. There are plenty more Fed speakers due today who could keep the price buoyed.

GBPUSD is holding steady versus the strong USD after the service sector PMI unexpectedly rose to 61, up from 60.5. Expectations had been for a decline to 59. However, the manufacturing PMI came in below forecasts at 55.5, down from 58.

GBP/USD +0.01% at 1.3213

EUR/USD -0.08% at 1.0995

Oil steadies as more sanctions on oil are unlikely for now

Oil prices are holding steady after posting gains of over 4% yesterday and as investors await news from President Biden’s meeting with European leaders.

Oil prices are steady as any news sanctions are unlikely to include Europe banning Russian oil imports, given the high dependency.

Data from the EIA showed that US crude oil reserves unexpectedly fell last week when analysts had been forecasting a rise.

Separately, progress on the Iran nuclear deal appears to have stalled. Without a substantial supply of oil into the market, the oil price will remain at these levels or continue to rise.

WTI crude trades -0.5% at $114.14

Brent trades -0.58% at $118.65

Learn more about trading oil here.

Looking ahead

15:00 Fed Bostic speaks

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit level.

- Place the trade.