US futures

Dow futures +0.32% at 33025

S&P futures +0.42% at 4160

Nasdaq futures +0.63% at 12999

In Europe

FTSE +0.4% at 7410

Dax +1.4% at 13256

Euro Stoxx +0.9% at 3670

Learn more about trading indices

Stocks rebound

US stocks are pointing to a solid open, steadying after a steep selloff post-Jackson Hole.

Stocks closed lower yesterday as investors continued digesting the Fed’s hawkish message that rates will stay higher for longer.

Investors will look towards Friday’s non-farm payroll for further clues. This is the last key jobs release ahead of the FOMC, and the CPI inflation release is after the meeting.

Ahead of Friday’s jobs report, today sees the release of the JOLTS job openings, which is expected to show that the labour market remains very tight, with 10.4 million vacancies still unfilled. This is down from around 11.5 million at the start of the summer.

Consumer confidence figures will also be under the spotlight and are expected to rise from the record low reached in July of 95.7 to 97.9 in August.

Corporate news:

Baidu is set to open higher despite revenue falling 5% to $4.43 billion in Q2. Revenue at the cloud business grew 31% as core business advertising revenue was soft . The stock has been doubling down on self-driving technologies.

Best Buy is falling after Q2 results highlight weaker demand for electrical gadgets. EPS fell to $1.54 ahead of $1.34 forecast. Sales fell 12.1%

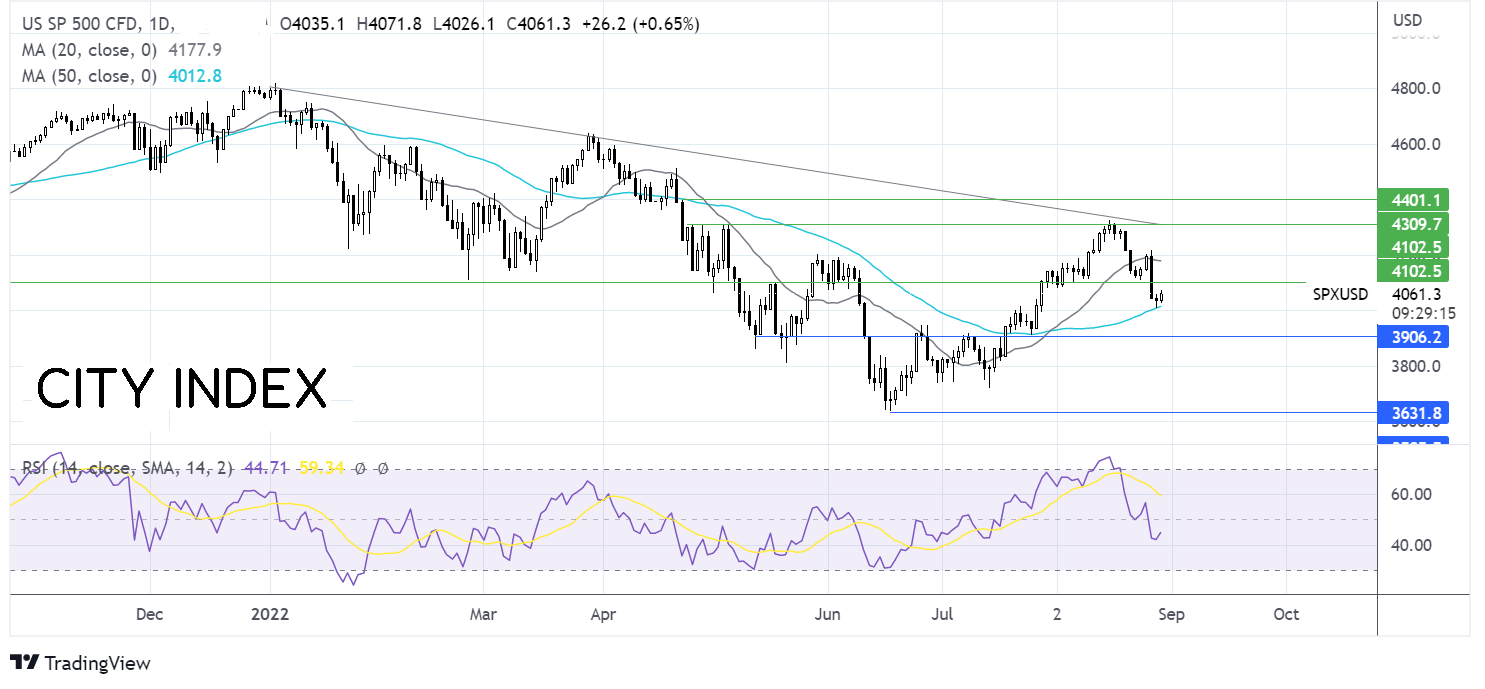

Where next for the S&P500?

The S&P500 found support at 4000, the psychological level, and the 50 sma yesterday and is attempting to push higher. Failure by the bulls to defend 4000 could see sellers targeting 3900, the July 26 low. On the flip side, buyers look towards 4100, the early August low , with a break above here needed to expose the 20 sma at 4180.

FX markets – USD falls, EUR rises.

The USD is heading lower amid an improved market mood. Investors will look to consumer confidence and JOLTS job openings for further insight into the health o the US economy.

EUR/USD is rising despite economic confidence in the eurozone falling more than forecast in August to 97.6, down from 98.9. Instead, news that Germany and the EU were well ahead of targets in filling gas reserves has pulled European gas prices lower and helped boost the mood in the region.

GBP/USD is rising cautiously versus the weaker USD, but trades below 1.1750 as concerns over the UK economic outlook weigh. Goldman Sachs has warned that inflation could reach 20%, fuelling recession fears. The forecast comes after the investment bank predicted a recession in Q4.

GBP/USD +0.1% at 1.1725

EUR/USD +0.37% at 1.0034

Oil falls almost 3%

Oil prices are falling today, paring solid gains from the previous session amid concerns that rising inflation and aggressive rate hikes will soften fuel demand.

With inflation edging towards double digits in some of the world’s major economies, central banks are expected to keep hiking rates aggressively throughout September and beyond. Higher interest rates mean slower economic growth and softer oil demand.

OPEC+ is due to meet on September 5th to discuss output plans. The meeting will come after Saudi Arabia has said it could consider cutting output to support oil prices.

API inventory data is due to be released and is expected to show that stockpiles fell 600,000 barrels last week.

WTI crude trades -2.75% at $94.78

Brent trades -2.7% at $100.17

Learn more about trading oil here.

Looking ahead

15:00 US consumer sentiment

15:00 JOLTS job openings