US futures

Dow futures -1.8% at 30800

S&P futures -2.4% at 3805

Nasdaq futures -3% at 11473

In Europe

FTSE -1.736% at 7197

Dax -2.1% at 13450

Euro Stoxx -2.4% at 3506

Learn more about trading indices

Fed fears, China COVID returns

US stocks fell sharply last week and are extending the selloff today as the treasury yield curve inverted on rising fears that aggressive Federal Reserve hiking will send the US economy into a recession.

Following the unexpected increase in CPI in May to 8.6%, the likelihood of a 75-basis point rate hike has risen significantly. Fed fear is hammering the market lower, investors are keen to whip their money off the table ahead of Wednesday’s decision.

Pressure is certainly mounting on Jerome Powell and Co, ahead of the meeting. The central bank looks like it will need to play catch up, whilst also attempting to restore credibility. Looking ahead, the economic calendar is quiet. Attention will be on a speech by Lael Brainard, the vice-chair, for further clues over the next steps for policy.

Adding to the market’s woes, authorities in both Shanghai and Beijing have ordered mass COVID testing with some districts once again barred from leaving home. This is a setback in China’s re-opening plans, which dragged stocks in Asia sharply lower. This comes after socks had risen last week amid improved relations between authorities and tech stocks.

In corporate news:

Tesla drops over 4% pre-market on the broader tech selloff and despite the EV maker filing for a 3 for 1 stock spilt late on Friday. Furthermore, the Shanghai factory is back operating at 100% capacity. The stock also received a broker upgrade from RBC.

Coinbase tumbles over 17% pre-market, weighed down by the crash in cryptocurrencies.

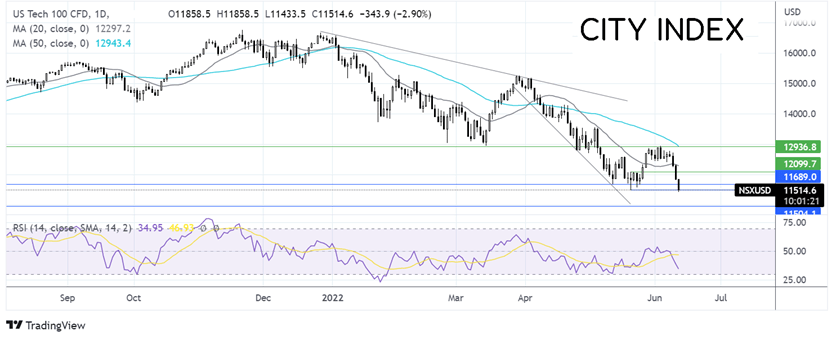

Where next for the Nasdaq?

The Nasdaq is falling, testing 2022 lows. The RSI supports further downside whilst it remains out of oversold territory. Sellers will need to break below 11490 to bring 10950 the October 2020 low into play. Resistance can be seen at 12070 the May 20 high, with a break above here exposing the 20 sma at 12300. It would take a move above 12940 the June high to create a higher high.

FX markets – USD rises, GBP tumbles

USD is rising, building on gains from last week as hawkish Fed expectations build and as investors seek out its haven properties. The greenback is rising for a fourth straight day and appears set to test its multi-year high. The buck has traced 10-year bond yields higher, which now sit at almost 3.2%

USD/JPY rose to its highest level since 1998 on central bank divergence ahead o the BoJ and FOMC rate decisions this month. The latest jump in the pair comes following Friday’s CPI data which has raised expectations of a 75 basis point rate hike this week.

GBP/USD is falling, trading around a monthly low after disappointing UK GDP data. The UK economy unexpectedly contracted -0.3% MoM in April after contracting -0.1% in March. Expectations had been for a 0.1% rise in economic activity. The data added to fears of a sharp economic slowdown just three days ahead of the BoE interest rate decision.

GBP/USD -1% at 1.2210

EUR/USD -0.27% at 1.0595

Oil falls on Beijing COVID & global growth concerns

Oil prices are falling after 7 straight weeks of gains. News of a rise in COVID cases in Beijing have hit hopes of a quick ramping up of demand in China. The outbreak which has been labelled as ferocious by officials means parts of China are likely to stay locked down for longer.

The cooling demand outlook comes as fears over the rising cost of living and slowing global growth also dampen the demand outlook. Concerns are rising that if the Fed hike rates too aggressively over a long period of time the US economy will fall into recession, which would cause demand destruction.

Meanwhile, supply remains tight as less Russian oil hits the market and as OPEC+ struggles to ramp up production. Capacity issues means that the oil cartel are failing to reach output targets even before they are raised in July.

WTI crude trades -2% at $116.30

Brent trades -1.9% at $118.60

Learn more about trading oil here.

Looking ahead

19:00 Fed Brainard to speak

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade