US futures

Dow futures -0.5% at 34295

S&P futures -0.7% at 4380

Nasdaq futures -0.71% at 14017

In Europe

FTSE -0.6% at 7338

Dax -1.1% at 14232

Euro Stoxx -0.9% at 3850

Learn more about trading indices

Stocks fall, oil rallies, peace talk trouble

US stocks are set to open lower as risk aversion returns on stalling peace talks and ahead of the Biden Jinping call.

Peace talks have now been continuing for four days, and there have been few tangible results. Meanwhile, attacks on the ground continue. The lack of progress makes the market nervous after a strong rally in riskier assets across the week, on optimism that a diplomatic solution was possible.

There is a sense that the market could have got carried away with peace deal hopes, when the messages for both sides remained mixed. Risk aversion got too relaxed across his week, particularly in Europe, were stocks are set for their best week since November last year.

Oil prices are extending gains, which naturally brings with it fears of stagflation which is hitting demand for riskier assets.

Looking ahead, there is very little on the economic calendar to grab investors’ attention. The focus is likely to be firmly on a call between US president Biden and China’s Xi Jinping, and Ukraine is expected to be top of the agenda. Amid concerns that China is starting to lean towards Russia, Biden is likely to warn China over further support.

In corporate news:

GameStop is set to open around 8% lower after reporting a surprise loss for the holiday quarter, when analysts had expected a profit of $0.85 per share.

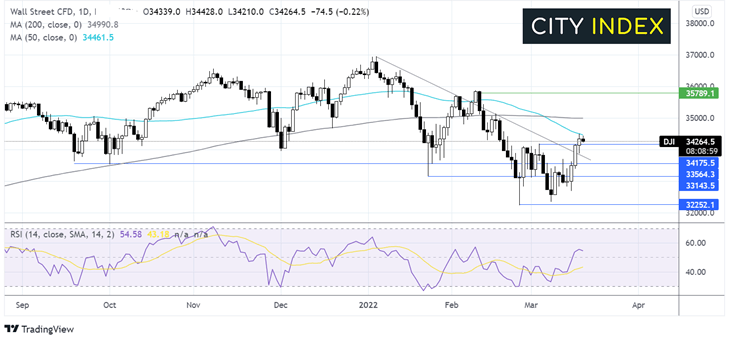

Where next for the Dow Jones?

The Dow Jones pushed over its falling trendline support earlier in the week but ran into resistance at the 50 sma today. The 50 SMA crossed below the 200 SMA in a death cross bearish signal, which could see sellers test support at 33500, a level which has offered support on several occasions across the past six months. A break below this level could see 33100 come back into play. However, investors are shrugging off this signal and are instead focusing on the rising RSI which is keeping hopes of more gains alive. Buyers will look for a rise over the 50 sma at 34470 to expose the 100 sma at 35000 a key psychological level.

FX markets USD falls, GBP tumbles post-BoE

USD is heading higher, snapping a two-day losing run as risk sentiment falls and safe-haven dollar demand rises.

EURUSD is falling after several days of rising; EURUSD is falling lower on fears that the Ukraine crisis could be drawn out given the lack of progress in peace talks. Eurozone trade hit a record deficit from a surplus a year earlier as the cost of imported energy rose.

GBP/USD -0.09% at 1.3137

EUR/USD -0.54% at 1.1030

Oil rallies on short supply fears

Oil prices rallied 8% in the previous session and in on the rise again today. Oil rallied yesterday on supply concerns after the IEA warned over the loss of 3 million barrels of Russian oil per day to the market from next month.

Oil prices are rising again today on news that peace talks appear to be stalling; this is boosting fears that sanctions could be ramped up further, potentially hurting the oil supply.

WTI crude trades +6.3% at $98.55

Brent trades +6.2% at $101.44

Learn more about trading oil here.

Looking ahead

18:00 Baker Hughes rig count

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.