US futures

Dow futures -0.5% at 33470

S&P futures -0.4% at 4310

Nasdaq futures -0.45% at 13774

In Europe

FTSE -0.5% at 6959

Dax -1% at 12973

Euro Stoxx -0.5% at 3545

Learn more about trading indices

Futures under pressure but off session lows

US futures are pointing to a weaker start as oil prices soar, prompting stagflation fears. Two weeks after the Russian invasion into Ukraine started and the volatility in the market shows no signs of letting up.

US Secretary of State Anthony Blinken said that the US and Western allies were discussing banning Russian oil and oil product imports, sending oil prices to 14-year highs.

Inflation in the US is already at 7.5% in January, and in February, CPI is due to be 7.9%. Higher oil prices will only send this figure higher, with the move fueling stagflation fears.

US jobs data revealed that the US jobs market is in good health. The Fed is expected to hike rates by 25 basis points, a move that was pretty much confirmed by Fed Chair Powell last week. The Fed also said it was willing to move faster to hike rates if necessary.

However, following a warning over the weekend from the IMF that the Russian war and sanctions will severely impact global growth, the Fed may even find that it too has challenging decisions to take between growth versus inflation.

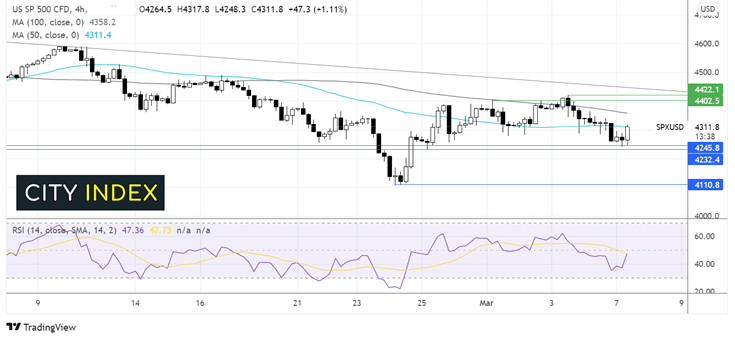

Where next for the S&P 500?

The S&P 500 has traded in a downwards trend since the start of January, forming a series of lower highs and lower lows running into resistance at 4110. The index then extended its recovery from 4110 the late February low to 4420 before easing lower to support at 4250. While the overall trend remains bearish, the RSI is attempting to move above 50 as the price attack the 50 SMA around 4310. A move above here and the 100 SMAat 4350 could see the price head back towards 4420. A move above here is needed for bulls to gain momentum. On the downside, a fall below 4250 would open the door to 4200 round number and 4110 the February low.

FX markets USD rallies, AUD rises, EUR falls.

USD is extending gains from last week on safe-haven flows. The US dollar index rose above 0.99 for the first time since May 2020. Although the price has since eased lower

AUD/USD the Australian dollar continues to outperform its peers as it heads towards 0.74 as metal prices and commodity prices surge higher. Gold hits $2000.

EURUSD continues to fall but has risen sharply from session lows of 1.08 after failing to find acceptance at that lower level. More robust than expected German retail sales and German factory orders were ignored by investors who are solely focused on Russia Ukraine developments.

GBP/USD -0.26% at 1.3205

EUR/USD -0.1% at 1.0921

Oil hits 14 year high

Oil prices have jumped higher on the open at the start of the new week, hitting levels last seen in 2008 as Western powers discuss whether to impose sanctions on Russian oil, banning oil imports.

Brent rallied to a high of $130 and WTI crude to $128 on fears of a supply shock. The market is already facing tight supply. A further 5 million barrels per day to be absent from the need for an extended period would create additional challenges for an already very tight market. Russia is a major oil supplier for both Europe and Asia.

Oil prices jumped 20% last week in their biggest weekly rise since mid-2020. According to analysts at JP Morgan, oil prices could continue to rise to $185 per barrel.

WTI crude trades +4.4% at $120.04

Brent trades +4.95% at $123.30

Learn more about trading oil here.

Looking ahead

N/A

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.