US futures

Dow futures -0.2% at 33910

S&P futures +0.02% at 4187

Nasdaq futures 10.14% at 13941

In Europe

FTSE +0.7% at 6950

Dax +0.44% at 15315

Euro Stoxx +0.2% at 4017

Learn more about trading indices

US stocks point to a mixed open

US stocks are heading for a mixed start on Wednesday as investors digest a more earnings from tech giants and ahead of the two key risk events this week, the Fed’s rate decision and a key speech from Biden.

Earnings

Alphabet impressed with earning on Tuesday after the close and trades +5% pre-market. Google parent posted a 34% gain in revenue as firms upped their advertising spend in anticipation if the economy reopening. Alphabet announced a $50 billion share buyback programme.

Microsoft reported solid but less spectacular numbers.

Looking ahead Facebook, Apple are due to report after the close.

Booing is set to release its earnings report which should shed some light on the travel industries recovery.

Federal Reserve

The Fed are not expected to move on policy so much of the focus will be on Fed Chair Powell’s pursuant press conference. With the US economic recovery looking increasing more convincing Powell will need to continue walking the fine line between sounding optimistic whilst reining in expectations. Should the Fed start sounding slightly hawkish, growth stocks could come under pressure.

The June meeting is likely to be much more significant as the US population will likely be close to the 75% vaccinated which the Fed has mentioned as a starting point to talk tapering.

Biden

Biden is due to give his first speech before a joint Congress. He is expected to lay out his plans for huge public spending financed in part by tax hikes.

Biden could confirm plans to raise capital gains tax to 39.6% to help pay for his $1.8 trillion spending plans covering education and childcare.

Previously reports of tax hikes have sent stocks lower so any signs that plans for tax hikes are becoming more concrete could unnerve investors. However, it is worth noting that this package faces more opposition from Republicans.

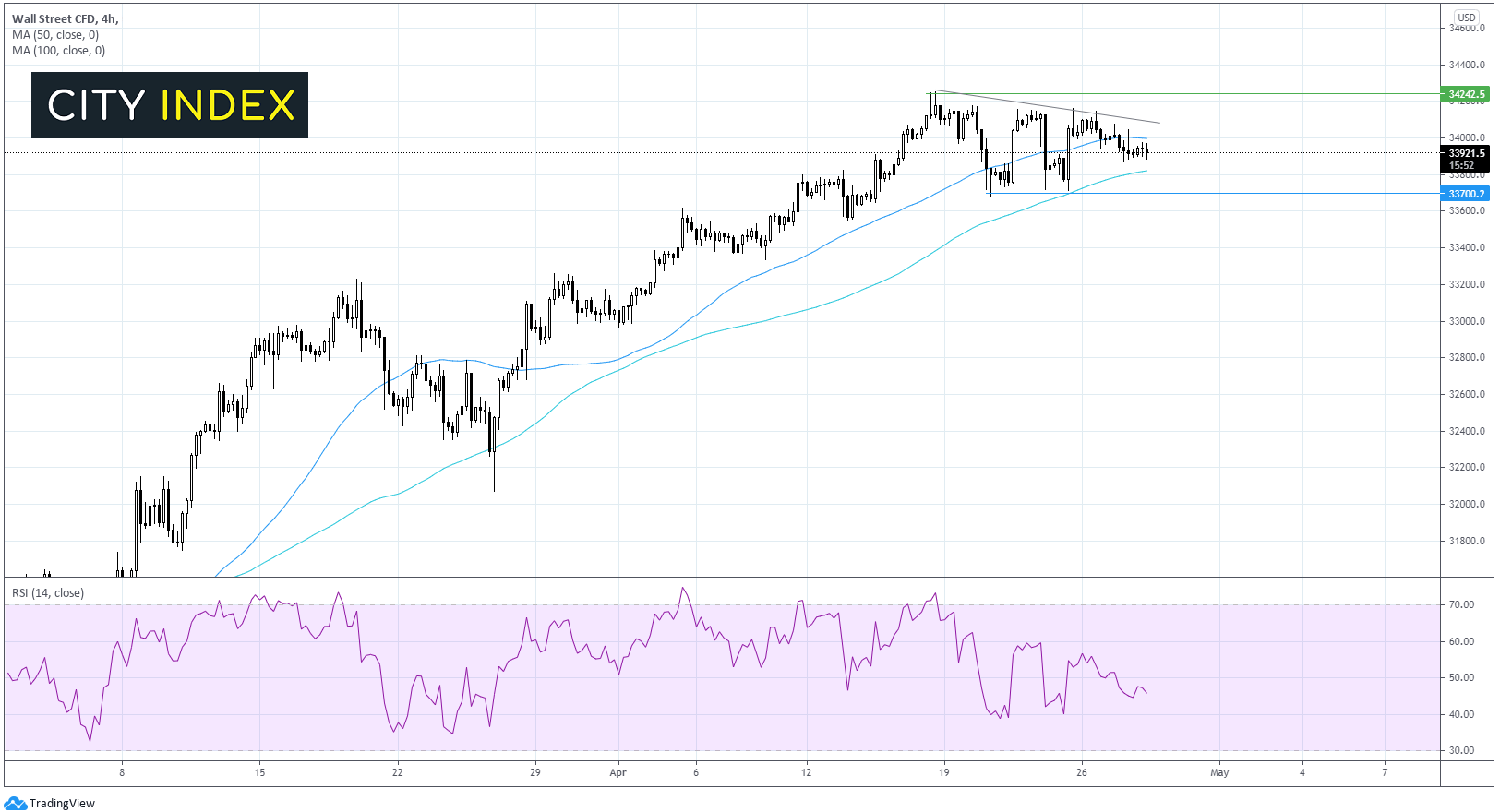

Where next for the Dow Jones?

The Dow has been easing lower, consolidating after hitting an all time high on April 16th of 34250. The Dow trades below a mild descending trend line and is caught between its 50 sma & 100 sma on the hour hour chart ahead of the Fed. A break above 34100 the trend line brings the bullish view back into play with a potential move back to the all time high. A move below 33850 the 100 sma could see 33700 tested and open the door to further losses.

FX – US Dollar extends gains, EUR fall on weak German confidence data

The US Dollar is extending gains from Tuesday, boosted by strong consumer confidence data. US consumer morale jumped to a 14 month high as business reopened, boosting hiring and demand.

EUR/USD trades under pressure following disappointing German consumer confidence. The closerly watched GFK consumer confidence index for May fell -8.8 points, down from -6.1 points in April. Expectations had been for a rise to -3.5 points. Given Germany’s current covid situation optimism surrounding the easing of lockdown restrictions and a revival of consumption have been dampened.

GBP/USD +0.3% at 1.3866

EUR/USD -0.21% at 1.2065

Oil rises despite OPEC+ sticking with plans to raise output

Oil is extending gains for a second straight session, despite OPEC+ sticking with plans to raise oil output. The OPEC+ group ditched that planned meeting instead agreeing to move ahead with easing restriction curbs between May 1st – July.

The oil market is focused on the upbeat demand forecast which has prompted OPEC’s decision rather than the fact that more oil will be released back into the market.

Goldman Sachs has added to the upbeat mood surrounding oil, lifting it price forecast to $80 as demand recovers.

The decision by OPEC+ comes even as the covid crisis continues in India the world’s third largest importer of oil.

EIA data is due later today.

US crude trades +0.7% at $63.29

Brent trades +0.5% at $66.27

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

13:30 US Trade balance

15:00 ECB Lagarde speech

15:30 EIA crude stock piles

19:00 Fed interest rate decision

19:30 Fed press conference