US Non-Farm Payroll for August showed a gain of +315,000 jobs vs an estimate of +300,000 and a slightly revised July print to 526,000 (528,000 previously). In addition, Average Hourly Earnings moved lower to +0.3% MoM vs 0.4% MoM expected and 0.5% MoM in July. But the most important piece of data from today’s release may be the Unemployment Rate, which rose to 3.7% in August vs 3.5% in July. However, part of this increase may be due to the increase in Labor Participation to 62.4% vs 62.1% prior.

Despite the mixed employment data, the Fed is unlikely to be swayed by anything in today’s report. The headline print is still in strong positive territory. In addition, the Fed said that it is willing to sacrifice some of the Unemployment Rate in order to bring down inflation. And although the increase in the Participation Rate may have added to the rise in the Unemployment Rate, the rise in interest rates by the Fed may finally be making its way to the jobs markets. Some private companies, such as Meta, are beginning to reduce their workforce as other expenses increase. Although one economic data point doesn’t make a trend, could this be the beginning of a string of higher Unemployment Rates?

Everything you need to know about the Federal Reserve

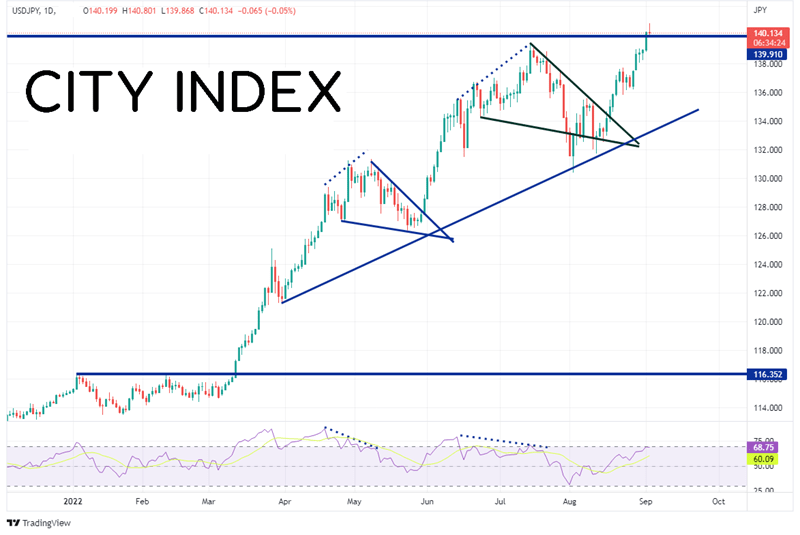

USD/JPY has been moving aggressively higher since breaking above horizontal resistance on March 11th near 116.35. After it became apparent that inflation was rising and the Fed would have to raise interest rates aggressively, the pair continued higher through the spring and summer. Twice, USD/JPY moved to new trend highs and corrected in a descending wedge formation. As price approached the apex of the wedges, it broke out and continued to move higher, retracing 100% of the wedges. Yesterday, USD/JPY reached its highest level since August 1998 at 140.23. Today, the pair eclipsed that print, making a new high of 140.80. However, the US Dollar began moving lower after the NFP print as profit taking ensued. If today’s print closes near unchanged (140.20) USD/JPY will have formed a shooting star, an indication of a possible correction ahead.

Source: Tradingview, Stone X

Trade USD/JPY now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

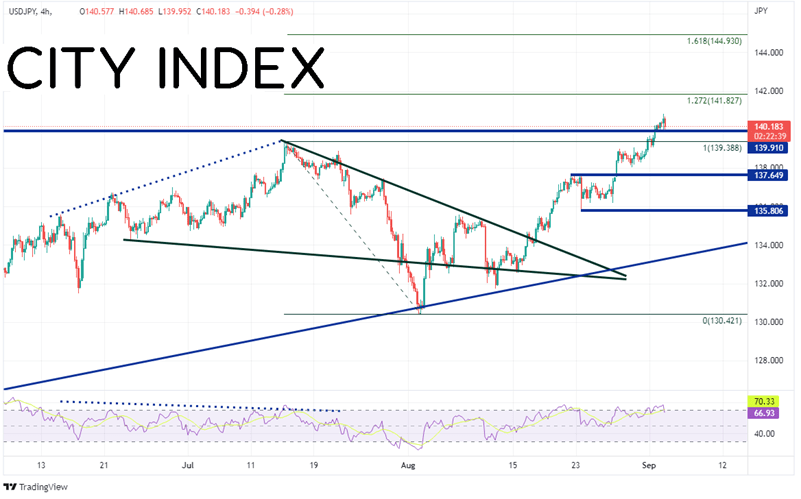

On a 240-minute timeframe, it is difficult to look for resistance when price continues to make new highs. The first level is today’s high at 140.80. Above there, resistance is at the 127.2% and the 161.8% Fibonacci retracement levels from the highs of July 14th to the low of August 2nd, at 141.83 and 144.93, respectively. If today’s highs hold and USD/JPY corrects, the first support level is the July 14th high at 139.39. Below there, USD/JPY can fall to horizontal support at 137.65, then the spike lows from August 23rd at 135.81.

Source: Tradingview, Stone X

Today’s Non-Farm Payroll print was near expectations. However, the Unemployment Rate was higher than expected, most likely due to the higher Labor Participate Rate. There doesn’t appear to be anything that would sway the Fed’s rate decision for either a 50bps increase or a 75bps increase at the next meeting. Perhaps USD/JPY is just correcting today as markets wait for the CPI print on September 13th.

Learn more about forex trading opportunities.