US CPI for October came out much weaker than expected at 7.7% YoY vs an expectation of 8.0% YoY and a September reading of 8.2% YoY. This was the fourth consecutive monthly decrease since inflation peaked at 9.1% YoY in June. Core CPI fell to 6.3% YoY vs an expectation of 6.5% YoY. This was much lower than last month’s 40-year high of 6.6% YoY.

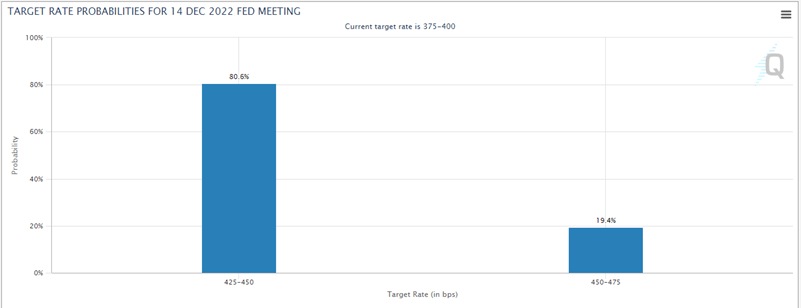

The focus now turns to the Fed. Does the lower print give the Fed permission to “only” hike rates by 50bps at the December meeting? Since June, the YoY prints have been 9.1%, 8.5%, 8.3%, 8.2%, and now 7.7%. Does this mean that the Fed’s aggressive rate hikes are working? The Fed Funds rate currently sits at 3.75%/4.00%, up from 0.00%/0.25% in early 2022. In the statement from the last FOMC meeting, the Fed noted that “in determining the pace of rate hikes, we will consider cumulative tightening, policy lags, and economic and financial developments”. This gives the impression that the Fed is willing to slow the pace of hikes in order to see how previous hikes have impacted the economy. In the press conference which followed, Fed Chairman Powell indicated that “how high to raise rates is more important than the pace of tightening”. In other words, the terminal rate is more important than whether the FOMC hikes by 50bps or 75bps. With the inflation reading today, it would seem that the Fed is on pace to hike 50bps at the December meeting. According to the CME Fedwatch Tool, after the CPI release, the chances of a 50bps rate hike at the December meeting jumped to over 80%!

Source: CME

Everything you wanted to know about the Federal Reserve

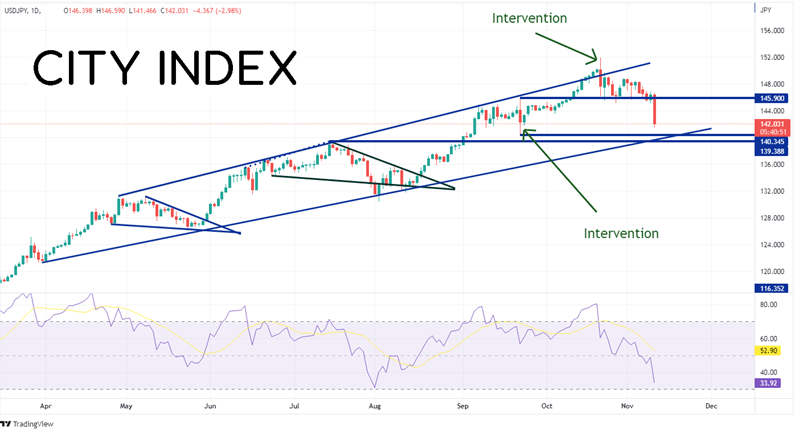

After the release of today’s CPI data, the US Dollar went into a freefall. In particular, USD/JPY fell from 146.22 down to 141.55.

Source: Tradingview, Stone X

Trade USD/JPY now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

On a daily timeframe, one can see the tremendous magnitude of the selloff versus other days that USD/JPY has pulled back. Japan first intervened in the fx market on September 22nd and the market was only down 175 pips, or 1.22%. Again, on October 21st the Ministry of Finance was in the fx markets, this time pushing USD/JPY down 250 pips, or 1.65%. If today's selloff holds, it will be much more effective in strengthen the Yen than the intervention. Today the pair is down 464 pips, or 3.18% (as of the time of the writing). A trifecta of support crosses below at the lows of September 22nd near 140.35, the bottom upward sloping trendline from the long-term upwards sloping channel near 139.80, and the highs of July 15th at 139.39. Resistance doesn’t cross above until the lows of October 27th at 145.10.

Source: Tradingview, Stone X

Will the Fed slow the pace of interest rate hikes based on today’s CPI print. The markets seem to think so! However, just remember that we still have the inflation components of the Michigan Consumer Sentiment Index (due out Friday), Core PCE, an NFP report and another CPI report before the next FOMC meeting. A lot can change in a month!

Learn more about forex trading opportunities.