S&P 500 falls as earnings season begins

The US S&P 500 closed 0.4% lower yesterday, well off session lows, and is set to open lower again today.

US inflation was hotter than expected at 9.1%, raising expectations that the Federal Reserve will act more aggressively to rein in soaring consumer prices.

Expectations of a 1% rate hike have jumped from 10% before yesterday’s data to 80% today. A more aggressive Fed raises the prospect of a recession in the US.

In addition to recession and inflation, attention will shift to earnings season, which kicks off today with the banks, JP Morgan and Morgan Stanley.

This will be the first real insight into how companies are coping with surging inflation and whether they have been able to pass forward rising costs. Fears of recession and full-year guidance to the lower end of forecasts, as well as exchange rate commentary, could be expected as well.

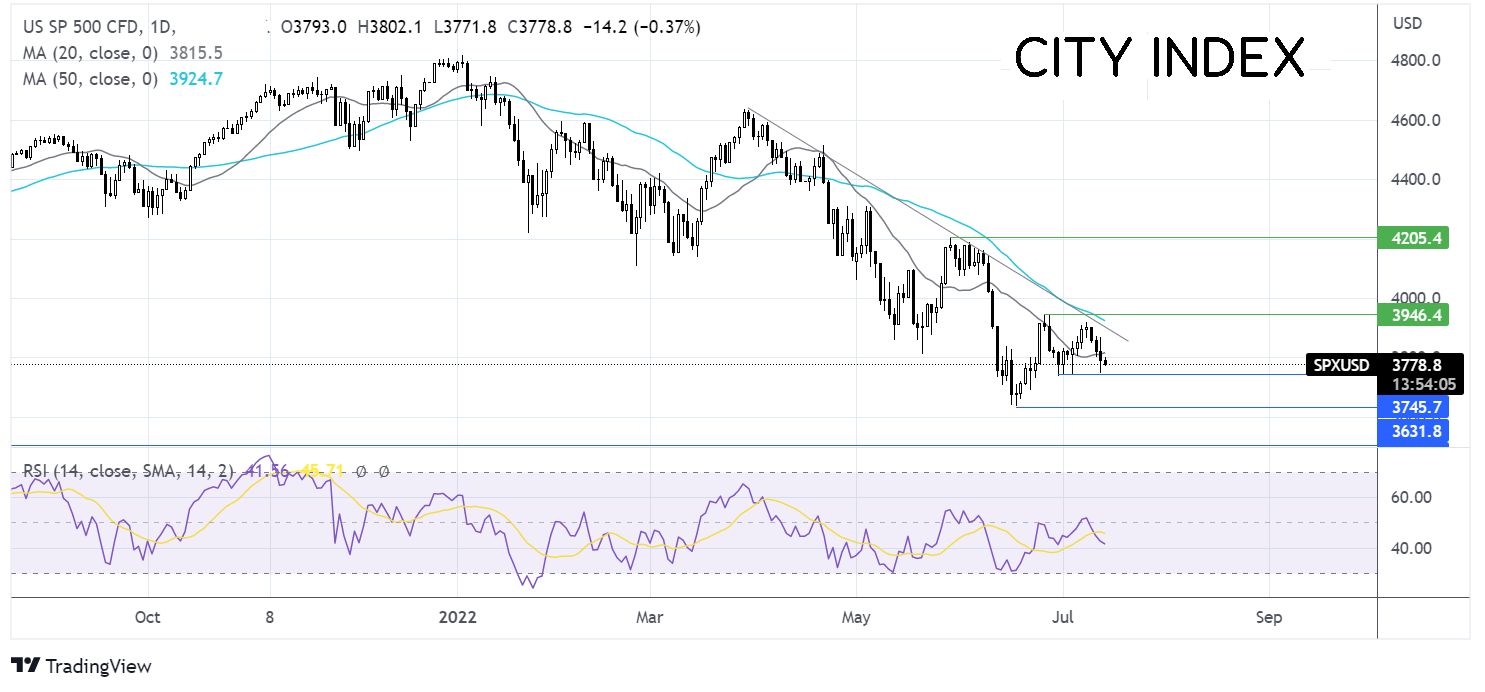

Learn more about the S&P500Where next for the S&P 500?

The recent rebound from 3636 to the 2022 low ran into resistance just below the 50 sma and is heading lower.

The break below the 20 sma combined with the bearish RSI keeps sellers hopeful of further downside. Sellers will need to break below 7545 the July low to extend losses towards 3700 round number and 3636 the 2022 low.

Buyers will need to retake the 20 sma at 3815 to push higher towards the 50 sna at 3915 and the late June high of 3950 to create a higher high.

EUR/USD heads towards parity again

After booking small gains in the previous session, EUR/USD is again heading lower on Thursday, pressurised by hawkish Fed bets following the hot US CPI data.

Central bank divergence is expected to grow this month, with the Fed heading for an increasingly likely 1% rate hike. In comparison, the ECB is expected to stick with 0.25%, testing the waters before a potentially larger hike in September.

Today German PPI was higher than expected at 21.1% YoY in June, down from 22.9% in May but still above the 20.5% forecast and still very elevated.

Looking ahead, EC growth forecasts are expected to be downgraded. US PPI could continue to fuel inflation and recession fears with expectations for a tick lower to 10.7% YoY in June from 10.8% in May.

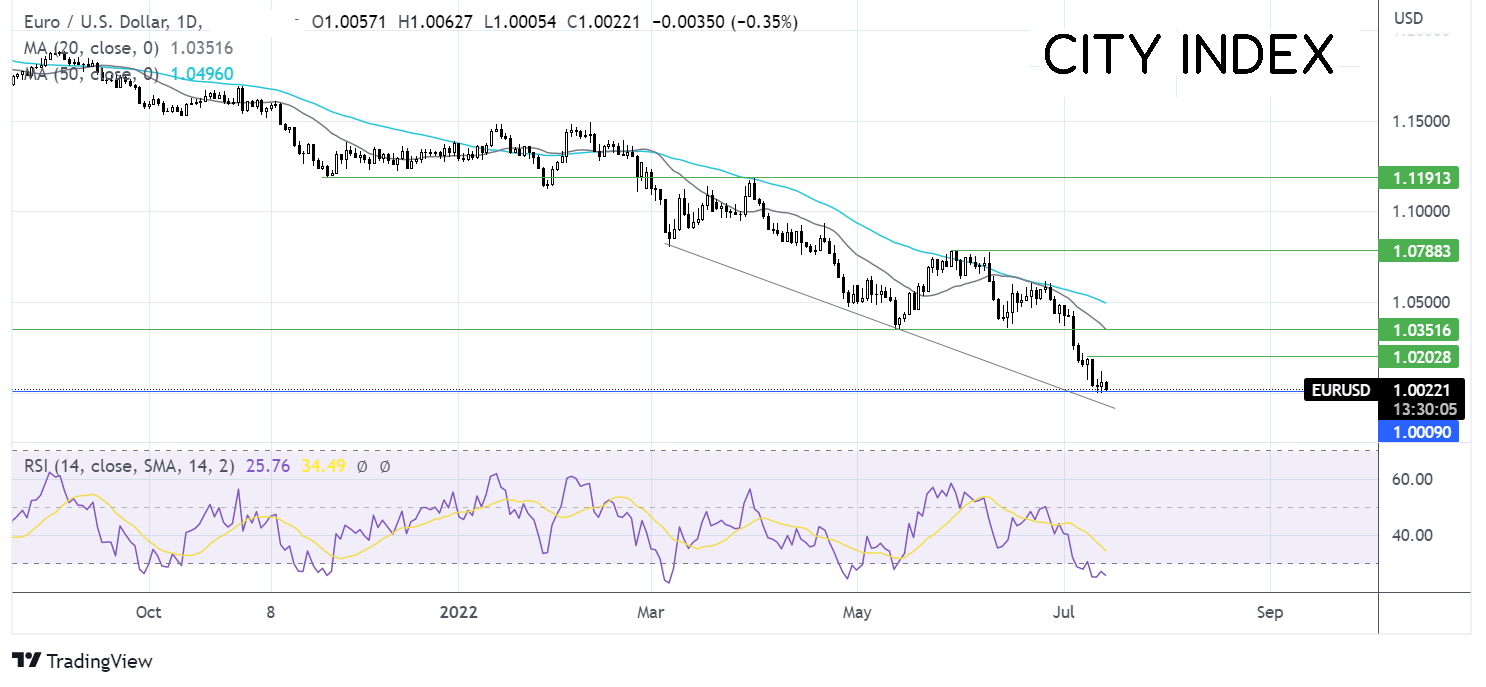

Learn more about when to trade forexWhere next for EUR/USD?

EURUSD rebounded lower from the 50 sma and has technically struggled to mount any serious recovery from parity.

The range-bound trading could be EURUSD consolidating after the steep selloff across the past few weeks. With the RSI in oversold territory, the consolidation phase could continue.

A move below 1.00 is needed to reaffirm the bearish trend and could accelerate a move towards 0.9950, the lower band of the falling trendline.

Any recovery would need to first retake 1.02, the weekly high, with a move overexposing the 50 sma and horizontal resistance at 1.0340.