GBP/USD falls despite hot inflation

GBP/USD is falling despite UK CPI returning to double digits as the USD rebounds.

UK CPI rose to 10.1% YoY in September, ahead of the 10% forecast and up from 9.9% in August. Core inflation also rose to 6.5%.

Inflation is five times the BoE’s target rate which shows that the central bank still has a lot of work to do to tame inflation. The data also highlights the squeeze that household incomes face as the cost of living crisis deepens.

Following the Chancellor’s U-turn on the mini-budget and limiting the energy support bill to April next year, the danger is that inflation could rise again in 2023.

Meanwhile, the USD is rising after falling across the past two sessions. Hawkish Fed comments are pushing the US dollar higher across the board.

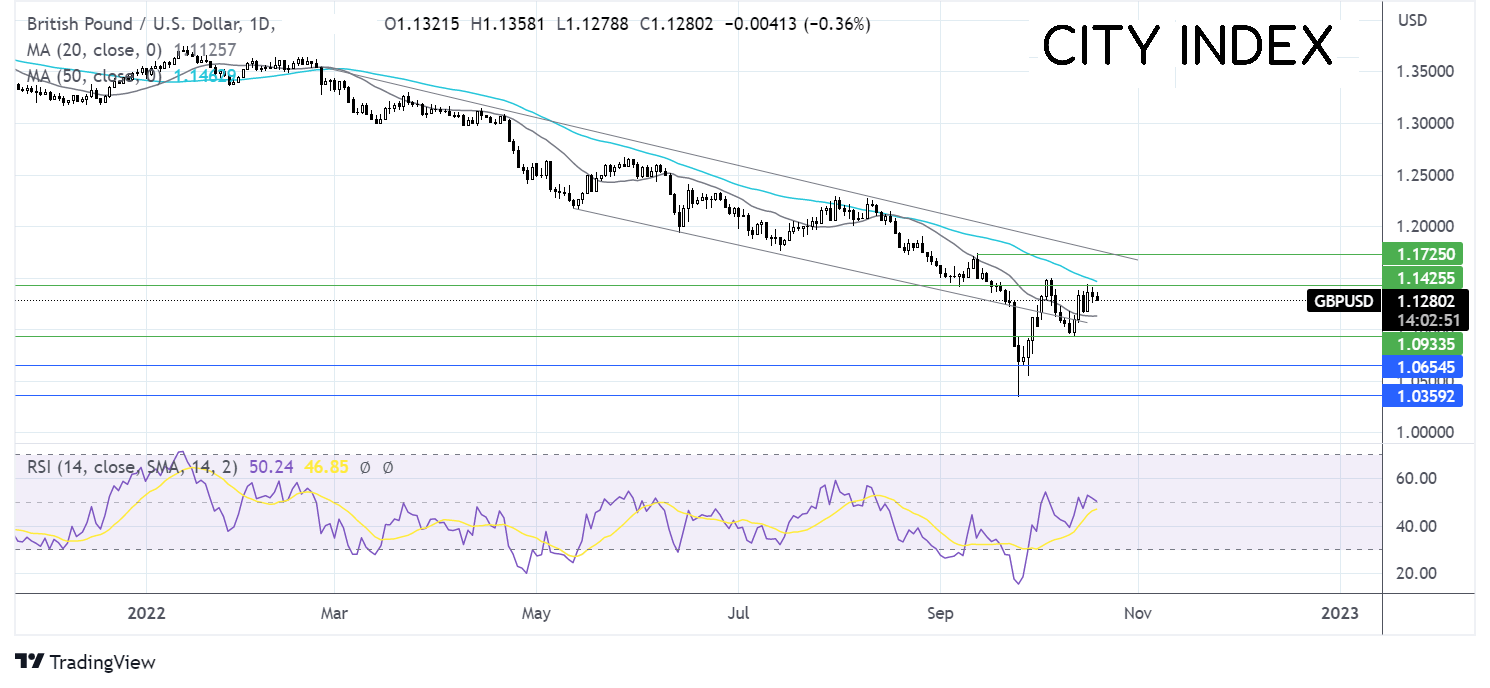

Where next for GBP/USD?

GBP/USD has rebounded from 1.0940, the October low, rising above the 20 sma and back into the descending channel – meaning that the broader trend remains bearish. The rebound stalled at 1.1440, just shy of the 50 sma.

The pair currently trades caught between the 20 and the 50 sma, and the RSI is neutral at 50.

Buyers will look for a move over 1.1440, the weekly high, and 50 sma, bringing 1.15, the October high into focus ahead of 1.1730 the September high, and falling trendline resistance.

Meanwhile, sellers will look for a move below 1.11 the 20 to open the door 1.0940. A break below creates a lower low.

Oil steadies after a sharp drop as the US plan more SPDR releases

Oil prices are holding steady after three straight sessions of losses. Oil prices fell almost 4% yesterday after several factors combined to unnerve investors. Firstly, China said that it would not release Q3 GDP data this week as scheduled, raising fears that the world’s largest importer of oil could disappoint.

Secondly, hawkish Federal Reserve bets raising recession fears also hurt the demand outlook for oil, dragging the price lower.

Reports that the Biden administration will release a further 15 million barrels from reserves and could consider releasing significantly more across the winter months in an attempt to reduce high prices at the pump. The announcement comes ahead of next month’s mid-term elections.

Today investors will digest EIA inventory data, which is expected to show a 1.38-million-barrel increase.

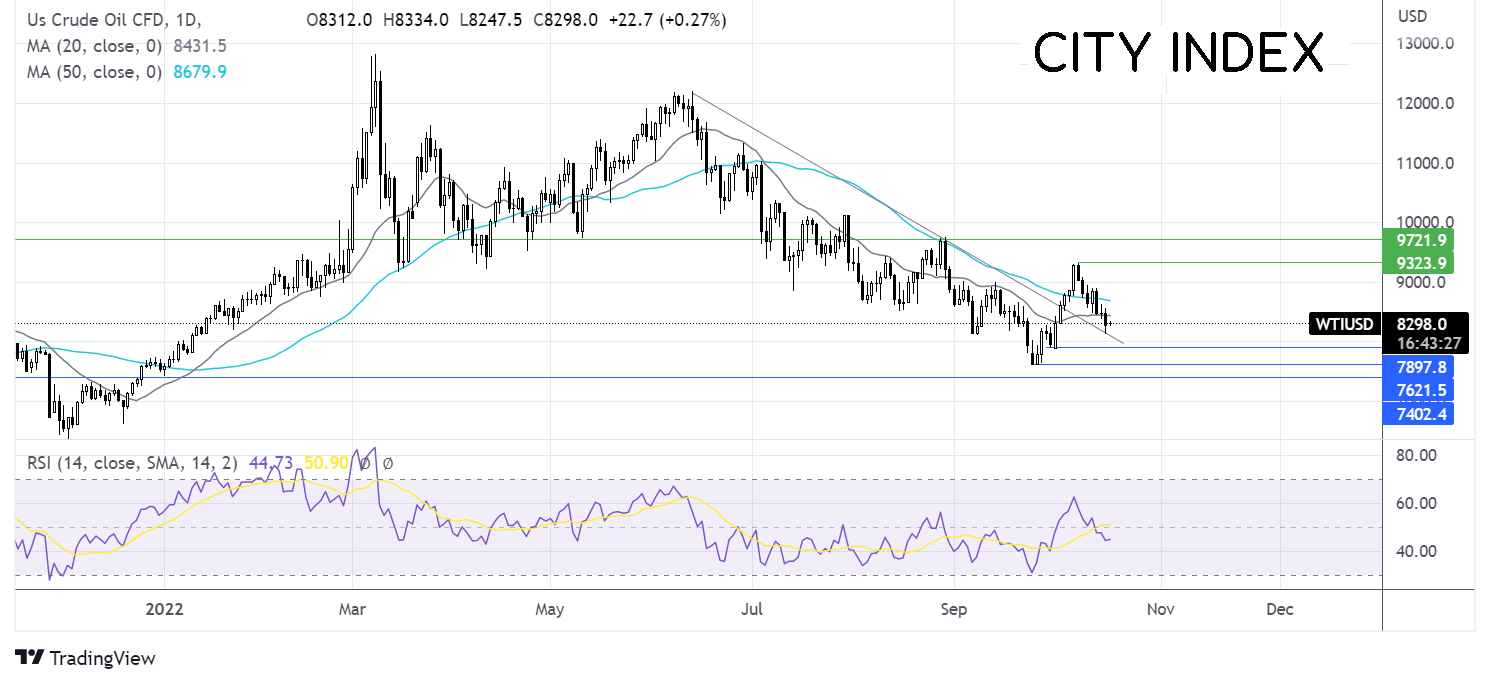

Where next for oil prices?

Oil prices ran into resistance at 93.20, falling below the 50 and 20 sma before finding support yesterday at 81.80 on the multi-month falling trendline support. The RSI is just below 50, which favors the bears.

Sellers could test support at 81.00 the falling trendline support ahead of 78.90 the October low. A move below here opens the door to 76.20 the September low.

Meanwhile, buyers will look for a move back over the 20 sma at 84.40 and the 50 sna at 87.20. A move over 93.20 is needed for the bulls to take back control.