GBP/USD falls post Fed & ahead of the BoE

GBP/USD is falling, extending losses from the previous session as investors continue digesting the surprise hawkish tone from Fed Chair Powell and ahead of the BoE interest rate decision.

The Fed hiked rates by 75 basis points, in line with expectations. While the statement had a dovish bias, Fed Chair Powell reiterated the Fed’s commitment to reining in inflation, saying it was too soon to talk about a dovish pivot, pouring cold water on market optimism that the Fed could take its foot off the hiking gas.

The BoE is now in focus and is expected to hike rates by 75 basis points, the largest hike in 3 decades, as the central bank continues its fight against 40-year high inflation.

The BoE is, in some respects flying blind at this meeting, given that the government’s fiscal statement has been pushed back to November 17th. That said, the government’s plans to raise taxes and cut spending could lessen the need for aggressive rate hikes going forward.

The vote split and language will be key for driving the pound’s reaction. The market expects the terminal rate to be 4.75%; the BoE could try to suggest that it could be lower, which could drag on the pound.

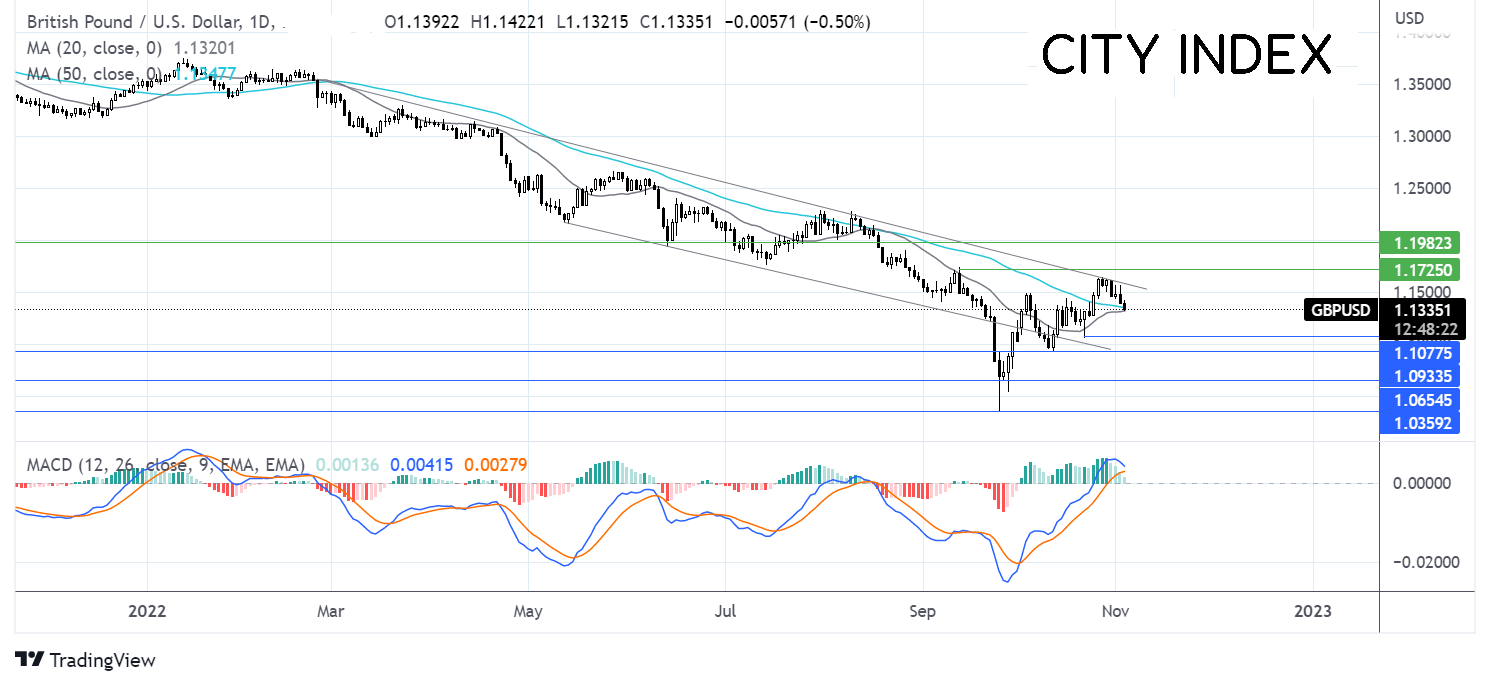

Where next for GBP/USD?

After failing to push above the falling trendline resistance, the price has rebounded lower. The falling through the 50 sma and the receding bullish bias on the MACD keeps sellers hopeful of further losses. Sellers need to break below the 20 sma at 1.1320 to extend the bearish trend towards 1.1060 the Friday 21st October low and 1.0930, the October low.

Should the 20 sma hold and buyers rise above the 50 sma, buyers could look to retest the falling trendline resistance at 1.1570 to bring 1.1720, the September high, into the target.

Nasdaq steadies after the Fed-inspired selloff

The Nasdaq closed 3.3% lower yesterday after the Fed hiked rates by 75 basis points as expected, the dovish statement and a hawkish Powell.

Heading towards the rate decision, the market was pricing in a slower pace of hikes going forward. While the market got acknowledgment from the Fed that there could be some smaller rate hikes along the path, it didn’t bargain for the Fed, saying that rates are now expected to rise higher than initially projected.

The market is pricing in a 50 basis point hike in December, but the terminal rate is now expected to be significantly higher than the 4.5% initially expected to be 5%.

Investors will continue to digest the FOMC meeting, and attention will also turn toward the ISM non-manufacturing PMI, which is expected to show activity growth slowed slightly to 55.5 from 56.7.

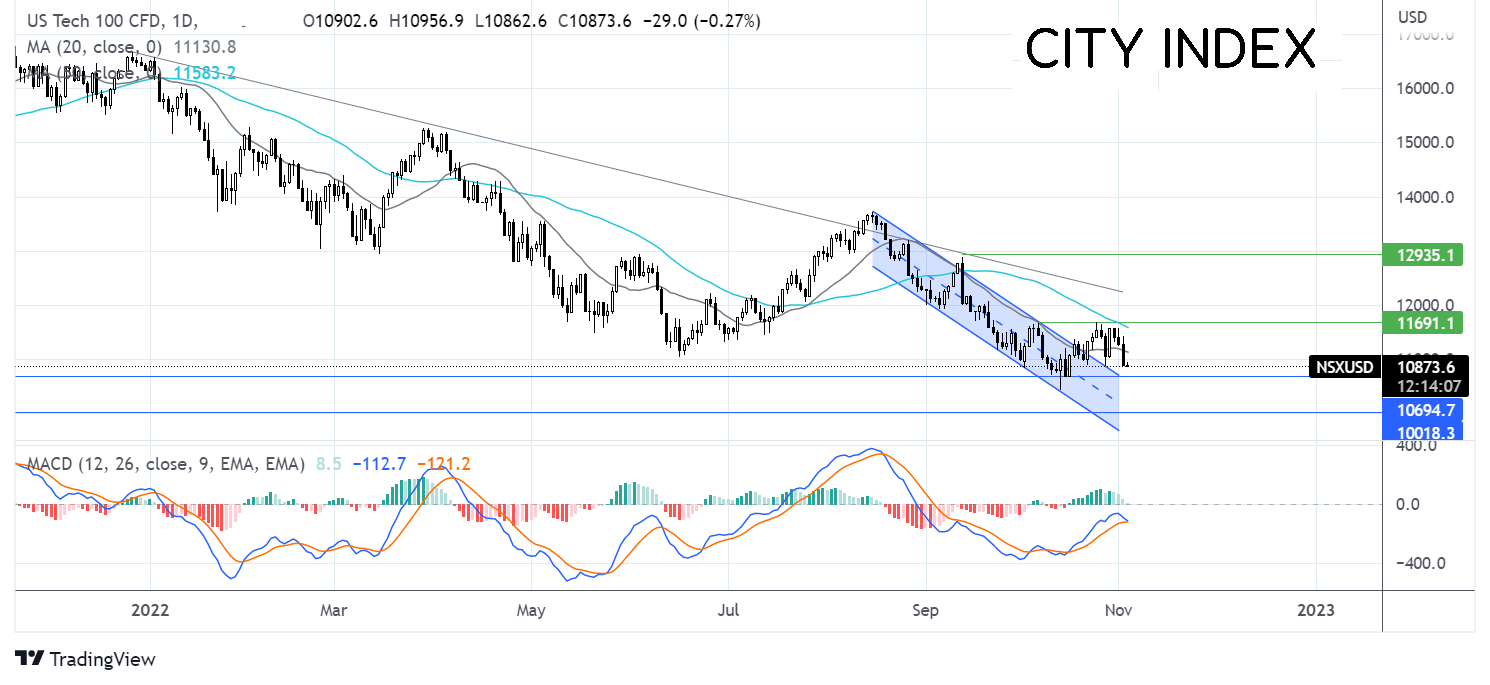

Where next for the Nasdaq?

After running into resistance at 11685, the weekly high, the Nasdaq has fallen lower, breaking below the 20 sma, and is testing last week’s low at 10880. A bearish crossover is forming on the MACD, keeping sellers optimistic about further declines. Bears will look to break below 10880 to test 10710, the October 11 low, before bringing 10430, the 2022 low, into focus.

On the flip side, buyers will look for a rise over the 20 sma at 11150 to expose the 50 sma and last week’s high at 11685. A rise above here creates a higher high.