EUR/USD looks to PPI & investor sentiment figures

EUR/USD is holding steady in quiet trade after steep losses last week. The pair dropped 1.2% last week after Fed Powell pledged to hike rates even if it meant a recession in the US. Meanwhile, ECB Lagarde’s hawkish comments were overlooked by investors who instead fretted over a recession in the eurozone.

Today the pair is holding steady ahead of Eurozone PPI inflation which is expected to cool slightly to 36.7% in May, down from 37.2% in April.

Eurozone Sentix investor sentiment is expected to fall to -20 after rising unexpectedly in June to -15.89 despite the dire economic tone.

Meanwhile, the USD could trade quietly given the US's July 4th Independence Day public holiday.

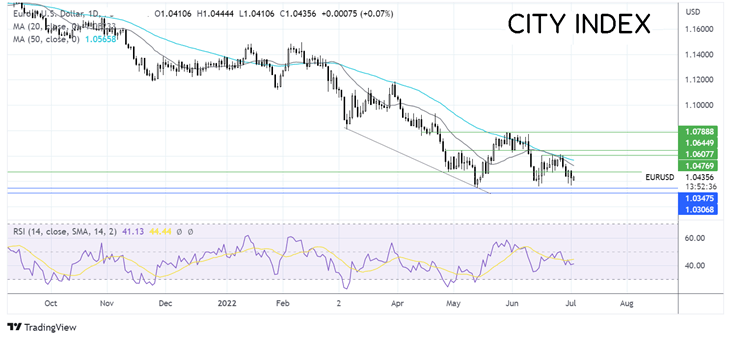

Where next for EUR/USD?

EURUSD has formed a series of lower lows and lower highs. The pair trades below its 20 & 50, and the RSI is below 50, suggesting that there could be further downside to come. Sellers need to break below 1.0360 to create a lower low and head towards 1.0340, the January 2017 low.

Buyers could look to move over 1.0530 the 20 sma to expose the 50 sma at 1.0580. It would take a move over 1.06 from last week’s high to create a higher high.

AUD/USD rises ahead of RBA rate decision

AUD/USD is climbing on Monday after falling almost 2% last week. The Aussie came under pressure as the market mood soured and gold prices fell for a third consecutive week. Overnight data showed that the labour market remains strong, with job advertisements rising 1.4% in MoM in June as demand remains strong. Building permits also rose 9.9% MoM in May.

Looking ahead, the US remains closed for Independence Day. However, the RBA rate decision will be in focus.

The RBA is expected to raise interest rates by 50 basis points after a 50 bp hike in June to tame inflation. This will take the benchmark rate from 0.85% to 1.35%.

The move comes as consumer demand remains hot with spending even as inflation expectations rose to 6.7%.

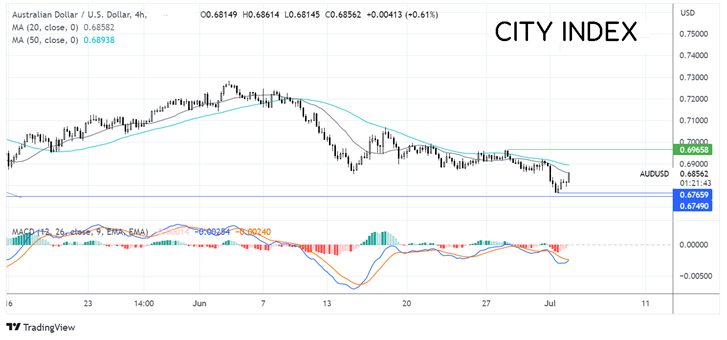

Where next for AUDUSD?

AUDUSD has been trending lower across June, falling to a low of 0.6765 on Friday. The pair is attempting to rebound from this level, rising back over 0.68, which, combined with the bullish crossover on the MACD, keeps buyers optimistic of further upside.

Bulls must retake the 20 sma on the 4-hour chart at 0.6855 to expose the 50 sma at 0.69. A move over here could create a higher high and encourage buyers towards 0.6965.

Failure to retake the 20 sma could see the pair skip back to0.6765 and pull the pair towards 0.6750 the November 29, 2019, low and 0.6670 the October 2, 2019 low.