AUD/USD rises after inflation and retail sales jump

The AUD/USD is rising above 0.69 to a five-month high following domestic data and thanks to a broader risk-on mood in the market.

Australian retail sales came in at 1.4% MoM in November, well ahead of the 0.6% forecast and -0.2% in October. Shoppers spent big, taking advantage of Black Friday sales in a sign that consumption remains resilient despite rising prices and higher interest rates.

Strength of demand was also evident in Australian CPI data, which showed that annual inflation re-accelerated to 7.3% in November, after falling to 6.9% in October.

Robust consumption and rising inflation has boosted bets that the RBA could raise interest rates by a larger clip in the coming meeting after slowing the pace to 25 basis points in December.

Elsewhere the re-opening of China’s economy has also supported the Aussie, a move which could provide further opportunity for Australian exports.

Meanwhile, the USD is trading lower across the board as investors scale back aggressive Fed bets. Attention is now firmly on tomorrow’s US CPI reading.

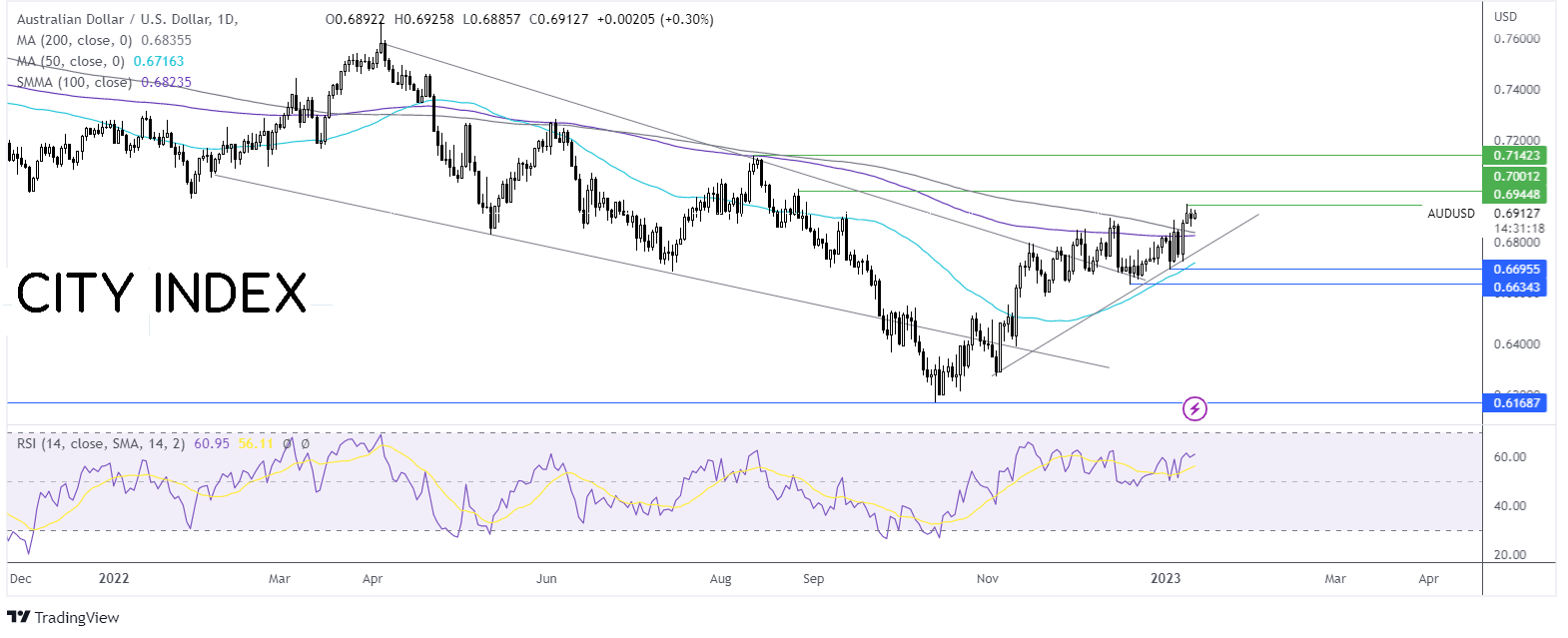

Where next for AUD/USD?

AUD/USD is extending is run up from the 2022 low of 0.6320, trading above its 50, 100 & 200 sma. The RSI is also above 50 supporting further upside. Buyers need to rise above 0.6950, the 2023 high, to attack 0.70, the psychological level and late August high. A rise above here could bring 0.7135, the August high, into play.

On the flip side, support can be seen at 0.6835, the 200 sma, and 0.6680, the 2023 low. A break below here could open the door to 0.6635, the December low.

Oil slips on recession fears & as inventories rise

Oil prices are heading lower amid an unexpected increase in US crude oil and fuel inventories and amid economic uncertainty hurting the demand outlook.

US crude oil stockpiles jumped 14.9 million barrels in the week ending 6th January, according to data from the American Petroleum Institute, and distillate stock rose 1.1 million barrels. Expectations had been for crude stocks to fall by 2.2 million barrels and distillate to drop by 500,000.

Recession risks are also capping oil prices. Yesterday the World bank sounded a recession warning in its latest growth projections. It now forecasts global growth of just 1.7%, down from 3% forecast in June. This is the lowest growth figure since 1991, excluding 2009 & 2020 due to the global financial crisis and Covid pandemic. Slowing growth or recession negatively impacts the oil demand outlook.

That said, oil has found some support from China’s reopening optimism which appears to be limiting losses for now.

Looking ahead, the IEA oil stockpile data is due.

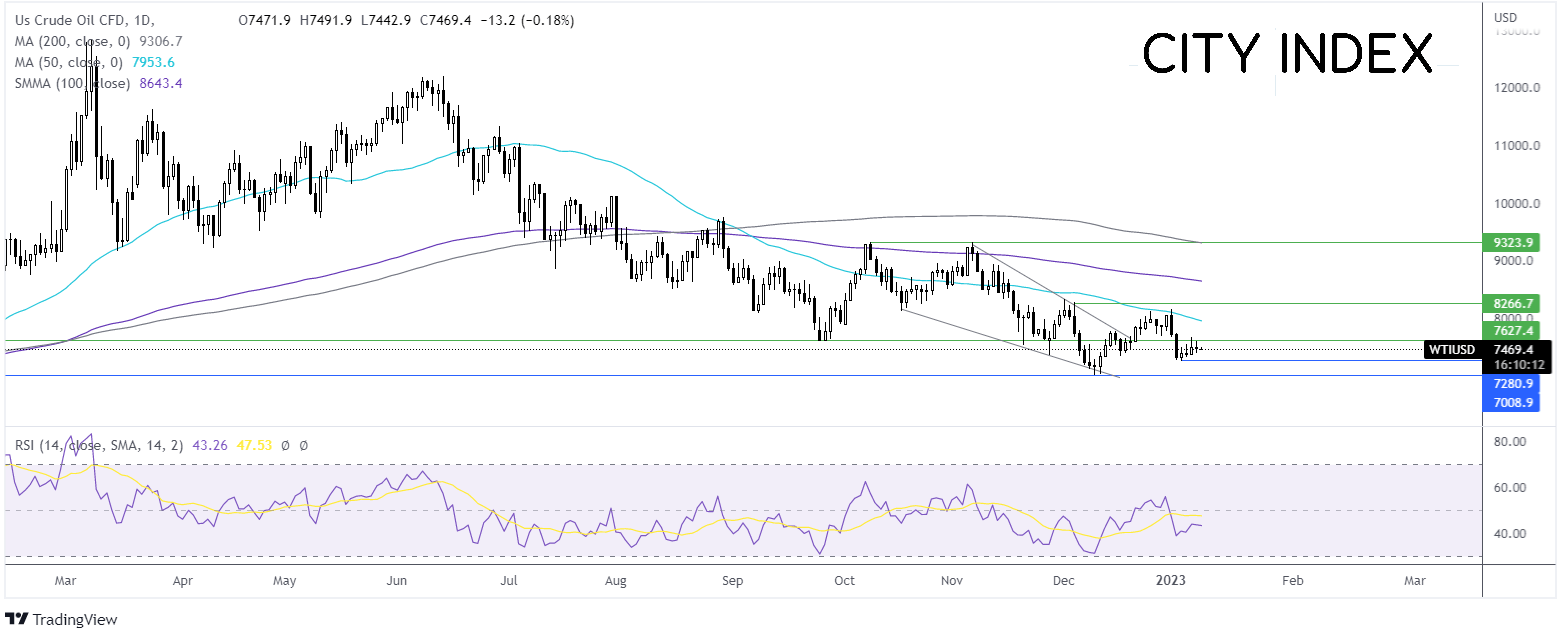

Where next for oil prices?

WTI has risen from the 2023 low of 72.50 but struggled to push beyond 77.00, which a long upper wick on the candle, suggesting that there was little demand at this higher level.

The RSI remains below 50, which combined with a failure to retake the 50 sma is keeping sellers hopeful of further downside.

Sellers could look for a move below 72.50 to bring 70.00 the psychological level and 2022 low into play.

Meanwhile, buyers could look for a rise above 77.00 to create a higher high and head towards79.70 the 50 sma and 81.50 the 2023 high.