In a preview earlier this week, we noted that a firm Q1 Australian inflation print would likely confirm the end of the era of ultra-low interest rates in Australia and the possibility of an interest rate hike as early as next week.

However, the strength of the inflation number means the possibility of a rate hike next week has become a necessity, putting the RBA in a very uncomfortable position. Let me explain.

The RBA has two masters. The market in whose eyes it must maintain credibility and under the RBA act of 1959, the Australian Government.

The RBA is an inflation-targeting central bank. It seeks to achieve an average inflation rate of 2-3% over time. It is viewed as a rate of inflation sufficiently low that it does not materially distort economic decisions in the community.

The RBA's preferred measure of inflation is the "trimmed mean". Yesterday the trimmed mean increased by 1.4% QoQ and 3.7% YoY. Core inflation is now 70bp above the RBA's 2-3% target band, raising questions about the RBA's credibility and its delay in acting while inflation surged in other developed market countries.

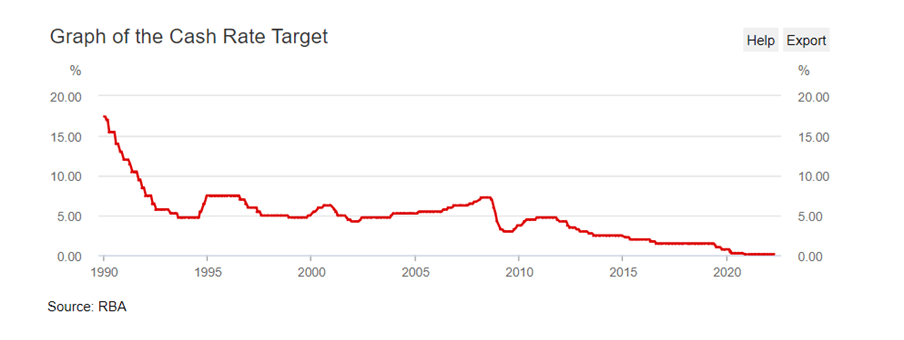

To rectify this, the RBA has no choice but to raise interest rates at its monthly board meeting next week for the first time since 2010. The issue with this is the timing. By raising interest rates in the lead up to the May 21 Federal Election, they will be doing their second master, the Australian Government a disservice.

The last time the RBA raised interest rates in the lead up to an election was in 2007. The incumbent Howard government promptly lost the election three weeks later. During an election lead up, the RBA would prefer to remain out of the spotlight, to maintain a sense of impartiality and keep the focus on politics.

In an attempt to satisfy both masters, I believe the RBA will raise interest rates by 15bp at its monthly board meeting next week to get the ball rolling, taking the cash rate to 0.25%, as outlined in this note here yesterday.

To maintain credibility and to achieve its inflation target, it will then likely raise the cash rate to 1.50% by yearend.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade