Top UK Stocks and Shares | JD Sports Share Price | Associated British Foods Share Price | AO World Share Price | Micro Focus Share Price | PZ Cussons Share Price | AVEVA Share Price

Top News: JD Sports profits to soar as customers flock back to stores

JD Sports Fashion has said it is on course to deliver at least 30% growth in pretax profits in the current financial year thanks to the strong demand seen since it reopened its stores.

The company has proven more resilient than many of its peers thanks to strong online presence, but closing over 3,300 stores in 29 countries during the various lockdowns has understandably weighed on the business. Substantially all of these outlets are now open again, although it is expecting some further temporary closures across Asia.

It said trading in the UK since reopening had been particularly strong. Sales retention in Europe was slightly ahead of what was seen after the first lockdown ended last year. Meanwhile, sales in the US have been boosted by the latest round of stimulus cheques lining consumer pockets with cash at a time when there is pent-up demand. It now has 60 JD Sports-branded fascias in the US as it continues to covert Finish Line stores and said it expects to convert 50 more before the current financial year ends.

As a result, JD Sports said it is now expecting to deliver pretax profit before exceptional items of ‘no less than £550 million’ this year – a huge improvement from the £421.3 million delivered in the last financial year.

JD Sports said it will ‘consider repaying government support on payroll costs’ but said it won’t make a final decision until it has more clarity on whether lockdowns could come back to bite later this year.

‘We are cognisant that the retention of sales in the period when the stores were closed combined with the positive trading in the immediate period after reopening did help to offset the negative financial impacts associated with the period of temporary closures. However, we must also acknowledge that the uncertainty surrounding COVID has not yet fully passed and the current resurgence in infection rates is affecting our core customer demographic more than was the case previously,’ said JD Sports.

JD Sports also announced that it plans to split the executive chairman and chief executive role before its next annual general meeting in order to improve governance.

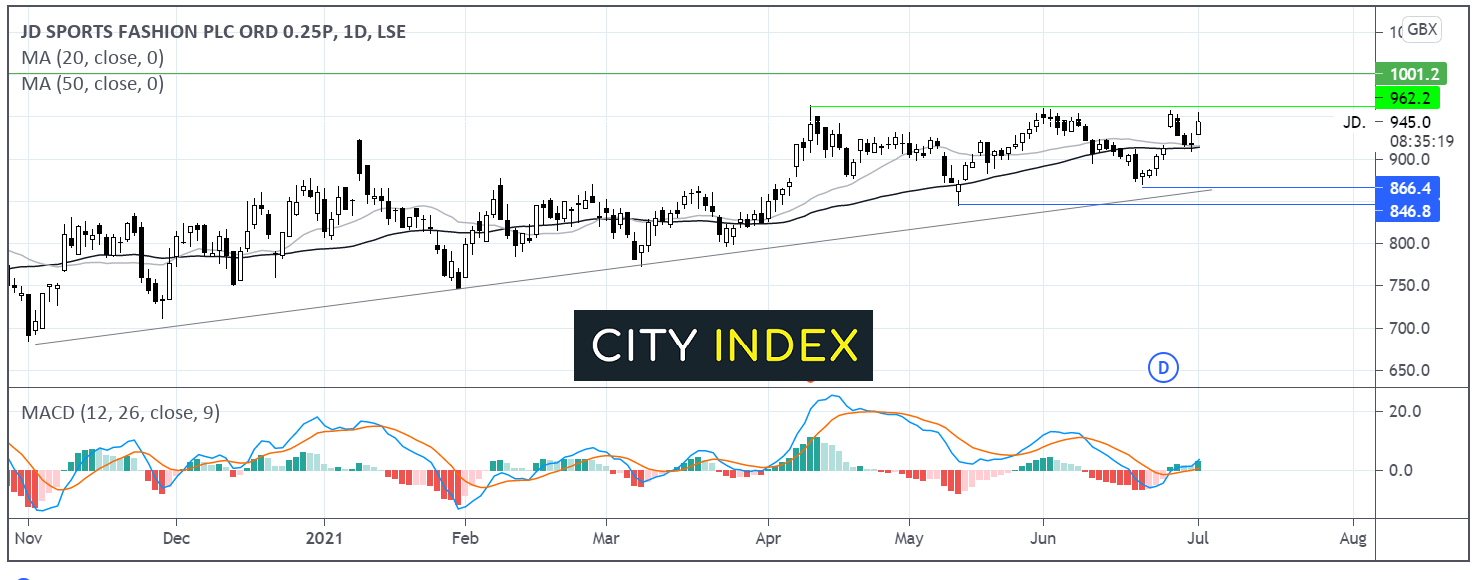

Where next for the JD Sports share price?

JD Sport trades above its ascending trendline dating back to early November, it has pushed above its 20 & 50 day ma showing a bullish trend.

The MACD appears to be forming a bullish crossover keeping buyers hopeful of further gains.

The price needs to move above 963 today’s high and the all time high in order to look towards 1000p key psychological level.

A move below 915p the 50 sma could negate the near-term uptrend, whilst a move below 865p the low June 18 and ascending trend line support could see sellers gain momentum.

AB Foods ups expectations following strong recovery in Primark sales

Associated British Foods revealed this morning that there has been a stronger than expected recovery in sales at Primark since stores reopened in April, which should allow it to post better profits this year than first thought.

Although demand for its food-based businesses has increased since the pandemic started, it has been more than offset by the steep decline in sales at Primark during lockdown. This was demonstrated by the fact revenue in the 40 weeks to June 19 was down 2% to £9.59 billion as gains from ingredients, agriculture, sugar and grocery divisions were offset by the 11% decline in sales at Primark, driven by the fact stores were closed for much of the period.

However, Primark has bounced back since stores reopened in April, with seven new stores having also been launched since then. The company said Primark sales were up a staggering 207% in the third quarter to £1.60 billion. This was flattered by weak comparatives, that, combined with continued growth from its food-based businesses, allowed AB Foods to report overall revenue growth of 47% to £3.64 billion in the quarter.

‘This quarter, sales in the reopened stores were ahead of expectation in all markets, a number of new sales records were set and the like-for-like performance was much improved on earlier periods during this pandemic reflecting an increase in both confidence and willingness to spend by our customers,’ AB Foods said.

‘Primark's like-for-like sales were 3% up on a two-year basis in the quarter, but volatility remains high and performance varied by region depending on the degree of restrictions related to COVID-19. Data for the total UK clothing market, which includes online sales, for the seven-week period after reopening shows both volume and value share gains for Primark on a two-year basis,’ it added.

AB Foods shares were trading 3.9% higher in early trade this morning at 2304.0p.

Primark being back in fashion is key for AB Foods as it is the main driver of earnings and cashflow in normal times. AB Foods said cash generation had been better than expected in the third quarter, with net cash before lease liabilities soaring to £1.45 billion at the end of the quarter from just £705 million three months earlier. AB Foods said it hopes to end the financial year with around £1.7 billion in net cash.

‘This improvement was mostly delivered by recovery in Primark sales along with a reduction in the inventories which had built up during lockdown. Assuming that no Primark stores are closed in the remainder of this financial year, we expect the excess inventory at the end of lockdown to have returned to more normal levels by the financial year end,’ it said.

Investors also welcomed news that growth in the food-based businesses has largely accelerated in the third quarter compared to the two previous quarters. For example, sugar sales jumped 21% in the third quarter, driven by strong volumes at Illovo and in China, but was only up 7% during the first nine months of the financial year.

‘We expect these improvements in our outlook to result in adjusted earnings per share for the group reaching a level below last year, only reflecting the charge for repayment of the job retention scheme monies and the higher year-on-year adjusted effective tax rate,’ said AB Foods.

AO World keeps up the momentum as sales and profits grow

AO World said it is stepping-up investment and planning to expand into more European countries over the coming years after reaping the rewards from the shift to online shopping during the pandemic, resulting in significantly higher revenue and profits.

The largest online-only retailer of electricals and white goods in the UK said revenue rose 62% to £1.66 billion in the year to the end of March from £1.02 billion the year before, as consumers opted to buy more big-ticket items online during lockdown. UK sales rose 59% while its smaller German business reported 81% growth. Notably, growth in both countries accelerated in the final quarter of the year, setting AO World up well for another year of growth.

Adjusted Ebitda leapt to £64.0 million from £22.0 million, although that was toward the bottom-end of its guidance range. Pretax profit of £20.0 million was much improved from the £1.0 million profit the year before but was less than half what analysts had forecast.

The news sent AO World shares 0.6% lower in early trade this morning at 249.9p.

One major milestone reached was the success in turning its German business profitable, with its gross margin coming in at 9% compared to minus 2% beforehand and it is now running at roughly breakeven on an adjusted Ebitda level.

AO World continues to believe the online shift is sustainable even as lockdown eases and shops reopen. In fact, the company said it is stepping-up its investment, with an additional £30 million to be spent on marketing and digital content in the new financial year, to allow it to capitalise further. It said it is also considering opening a second recycling facility over the next 18 months at a cost of around £20 million.

‘Coming out of the pandemic, the direction of travel is firmly with AO, and our proven ability to build scale and drive growth gives us confidence to look towards further European expansion over the next five years,’ said founder and chief executive John Roberts.

AO World wants to expand out of the UK and Germany and be operating in three more European countries within the next five years.

‘Our markets remain robust and attractive; however, we are conscious that forecasting the next 18 months will remain difficult. We have started the new financial year well and remain prudently optimistic that we will be able to deliver double digit growth as we lap the strong Covid performance comparatives,’ AO World said.

Micro Focus revenue falls but should still improve over the full-year

Micro Focus said it is still hoping to deliver an improvement in revenue during the current financial year after reporting a fall in sales during the first six months.

The company, which provides enterprise software to businesses and organisations around the world, said revenue fell 4.6% at constant currency and 2% on a reported basis to $1.4 billion in the six months to the end of April, but said this was still better than expected.

Strong growth in licensing, partly thanks to weak comparatives from being disrupted by the pandemic last year, was countered by declines in revenue from maintenance and consulting work, as well as a fall in recurring revenue from its Software-as-a-Service unit.

Adjusted Ebitda was down 7.7% to $519.0 million as a result of lower revenue and tighter margins. Still, that was slightly ahead of the $502.0 million forecast by analysts. Adjusted diluted EPS was down 8.3% to 66.15 cents from 72.10 cents.

‘We are pleased with a period of further solid progress in most areas of our business. The product investments and operational changes we are making are beginning to deliver performance improvements, and our value propositions are resonating with customers and partners, as demonstrated by the signing of the significant, long term commercial agreement with Amazon Web Services,’ said chief executive Stephen Murdoch.

Micro Focus said it is still trying to deliver a ‘meaningful improvement’ in revenue growth at constant currency over the full-year.

‘Revenue stabilisation by the end of FY23 remains our most important business objective. To deliver against this goal, we are targeting incremental improvements in revenue trajectory annually and continuing our targeted investment in product portfolios to achieve this,’ said Micro Focus. ‘We are pleased with this period of further solid progress in most areas of our business, and remain committed to delivering strong, sustainable levels of free cash flow over the long-term.’

Micro Focus shares were trading 4.5% lower in early trade this morning at 529.4p.

PZ Cussons to beat expectations as sales continue to grow

PZ Cussons, known for big brands spanning Carex soap to Fudge haircare products, said it expects to deliver adjusted pretax profits ahead of expectations in the financial year to the end of May as sales grew across all geographies and categories.

The company said annual adjusted pretax profit will be above the £63 million to £64 million currently forecast by analysts. That means PZ Cussons is on course to deliver mild growth from the £62.0 million delivered in the last financial year, but it will still be below the £72.3 million delivered the year before prior to when the pandemic hit.

PZ Cussons shares were trading 2.1% higher in early trade at 249.5p.

The company said revenue was up 7% in the year, with its core ‘must-win’ brands jumping 11%. Sales of hygiene, baby and beauty products all increased during the period and revenue improved in all regions. Plus, its overall gross margin improved thanks to higher prices and changes to its sales mix.

PZ Cussons warned that it will post lower revenue for its hygiene products in the fourth quarter as it comes up against strong comparatives from when the pandemic initially erupted last year and caused a surge in demand for cleaning products. However, it said its must-win brands bucked that trend and still managed to deliver 7% growth in the fourth quarter compared to pre-pandemic levels.

‘In the immediate term we are lapping some exceptional demand levels from the peak months of the COVID-19 pandemic, both as we ended the last financial year and as we navigate the first quarter of this year,’ PZ Cussons said.

The company also warned it is facing a rise in costs thanks to inflationary pressures and that it was accelerating price increases to pass these on to the consumer quicker.

‘In the longer term we are working to sustain the early impetus of the turnaround over the coming years. We have much to do but I am confident that we are building the team and the momentum to deliver this multi-year transformation,’ said chief executive Jonathan Myers.

AVEVA aims for better margins and cash conversion in coming years

Industrial software specialist AVEVA Group said revenue was up 10% year-on-year in the first two months of its new financial year as it outlined ambitious plans for the next five years.

That was in-line with the company’s new goal to deliver a compound annual growth rate in revenue of around 10% between now and the 2026 financial year. This will be partly achieved by tapping-into the revenue synergies from the OSIsoft acquisition, which it expects to total at least £100 million over the next four years.

AVEVA bought OSIsoft at an enterprise value of around $5 billion, which was part-funded by a large rights issue conducted late last year.

AVEVA is also focusing on growing recurring revenue. Currently, just under 70% of total revenue is recurring but AVEVA is aiming to get that up to over 80% by 2026.

‘Recurring revenue growth is expected to be driven by a continued transition to subscription and the accelerated adoption of cloud by customers,’ AVEVA explained.

Meanwhile, it will try to improve its adjusted Ebit margin to over 35% from just 27.5% in its last financial year. It is also aiming to deliver 100% cash conversion during the period.

AVEVA shares were trading 3.8% higher in early trade this morning at 3828.0p.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade