Top UK Stocks and Shares | Bunzl Share Price | Crest Nicholson Share Price | 888 Share Price | Wood Group Share Price | Wise IPO

Top News: Bunzl to deliver growth as it buys two businesses

Distribution giant Bunzl said it has continued to deliver ‘good overall growth’ and will report higher revenue and better margins when it releases its interim results, as it revealed it has also purchased two new businesses.

Group revenue is expected to rise 1% in the six months to the end of June, having been held back by unfavourable foreign exchange rates. At constant rates, revenue is expected to have grown by 6% to 7% year-on-year. The contributions from acquisitions has helped offset the impact of forex rates.

For perspective, Bunzl’s interim revenue the year before came in at £4.84 billion.

Underlying revenue is expected to be up 6% year-on-year. Bunzl said that growth is ‘expected to reflect a strong recovery in the base business, including the foodservice and retail sectors, largely offset by the anticipated decline in larger Covid-19 related orders.’

Bunzl has been able to capitalise on increased demand for everything from gloves and soap to masks and thermometers during the pandemic, but these sales have started to unwind as restrictions have eased.

Its group adjusted operating margin should be nearly 1% higher in the first-half than the 7% reported the year before, largely thanks to a smaller number of lower-margin Covid-19 orders.

Bunzl reiterated its topline guidance for the full-year that was outlined in April, when it said it expected growth in revenue in the first half to be followed by a decline in the second. Reported revenue will likely fall as Covid-19 orders fall away, having accounted for around £550 million of annual sales last year, but Bunzl is stripping this out of its guidance for this year.

Bunzl said it now expects its adjusted operating margin to be ‘slightly ahead of historic levels’ this year, having previously said margins were expected to stay broadly flat from previous years.

Bunzl also announced it completed the acquisition of two businesses in May. The first is a distributor to the leisure and foodservice sectors in the UK called Comax, which booked £14 million in revenue during 2020. The second is a cleaning and hygiene distributor in Australia named Harvey Distributors, which booked AUD7.0 million in revenue last year. The cost of the purchases was not revealed.

‘Growth through acquisitions is an important part of the ongoing strategy for Bunzl and I am pleased to welcome both Comax and Harvey Distributors to the Bunzl family. Both businesses strengthen the Group's cleaning & hygiene operations, an area we expect will be supported by enhanced hygiene trends. Inclusive of these acquisitions the Group has now acquired six businesses since the start of the year with a total committed spend of £114 million. The pipeline for acquisitions remains active, with discussions ongoing,’ said chief executive Frank van Zanten.

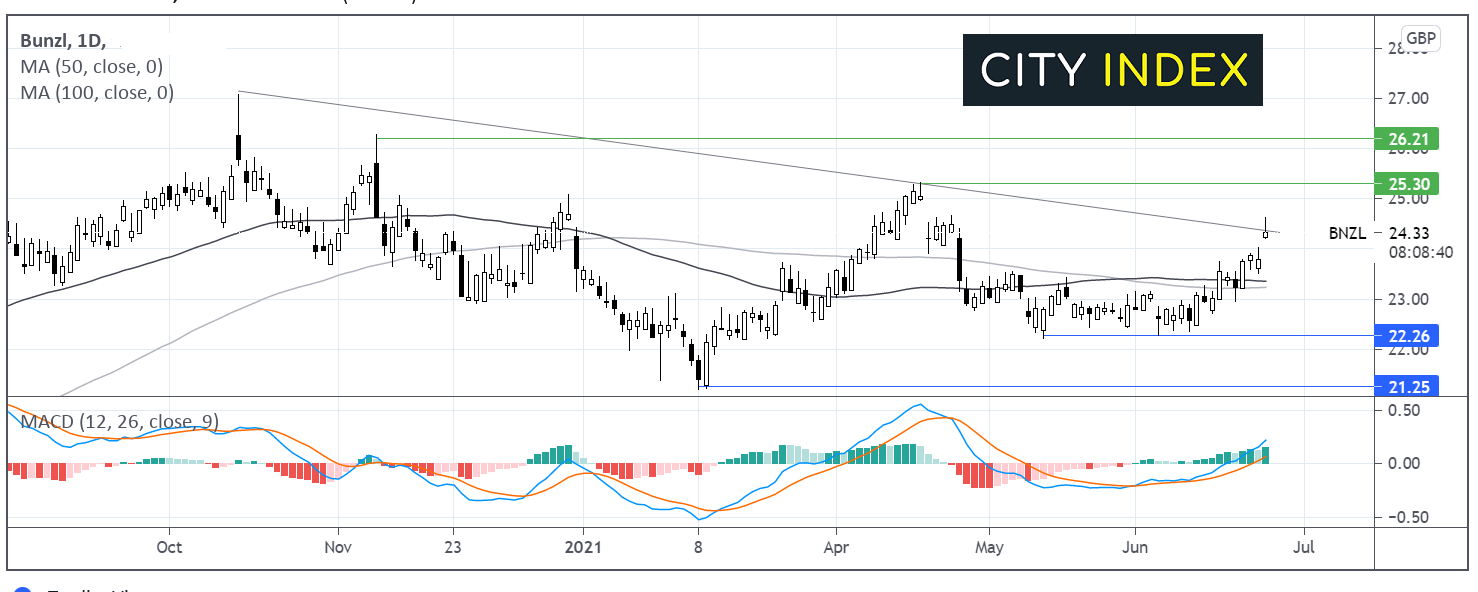

Where next for the Bunzl share price?

Bunzl share price has been trending lower since early October. Today’s jump of over 2% this morning has seen the share price break over the multi-month descending trendline. The share price also trades above the 50 & 100 sma on the daily chart.

The 50 sma crossed above the 100 sma at the start of the month in a bullish signal. The MACD is supportive of further upside.

A close above 24.40p the descending trend line could encourage buyers to target 25.3p the April high.

On the downside strong support can be seen around 23p the 50 & 100 sma. A break below here could negate the near-term uptrend and see sellers target 22.25p the May and June low.

Crest Nicholson raises expectations again after strong first-half

Housebuilder Crest Nicholson raised its full-year guidance for a second time after reporting strong growth in revenue and profits during the first-half.

Revenue in the six months to the end of April rose to £324.5 million from just £240 million the year before. That was the result of building 1,017 homes compared to only 775 the year before.

Adjusted pretax profit rose to £36.1 million from £4.5 million, and at the bottom-line it turned to a profit of £36.3 million from a £51.2 million loss the year before, when it booked a large exceptional charge.

The company said it now expects to deliver annual adjusted pretax profit of ‘at least’ £100 million, up from its previous target of £85 million that was set when it raised its guidance the first time round in March. The latest hike will have been helped by a £10 million boost from the sale of its interest in the Longcross film studio last month, but also reflects an improved outlook.

If achieved, that will mark a significant improvement from the £45.9 million profit reported in the last financial year but would still be below the £121.1 million reported the year before prior to when the pandemic hit.

The news sent Crest Nicholson shares up 2.7% in early trade this morning to 441.3p.

Crest Nicholson is paying an interim dividend of 4.1 pence, having not made a payout the year before due to the pandemic. This represents one-third of the total payput Crest Nicholson intends to make for the full-year.

The payout comes as the company said it had made ‘transformational progress’ with its balance sheet, ending the period with net cash of £130.4 million compared to net debt of £93.3 million a year earlier. It has continued to generate cash over the last year and expects to end the financial year with net cash of around £170.0 million.

Looking forward, Crest Nicholson said forward sales sit at 2,771 units with a gross development value of £691.8 million at June 18, having improved from 2,715 units worth £575.1 million a year ago. It said 93% of its anticipated full-year revenue is now covered.

‘Our trading performance in the first half has been strong, reflected in our HY21 SPOW rate of 0.69 and our forward order book being approximately 93% covered as at 18 June 2021. Based on demand for homes which will complete after the 30 September 2021 stamp duty deadline, we are confident that the housing market will remain robust, and this transition can be managed smoothly. We are also continuing to make good progress in all five of our strategic priorities and are increasingly confident about our future growth prospects,’ the housebuilder said.

888 strikes US partnership with owner of Sports Illustrated

Online betting and gaming firm 888 has struck an exclusive partnership with Authentic Brands to tap into the company’s Sport Illustrated brand to create new branded sports betting and gaming products in the US.

Sports Illustrated is a popular sports magazine and website owned by Authentic Brands. In February, media reports suggested it had around 1.7 million premium subscribers.

The deal will combine 888’s expertise in creating new digital gambling products using the Sports Illustrated brand. The first will be an ‘all-new Sports Illustrated wagering experience later this year.’

‘We are delighted to announce this strategic partnership, enabling us to accelerate our investment into the US, which represents one of the most exciting long-term growth opportunities for our company. Sports Illustrated is an iconic sports media brand, with high awareness and consumer loyalty. This agreement provides us access to millions of engaged sports fans across the US, giving us a high-volume and cost-effective customer acquisition channel, and great content to engage sports fans,’ said chief executive Itai Pazner.

The deal will see 888 have an exclusive licence to use the Sports Illustrated brand and trademarks for sports betting and iGaming purposes, as well as some exclusive advertising rights. In return, Authentic Brands will receive brand and license fees and a ‘minority passive interest’ in 888’s US business that is responsible for its B2C activity.

888 shares were trading 2.5% in early trade this morning at 403.2p.

Wood Group expects to return to growth this year

Engineering and project manager Wood Group said it expects momentum to build and allow it to return to growth and improve margins during the second half of the year after its results were hit by the pandemic during the first.

The company said revenue plunged 21% on a like-for-like basis in the first six months of 2021 to $3.2 billion, mostly down to the impact of the pandemic. This has reduced demand for work helping construct big new projects for the likes of the energy industry, although it has partly offset this with strong demand for consulting work and contracts to operate sites on behalf of other companies.

Its adjusted Ebitda margin for the first half should be between $255 million to $265 million, down around 12% on a like-for-like basis. Operating profit before exceptional items should be between $85 million and $95 million, down from $101 million the year before.

The news sent Wood Group shares down 2.8% in early trade this morning at 222.5p.

Still, things are improving and momentum was better in the second quarter compared to the first, and Wood Group is expecting a better second-half.

Its order book at the end of May was worth $6.9 billion, up 6% from December and supporting the view that things are steadily improving. That should continue to grow thanks to consulting and operations work in the short-term, while work for big projects should start to recover later this year.

‘Our full year outlook is unchanged with trading momentum and growth in our order book, which is up 6% year-to-date driven by consulting and operations, giving us confidence that the group will return to growth in the second half, compared to both H1 2021 and H2 2020. In line with our strategic objective we anticipate growth in Ebitda margin,’ said chief executive Robin Watson.

Wood Group said it expects its full-year margin to come close to its medium-term target of 9.6%.

Wise confirms plans for direct listing in London

Wise has confirmed its plans to conduct a direct listing on the London Stock Exchange early next month and said it has seen a strong level of interest from customers that want to invest in the business.

The company, previously known as TransferWise, outlined initial plans to go public last week and has now said shares should be admitted to trading in ‘early July’.

Notably, companies that go public using direct listings do not raise any new cash or issue any new shares and usually only see existing shareholders sell some of their shares. This will also mean that Wise will not be setting a price for its shares before they start trading, with the price ultimately determined by the level of supply and demand on the day of admission.

Wise was last valued at around £3.6 billion during its last fundraise back in July 2020, but is expected to be hoping for a price tag closer to £5 billion with its listing.

‘I am pleased to confirm our plans for a direct listing in London. This process will broaden the ownership of Wise, in support of our mission to move money around the world faster, cheaper and more conveniently,’ said chief executive and co-founder Kristo Karmann.

‘Since announcing our expected intention to float last week, we've had over 60,000 expressions of interest in our customer shareholder programme, OwnWise, which is designed to reward customers who buy Wise shares and stick with us for the longer-term. This direct listing is about further aligning our mission and our shareholder base and I'm enormously proud that customers want to be a part of that,’ he added.

Wise was founded in 2010 and has roots in money transfer services after its founders established the business in response to their experience of costly money transfers between UK and European bank accounts. It has since expanded into other areas such as consumer and business accounts.

Wise is profitable and has been since 2017. Its latest net profit figure for the fiscal year ending March 2020 came in at £21.3 million, on revenues of some £302 million. That was up from £10.3 million in the same period the previous year.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index. Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade