Top UK Stocks to Watch: Aviva exits Italy and prepares to return cash

Top News: Aviva exits Italy as investors prepare for higher returns

Aviva said it is selling the remainder of its Italian business and exiting the country in order to raise cash to pay down debt and streamline the company to focus on the UK, Ireland and Canada.

The announcement coincided with the release of Aviva’s annual results for 2020, which showed net profit ticked-up to £2.9 billion from £2.7 billion the year before, driven by a record year for its retirement businesses that services pensions.

‘Our performance in 2020 demonstrates the resilience of our core businesses and our growth potential. We delivered record sales in group protection; record sales of bulk purchase annuities; and record net flows in savings and retirement, where we are the largest provider of workplace pensions in the UK,’ said chief executive Amanda Blanc, who took the top job last year.

Aviva said it was selling the remainder of Italian Life and General Insurance for EUR873 million in cash. This will see its life insurance business be offloaded to CNP Assurances for EUR543 million and its general insurance business to Allianz for EUR330 million.

Combined with the previous sale of Aviva Vita to UBI Banca, the company has booked EUR1.3 billion in cash from selling its Italian insurance businesses. Including exits from other countries like Singapore, Hong Kong and Turkey, Aviva has booked around £5 billion worth of divestment proceeds under its transformation programme. This is streamlining the business to focus on the UK, Ireland and Canada.

The transformation programme was launched by Blanc last year. Blanc said the exit from Italy represented the final major disposal and places Aviva in a position ‘to make a substantial return of capital to our shareholders’.

The total dividend for the year of 21 pence per share was significantly higher than the 15.5p paid out in 2019.

It has previously said it should be able to return excess capital if its solvency II ratio – a measure of financial strength – was above 180% and that came in at 202% in 2020. The exit from Italy should further strengthen that ratio.

The primary ambition before returning any excess capital is reducing debt and investment. Aviva also launched an £800 million debt tender offer today, helping it to achieve its plan to cut debt by around £1.7 billion in the first half of 2021.

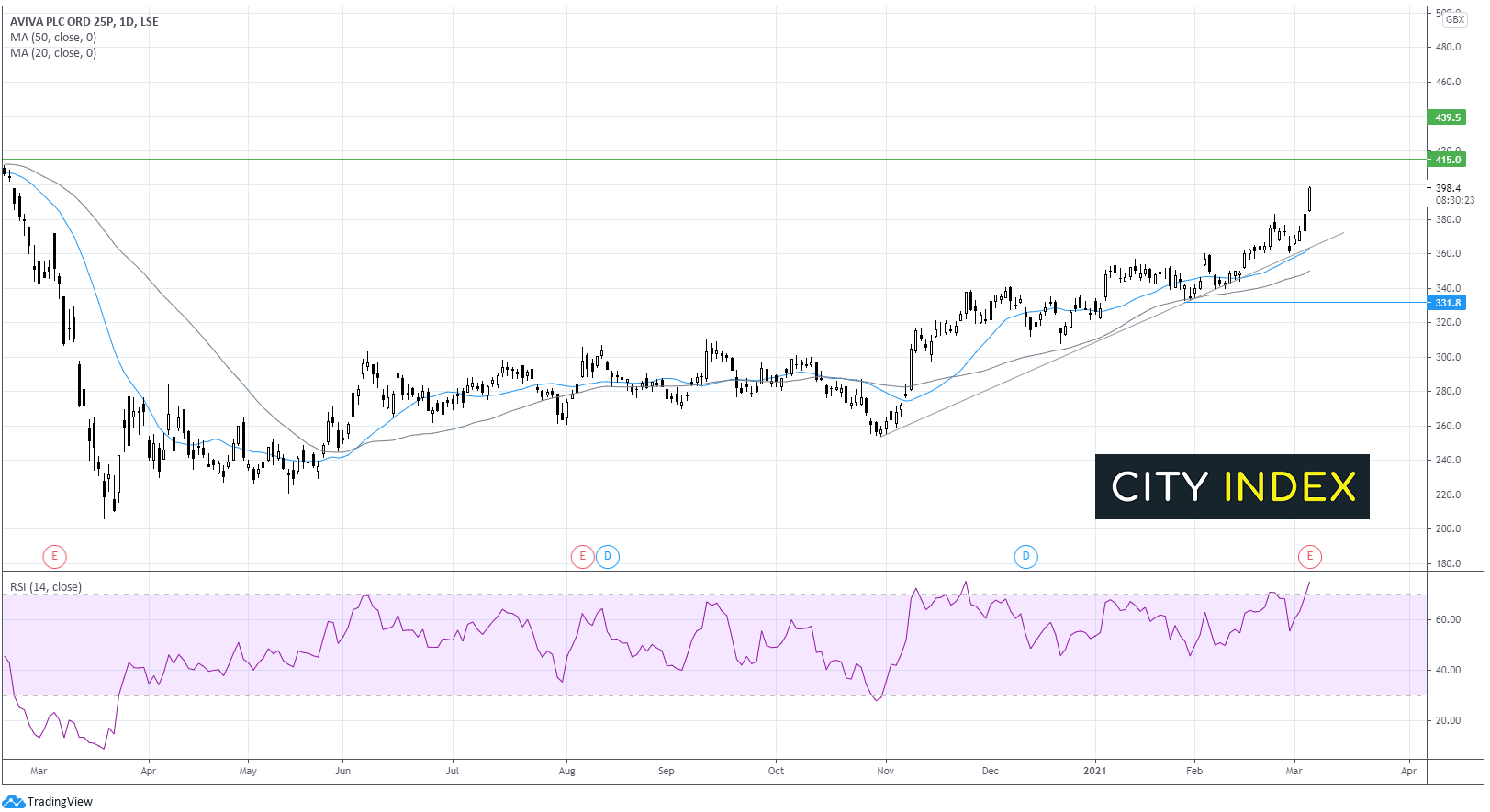

Where next for the Aviva share price?

Aviva shares are trading over 3% higher in early trade, reaching fresh 11 month highs.

The Aviva share price trades above its ascending trendline dating back to early November. It also trades above its 20 & 50 sma on the daily chart showing an established bullish trend.

The RSI is in overbought territory so a period of consolidation or even a slight pull back could be on the cards before further gains.

Resistance can be seen at 415 the February pre-pandemic high. A move through here could see the bulls target 440 the 2019 high.

Any move lower could run into support at 365 the ascending trend line and 20 sma before 350 the 50 sma is tested. A break below here would negate the nears term bullish trend.

Entain’s online and US performance pays off in 2020

Entain delivered a significant improvement in earnings during 2020 as a strong performance in the US and online countered the impact of having to close its stores during lockdown, but said it will not pay a dividend for the year because of the uncertainty plaguing its outlook.

The company said net gaming revenue was flat year-on-year at £3.56 billion. The company continues to perform well online, having now delivered 20 consecutive quarters of double-digit net gaming revenue with 28% growth in the year. However, many of its physical stores in the UK and Europe continue to be impacted by lockdowns.

Entain said it gained market share ‘across all major markets’ and performed particularly well in Australia, Brazil, Georgia and Italy. It also expanded into new regulated markets by launching the bwin brand in Colombia. Its proposed acquisition of Enlabs in the Baltics and Bet.pt in Portugal will allow it to expand further.

Plus, its joint venture in the US with MGM Resorts is now live in 12 states and building momentum, having booked better-than-expected revenue of $178 million during the year. Entain said the venture has around 18% market share and was the ‘number one operator in iGaming in January 2021’ across the US.

Underlying Earnings before interest, tax, depreciation and amortisation was up 11% to £843.1 million from £761.4 million in 2019, mainly thanks to lower operating costs. Underlying operating profit inched up 2% to £529.5 million.

Entain swung to a pretax profit of £174.7 million from a £164.4 million loss in 2019, with basic earnings per share of 15.8 pence compared to a 24.8p loss. The loss in 2019 was caused by higher one-off charges booked against acquisitions and assets.

Entain said it would not be paying a dividend for the year because of the uncertainty plaguing its outlook.

‘Given the ongoing uncertainty as a result of Covid-19, the board does not consider it prudent to pay a dividend at this time. However, the board recognises the importance of dividends for shareholders and will consider dividend payments with future results,’ said Entain.

‘The group performed strongly through a difficult year reflecting both the diversified nature of our business model and the quality of our people. We have started the year with good momentum in line with expectations and we hope to see normality returning over the coming months. As a result we remain confident in our own financial performance and long-term prospects,’ said Entain.

Entain shares were down 2% in early trade at 1430.8.

B&M European Retail ups expectations as trading remains strong

B&M European Retail Value raised expectations for the full year after experiencing better than expected trading in the UK during lockdown, but warned it will soon start to face stronger comparative periods over the coming quarters.

The discount retailer reported strong sales in the third quarter but had warned the latest lockdown meant its outlook was uncertain. However, revenues and margins have ‘remained strong’ during the final quarter of its financial year, particularly from its UK business.

As a result, B&M said it now expects to deliver adjusted Earnings before interest, tax, depreciation and amortisation of between £590 million to £620 million. That has been raised from its previous target range of £540 million to £570 million and would be a huge improvement from the £342.3 million reported in the last financial year to the end of March 2020.

However, B&M warned that it enters the new financial year facing tougher comparative periods, implying that the rate of growth could slow.

‘Group sales will shortly annualise against the elevated sales, driven initially by consumer stockpiling in mid-March 2020, and which continued throughout FY21 due to the ongoing impacts of Covid-19. This, together with the unknown impact of changes to restrictions in 2021, creates significant forecasting challenges which will persist well into the new financial year,’ said B&M.

B&M shares were down 1.2% in early trade at 537.6.

Vesuvius profits take heavy hit during coronavirus crisis

Vesuvius said profits took a battering as demand fell during the pandemic but said a recent restructuring means it is well positioned to recover this year, whilst strong cash generation allowed it to almost treble its dividend.

The molten metal flow engineering company, which serves the likes of the steel industry, said revenue fell 14.7% in 2020 to £1.45 billion from £1.71 billion the year, as the pandemic weighed on demand.

Vesuvius said it outperformed the wider market in high-growth markets like India, Vietnam, Turkey, Russia, Ukraine and across South America.

Operating profit plunged 42% to £74.3 million from £127.5 million in 2019. Pretax profit was down 46% to £64.5 million from £118.6 million.

Vesuvius raised its dividend to 17.4 pence from just 6.2p in 2019. It cancelled the 14.3p final payout for 2019 as the pandemic erupted.

‘Clear signs of recovery are now apparent in both our steel and foundry end markets and we believe that this recovery should accelerate in the second half of 2021, supported by the lifting of most pandemic-related restrictions by then,’ said chief executive Patrick Andre.

‘Vesuvius is emerging from this difficult period stronger than before. We have low leverage and an optimised manufacturing footprint resulting from our successfully completed restructuring programmes. We also benefit from our flexible and low capital intensive, entrepreneurial and decentralised business model, which has proven its value during 2020. We are confident that the group will deliver a meaningful improvement in financial performance in 2021,’ he added.

The recent restructuring has delivered an ‘optimised manufacturing network geared for growth’, Vesuvius said.

Vesuvius shares were down 6.9% in early trade at 515.0.

How to trade top UK stocks

You can trade all these UK stocks with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade