Top News: Royal Mail buys Rosenau Transport to bolster GLS in Canada

Royal Mail said it has struck a CAD360 million deal to buy a logistics company to create a delivery network spanning across Canada.

The company said its international arm GLS has agreed to buy Mid-Nite Sun Transportation, which is one of the largest independent freight carriers in Western Canada. The firm trades under and is better known as Rosenau Transport. It owns 24 facilities across four provinces.

‘The combination of the two businesses will create a network stretching across Canada which will enable GLS to cover the vast majority of the Canadian population and deliver further growth and synergies. It also provides a link to GLS operations along the US West Coast, unlocking significant growth opportunities with new and existing customers as the Rosenau Transport network moves to the combined GLS freight and parcel model,’ Royal Mail said.

The firm generated CAD175 million in revenue and CAD41.6 million of Ebitda in the year to the end of August 2021.

Royal Mail said it is also hoping to unlock revenue synergies from the deal, and is expecting the purchase to boost earnings and cashflow in the current financial year to the end of March 2022.

The purchase price is equal to around £210.5 million and is being funded by existing cash and debt facilities.

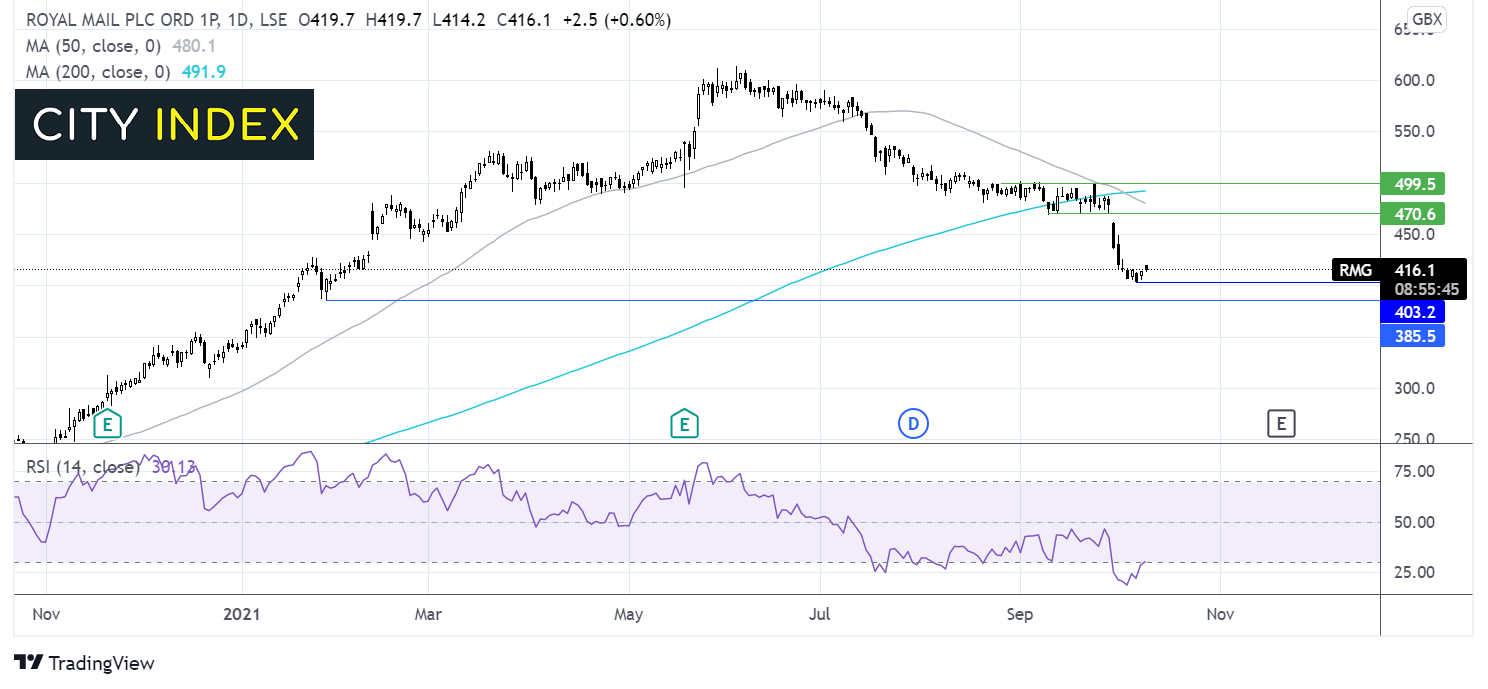

Where next for the Royal Mail share price?

The Royal Mail share price rallied hard across the start of the year, running into resistance at 613p in early June.

The price has since been forming a series of lower highs and lower lows. It trades below its 50 & 200 sma. The 50 sma also crossed below the 200 sma in a death cross bearish signal.

The price has found support this week at 403p and is attempting to claw higher, pulling the RSI out of oversold territory. Immediate resistance can be seen at 426p this week’s high. However, it would take a move back over 468p to negate the near term down trend.

The dominant trend is still bearish. On the downside, a break through 403p could open the door to 384p the late January low.

Airline stocks in play ahead of UK travel rule change

The environment for airline stocks will improve next week when the UK’s new travel rules come into play, when just seven countries will be on the country’s travel red list.

There are currently over 50 countries on the UK’s red list, which requires returning passengers to quarantine in an approved hotel for 11 nights at a huge cost to the traveller. As of Monday morning, 47 countries will be removed from the red list, leaving just seven left: Panama, Colombia, Venezuela, Peru, Ecuador, Haiti and the Dominican Republic.

Travellers that are fully vaccinated will also be able to take cheaper lateral flow tests upon their return rather than PCR tests, which are much more expensive. Still, if the lateral flow test comes back positive, they will be offered a PCR test free of charge.

Still, it is important to flag that whilst the UK has eased its rules, travellers could still face headaches depending on the rules in place in the country they wish to travel to.

Ultimately, the move will be welcomed by the airline and travel industry as it makes things easier and simpler for travellers, which should encourage more people to book trips and holidays. But the nature of international travel means it is not a one way street, and the uneven recovery across the likes of Europe will still pose problems for the industry.

British Airways owner IAG was up 2.5% this morning while easyJet was up 1.2%. Wizz Air and Ryanair were both trading flat.

Unite Group lowers expectation on disappointing occupancy

Unite Group warned that earnings will be at the lower-end of expectations this year after failing to fill the number of beds it had hoped for despite seeing a record level of university applications.

Unite Group shares were down 4% this morning at 1056.8p, marking the lowest level since March 2021.

The company, which lets out student accommodation, said occupancy is currently at 94% as it enters the final stages of the lettings cycle for the 2021/2022 academic year. That is up from 88% this time last year when the pandemic hit the business, but below the 98% delivered before the pandemic.

That is also below the 95% to 98% occupancy levels targeted by Unite Group. However, it said its waiting lists could boost occupancy by 1% to 2%.

‘A record level of university applications has not translated into higher student intake as expected with higher grade attainment distorting the distribution of students among our cities. We are sold out in the majority of our markets with significant waiting lists in a number of key cities for students struggling to find suitable accommodation. However, we have seen a concentration of voids in cities where we expect universities to have lost market share of students or which are adjusting to new supply,’ said Unite Group.

Unite Group said that it has been disciplined with pricing after having to offer discounts during the pandemic. This should see rental growth of around 2.3% in the 2021/2022 academic year.

The consequence of lower occupancy will be EPRA EPS at the lower end of its full year guidance range of 27.0 pence to 30.0p. It warned that this will also have a knock-on effect and knock a further £8 million to £10 million off rental income in the 2022 financial year.

‘We will seek to mitigate this impact on 2022 EPRA EPS through ongoing sales activity by targeting international students who may delay their arrival to the UK until the new year and the reintroduction of summer business in 2022,’ said Unite.

‘In addition, we are targeting cost savings from operational efficiencies resulting from lower occupancy. We are fully-hedged for our FY2022 energy costs, which represent 5% of rental income, protecting earnings from rising wholesale prices,’ Unite added.

N Brown switches focus to profitable growth

N Brown Group said it is changing tact by focusing on profitable growth rather than promotion-led sales as it posted a significant improvement in earnings during the first half.

N Brown shares were up 6.6% this morning at 50.78p.

Revenue dipped 0.1% in the 26 weeks to August 28 to £346.8 million, as a 5.7% fall in revenue from financial services offset the 3.3% rise in product sales. Still, the company said its five core strategic brands delivered product revenue growth of 14.9% in the period, with its performance dragged down by legacy brands.

N Brown Group said it continued to grow its customer base in the period, with active customers rising 1.1% in the second quarter compared to the first. It cited its marketing activities for the growth, having launched new campaigns and signing-up the likes of Davina McCall and Amanda Holden as brand ambassadors for JD Williams.

Financial services revenue was down due to a smaller debtor book at the start of the year, N Brown Group said, but margins improved thanks to higher provision rates and fewer write-offs, with bad debt provisions remaining stable.

Adjusted Ebitda jumped over 10% to £53.0 million from £48.0 million, driven by the improved profitability in financial services. Adjusted pretax profit increased 7.1% to £24.2 million while reported pretax profit at the bottom-line doubled to £28.2 million.

‘We continue to deliver on our plan and are feeling well prepared for peak trading. Ebitda remains in-line with our expectations, and we are looking forward to exciting our customers with our new ranges as we head towards the Christmas peak. However, we do so with the backdrop of continued uncertainty around consumer confidence,’ said CEO Steve Johnson.

N Brown Group said the warm reception to the new products of its core brands and its marketing efforts has prompted it to focus on ‘profitable growth, rather than promotion-led sales.’

This will see product revenue grow 1% to 4% over the full year while financial services is forecast to be down 5%. This should level out for overall revenue to be broadly flat from the £728.8 million delivered last year (which would remain below the £837.5 million delivered in the financial year before the pandemic hit).

Adjusted Ebitda over the full year is to be between £93 million to £100 million, which would be an improvement from £86.5 million last year but also below pre-pandemic levels.

‘We remain committed to our medium-term targets of 7% product revenue growth per annum and a 14% adjusted Ebitda margin. Achieving these will deliver sustainable returns for shareholders,’ N Brown Group said.

Electrocomponents ups guidance despite supply chain pressure

Electrocomponents performed better than expected during the first half, prompting it to raise guidance for the rest of the year despite flagging significant pressure on its supply chain.

Electrocomponents shares were up 2.3% this morning at 1092.0p.

The company, which supplies a range of industrial and electronic products, said like-for-like revenue jumped 37% year-on-year in the first quarter and 26% in the second, levelling out at 31% for the first half to the end of September. Notably, like-for-likes were some 22% above pre-pandemic levels seen in 2019.

It also said it managed to improve its gross margin despite rising cost pressures. It said freight charges remain elevated and that rising labour costs ‘are showing no signs of abating’.

With that in mind, Electrocomponents looks set for a more challenging second half considering it will come up against tougher comparatives, but remains confident in its prospects.

‘Looking forward, we face much tougher comparatives and a number of external challenges, including supply chain shortages, which are affecting industrial production and increasing cost pressures. Hence, we expect our full year profit to be more weighted to the first half than in previous years,’ said Electrocomponents.

‘However, with the strong performance in the first half, and notwithstanding the uncertain trading environment, we now anticipate full year revenue growth and adjusted operating profit margin to be slightly ahead of the guidance provided with our Q1 update,’ the company added.

Electrocomponents said in July it was aiming to deliver low double-digit to mid-teens like-for-like revenue growth to help return to a positive adjusted operating margin.

Electrocomponents will release interim results on November 4, which will also include an update on its ESG plans.

Just Eat Takeaway.com says GrubHub founder to leave

Just Eat Takeaway.com has announced that Matt Maloney, the founder of GrubHub that joined the business after the two companies merged earlier this year, is leaving at the start of December.

The two businesses completed a $7.3 billion deal after securing regulatory approval back in June, resulting in Maloney joining the board of the combined company. However, he is leaving to ‘pursue other opportunities’.

‘Great entrepreneurs like Matt start businesses that touch the lives of millions of people. He has built a magnificent company and helped create hundreds of thousands of jobs across the US. We are sorry to see him leave the Company and wish him the best in his future endeavours,’ said Jitse Groen, the CEO of Just Eat Takeaway.com.

Just Eat Takeaway.com shares were down 1% this morning at 5584.0p.

Drax Group biomass plant biggest UK emitter of CO2

Drax Group’s subsidised renewable energy plant in Yorkshire is reported to be the single biggest emitter of carbon dioxide in the UK, according to Sky News.

The report said Drax’s Yorkshire power plant, which burns wood-based biomass pellets to generate electricity, is heavily subsidised and receives hundreds of millions of pounds in taxpayer funds.

Research shares by Ember suggested the plant is ‘among the biggest sources of carbon dioxide and PM10 (particulate matter of 10 micrometres and smaller) air pollution of all EU power stations’, according to Sky News, adding that it is worse than some of Europe’s coal plants.

Notably, the UK does not include these emissions in its figures as biomass is excluded.

Drax has spent years transitioning its plants from coal to biomass, claiming it has cut emissions by 90% as a result.

Drax shares were up 0.3% this morning at 497.0p.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade