Top News: Future profits could more than double this year

Future said that profits could more than double in the current financial year as demand for digital advertising continues to rise and yield growth improves.

The multi-platform media company, which connects with over 390 million people every month through its 200 brands spanning websites, events and magazines, said annual adjusted operating profit this year will be at the top end of the £183.5 million to £193.6 million range forecast by analysts.

That would mark a significant uplift from the £93.4 million delivered last year, when profits boomed thanks to increasing audience numbers during the pandemic. Future said its performance has been driven by ‘continued momentum in digital advertising with sustained yield growth more than offsetting the impact of strong comparators on audience growth.’

Future will publish annual results on November 30.

Future also announced that chief financial officer Rachel Addison will leave the business at the end of October, when Penny Ladkin-Brand – currently the company’s chief strategy officer – will take over. Notably, Ladkin-Brand was Future’s CFO for five years before she took up her current role.

It also confirmed it has completed its acquisition of Dennis announced earlier this year, which has seen Future get its hands on a number of media titles including The Week, MoneyWeek, Kiplinger, PC Pro and Minecraft World.

‘I am pleased to report that the continued successful execution of our strategy puts us on track to report another year of strong revenue and profit growth. I am confident that the acquisition of Dennis will help to accelerate our progress, and am delighted to welcome the team to Future,’ said chief executive Zillah Byng-Thorne.

Future shares were down 2.9% in early trade this morning, having more than doubled in value since the start of 2021. Notably, Future was among the top 10 most-shorted stocks among our UK clients last week.

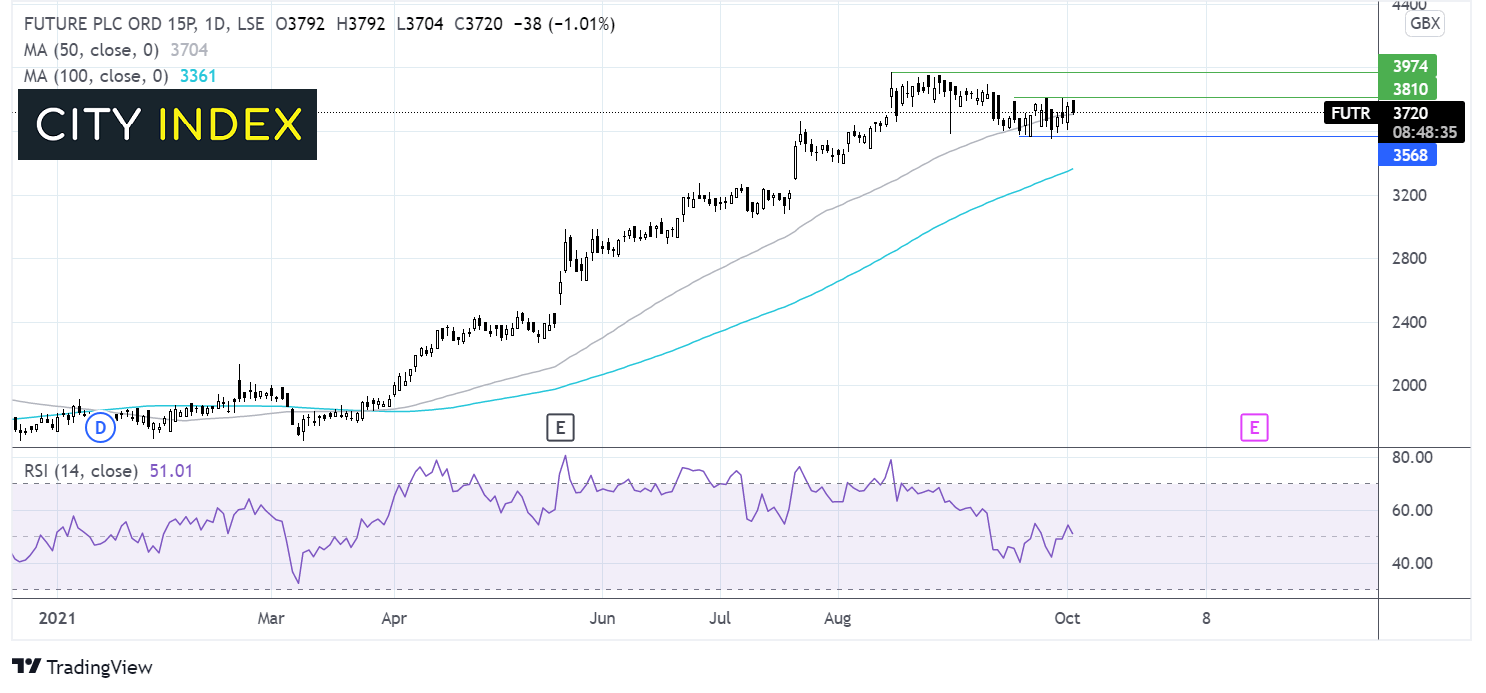

Where next for the Future share price?

Future share price trended higher from early March before running into resistance at 3968p in August. The price was unable to maintain this level and has been consolidating lower, capped on the upside by 3810p and on the lower band by 3585p.

The RSI is providing few clues sat at 50 and the 50 sma is offering support at 3704p. Sellers might look for a move below 3585p which could expose to the 200 sma at 3360p.

Meanwhile buyers could look for a breakout trade above 3810p to target 3968p and fresh all time highs.

Morrisons recommends CD&R takeover after auction process

The battle for Morrisons looked to be settled over the weekend, as US private equity firm Clayton, Dublier & Rice won the auction process for the UK’s fourth largest supermarket on Saturday.

CD&R won with a bid of 287 pence per share, beating the consortium led by Softbank-owned Fortress Investment Group which was willing to pay 286p. Notably, CD&R’s successful bid is at a 61% premium to the Morrisons share price before the takeover battle started back in June.

The battle was taken to auction after both bidders refused to make their offers finals.

Morrisons shares were down 3.5% this morning at 285.8p, signalling investors were hoping the auction process would deliver a higher price.

Morrisons shareholders will now vote on the CD&R takeover - which is worth £7.1 billion or just under £9.8 billion when debt is included - at a general meeting on October 19.

‘Today's final offer from CD&R represents excellent value for shareholders while at the same time protecting the fundamental character of Morrisons for all stakeholders,’ said Morrisons chairman Andrew Higginson.

‘CD&R have good retail experience, a strong record of developing and growing the businesses in which they invest, and they share our vision and ambition for Morrisons. We remain confident that CD&R will be a responsible, thoughtful and careful owner of an important British grocery business. Shareholders will now have the final say and, if the offer is approved, the board is confident that Morrisons will continue to go from strength to strength under CD&R's ownership,’ he added.

The deal, if approved, could see CD&R complete its takeover of Morrisons within weeks and will see Terry Leahy, the former chief of Tesco who has worked with CD&R on the deal, return to the UK supermarket industry.

‘We are gratified by the recommendation of the Morrisons board and look forward to the shareholder vote to approve the transaction. We continue to believe that Morrisons is an excellent business, with a strong management team, a clear strategy, and good prospects,’ said Leahy.

Morrisons is set to become the second major UK supermarket to be bought in 2021 following the £6.8 billion takeover of Asda earlier this year, and the rising interest in the sector has prompted some to believe Sainsbury’s could become the next target.

AstraZeneca gets another approval for Enhertu

AstraZeneca announced that Enhertu has been awarded Breakthrough Therapy Designation by the US Food & Drug Administration and given the green light to treat patients with breast cancer.

Regulators have approved the drug to treat adult patients with unresectable or metastatic HER2-positive breast cancer who have received one or more prior HER2-based regimens. Enhertu is a HER2-directed antibody drug conjugate that has been developed alongside Daiichi Sankyo Co.

The approval has come following the latest Phase III trial results that were presented during the European Society for Medical Oncology Congress 2021.

Notably, Enhertu has already been awarded Breakthrough Therapy Designation in breast cancer and this is the fourth it has received in total.

The designation paves the way for Enhertu to undergo faster development and regulatory review of potential new medicines.

AstraZeneca shares were up 0.9% this morning at 8824.5p.

Ryanair and Wizz Air see uptick in passenger numbers

Low-cost airlines Ryanair and Wizz Air both reported a significant uptick in passenger numbers during September as traffic continues to steadily rebound from the pandemic.

Ryanair said it carried 10.6 million passengers in September with a load factor of 81% compared to just 5.2 million passengers in September 2020 at a load factor of 71%. Notably, that marks a slight fall from the 11.1 million passengers carried in August.

Traffic is still well below pre-pandemic levels, with Ryanair having carried 14.1 million passengers in September 2019 at a 96% load factor.

Meanwhile, Wizz Air said it carried 2.99 million passengers during September, up 91% from the 1.56 million carried last year when stricter restrictions severely hampered the industry. Capacity was raised by over 57% to 3.8 million seats, delivering a load factor of 78.4% during the month compared to 64.6% a year earlier.

Still, traffic numbers remain considerably below pre-pandemic levels considering Wizz Air carried 3.81 million passengers in September 2019 at a load factor of 94.5%.

On a rolling 12-month basis to the end of September, Wizz Air carried 16.2 million passengers at a load factor of 72.4%, down from 29.5 million passengers at a 82.7% load factor in the 12 months to the end of September 2020.

Wizz Air said it is launching new routes from Debrecen in Hungary that will go to Brussels in Belgium and Kyiv-Zhulyany in Ukraine. These will be operated twice a week from the middle of December 2021. It is also planning to restart three routes from Debrecen to Tel-Aviv, Moscow and Santorini.

It also said Wizz Air Dubai completed its inaugural flight to Bahrain in September, providing a new alternative route for passengers between the two Gulf countries.

Other airline stocks will also be in play today after the UK introduced new rules for international travel today. There is now only a red-list of countries where passengers will have to quarantine upon their return, with the green and amber lists being scrapped to allow fully-vaccinated travellers more freedom. Testing rules have also been eased for some countries.

Ryanair shares were up 2.9% this morning at 1765.0p while Wizz Air shares were up 0.2% at 5235.0p.

SEGRO acquires London warehouse in swap with Schroders

SEGRO and Schroders have completed a property swap transaction that has seen the former acquire an urban warehouse estate and sell two big box assets.

Under the deal, SEGRO has acquired a 256,000 square foot urban warehouse in West London for £140 million. Matrix Park is in Park Royale in West London, close to some of SEGRO’s existing assets. The site comes with a 1.4 acre development site. The company said the site currently generates passing rent of £4.1 million with leases not set to expire for five years on average.

In exchange, Schroders has bought a portfolio of two standalone big box assets in Birmingham and Northampton and four multi-level warehouses – one near Heathrow Airport, another in Park Royal, another in North London and a fourth in Radlett. Those sites currently have passing rent of £7.5 million and leases that will expire in six years on average. Schroders has paid £205 million in total.

Importantly, the £65 million difference in purchase prices means Schroders has plugged that gap with a payment to SEGRO.

‘This off-market transaction has allowed us to acquire a significant multi-let industrial estate in one of our core markets, offering strong rental growth potential as well as a medium to long term redevelopment opportunity. At the same time we have been able to divest a number of relatively small holdings, all of which were ear-marked for disposal in the near to medium term,’ said David Proctor, the managing director of group investment at SEGRO.

SEGRO shares were down 1.3% this morning at 1194.0p while Schroders shares were down 1.7% at 3541.0p.

Flutter hands FanDuel CEO role to Howe

Flutter Entertainment has appointed Amy Howe as the new chief executive of US outfit FanDuel.

Howe joined FanDuel back in February as president, charged with overseeing the company’s core operations across its Sportsbook, Casino, Racing and Daily Fantasy businesses. She has already been acting as interim CEO since July.

‘I am delighted to confirm the appointment of Amy as our new US CEO. Since joining the business at the start of this year she has done an excellent job of leading our commercial functions and ensuring that we execute well at this critical phase of growth for our business. The expansion of the US market represents the single most exciting opportunity for Flutter today. Amy's track record of leadership and experience in scaling a digital business will be invaluable as we look to grow our leadership position there,’ said Flutter CEO Peter Jackson.

Before joining FanDuel, Howe was the chief operating officer of Ticketmaster, part of Live Nation Entertainment, where she helped double its growth in gross ticketing value and expand its mobile app.

Flutter shares were down 0.2% this morning at 14723.0p.

Compass Group CFO Witts resigns

Food and support services outfit Compass Group said chief financial officer Karen Witts will resign at the end of this month, when Palmer Brown will take over.

Witts will leave on October 31 and Brown, currently group commercial director, will become CFO designate on November 1. Brown, who previously served as interim CFO between 2018 to 2019, will also become a director.

‘The board is pleased to appoint Palmer as chief financial officer. Palmer, who has been with the group for more than 20 years, knows the business very well and is ideally suited to help lead the group as it recovers strongly from the impact of the Covid-19 pandemic,’ said chairman Ian Meakins.

Compass shares were down 0.7% this morning at 1551.8p.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade