US futures

Dow futures -0.7% at 31642

S&P futures -1.2% at 3925

Nasdaq futures -1.85% at 11808

In Europe

FTSE +0.01% at 7506

Dax -0.65% at 14054

Euro Stoxx -0.86% at 3675

Learn more about trading indices

Tech stocks take a hammering

After yesterday’s rebound US futures are falling. A profit warning from Snap hit shares of social media companies. The Nasdaq is leading the charge lower.

Snap share price is dropping over 30% pre-market after the company cut its Q2 outlook, blaming a faster than expected decline in the economic outlook. The update comes just one month after SNAP reported and guided so that makes the announcement all the more surprising.

Other tech stocks that rely on advertising spend, such as Alphabet, Meta, and Twitter are also falling hard pre-open.

Last week retailers unnerved the market as rising costs took their toll on retailers’ profits. Today Snap’s warning has sent alarm bells ringing that advertising spend could have peaked. When the economic outlook darkens, advertising spend is often one of the first cutbacks that businesses make.

This latest warning from companies comes just as risk sentiment was trying to find a firmer footing. But actually, what it tells us is there is still more bad news to come out in the wash, which inevitably means more downside to come.

In corporate news:

Airbnb trades 2.3% lower pre-market after saying that it will close its domestic China business, joining a growing list of western companies that have opted out of China.

The announcement by Snap opened a new can of worms for the Twitter deal. If it was looking unlikely before, it seems even less likely now.

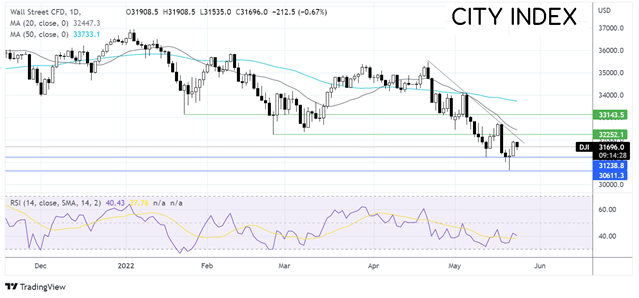

Where next for the Dow Jones?

The Dow Jones has formed a series of lower highs and lower lows since mid-April. The index trades below its 20 & 50 sma and its multi-week falling trendline. The RSI supports further downside. Sellers will need to break below support at 31225 to open the door to the 2022 low of 30635 and create a lower low. Buyers will need to rise over 32250 to expose the 20 SMA and bring 32735 the May 19 high to play. A move above here is required in order to create a higher high.

FX markets – USD falls, EUR jumps.

USD is edging lower after steep losses yesterday. The USD is tracing treasury yields lower, sinking to its lowest level in around a month. Attention is shifting towards the PMI data and Powell’s speech later, which could offer fresh insight into the Fed’s plans.

GBP/USD is falling hard, underperforming its major peers after services PMI missed forecasts by a wide margin. The service sector PMI was 51.8, down from 58.9 in April and well short of 55.1 forecast. The level 50 separates expansion from contraction. The service sector is the dominant UK sector, so the data doesn’t bode well for the GDP.

EUR/USD is outperforming its major peers, surging above 1.07 after ECB Christine Lagarde continued with her hawkish commentary. Yesterday she said that the ECB could end negative interest rates by the end of September, suggesting a summer of rate hikes. Today she added that she wasn’t against a 50 basis point hike if needed. This marks a massive change in stance for the ECB, which was not even looking to hike this year just a few weeks ago.

GBP/USD -0.6% at 1.2505

EUR/USD +0.3% at 1.0715

Oil edges higher

Oil prices are holding steady on Tuesday after losses in the previous session as the market continues to weigh up the prospect of a global recession on oil demand again tighter supply.

Investment banks UBS and Goldman Sachs have cut their China growth outlook for the year as COVID cases in Beijing rise, and widespread lockdown restrictions seem almost inevitable as long as China sticks to its zero-COVID policy.

Between slower growth in China and the ongoing Russian war, tighter monetary policy, and elevated inflation, the economic outlook is undoubtedly very gloomy.

However, tight supply also looks here to stay. The EU is moving closer to a ban on Russian imports, which is keeping the price of oil supported, in addition to solid demand in the US as the driving season ramps up.

WTI crude trades +0.28% at $110.17

Brent trades +0.29% at $111.60

Learn more about trading oil here.

Looking ahead

14:45 Composite PMI

15:00 New Home Sales

17:20 Fed Chair Powell’s speech

21:30 API oil inventories

How to trade with City Index

You can trade with City Index by following these four easy steps:

- Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade