The S&P500 extended its rebound overnight, brushing off another round of hawkish Fed Speak ahead of the start of the Sep 10 Fed blackout period AND ahead of next week's all-important CPI release.

Speaking at the Cato institute's conference overnight, Fed Chair Powell reiterated that the Fed would continue tightening "until the job is done".

As far as the interest rate market is concerned, 72bp of a 75bp rate hike for the upcoming Sep FOMC is priced (was a 50/50 split between a 50/75bp hike at the start of the week). Followed by a 50bp, and then a 25bp rate rise that would take the Fed Funds rate to 3.75%-4% by year-end.

The expected slowing of the Feds front-loaded rate cycle will follow the lead of the Bank of Canada as it this week became the first G10 central bank to slow the pace of its rate hiking cycle.

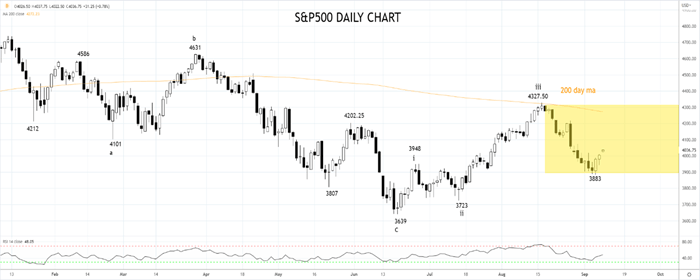

In terms of what it means for the S&P500, two weeks ago, we penned a note here called "S&P500 get ready to play the range", calling for the S&P500 to trade a range between 4300 and 3950ish into late October.

While the move to the downside earlier this week overshot our expected 3950ish range low, the ability to avoid a daily close below 3900 and the subsequent 4% rebound keeps our range trading call intact.

The call was based partly on the idea that after a year that has already seen a 25% sell-off followed by a 20% rebound, the logical next step was for an extended period of choppy range trading.

Furthermore, limiting the downside, the interplay between recession fears and higher rates that flamed tail risks and drove U.S equity markets to the June lows have eased. The labour market remains strong, and economic data outside the housing market has been reasonably solid.

On the topside, the bout of recent hawkish Fed speak has seen real yields move considerably higher and financial conditions tighten. If financial conditions were to ease too quickly from here because of a rapid rally in stock prices, the Fed simply needs to wheel out the hawkish rhetoric after the Sep FOMC to tighten financial conditions again.

The conclusion, therefore, is the S&P500 has entered a period of choppy range trading between 3900 and 4300. A view we will remain with unless the S&P500 were to post a daily close below 3900. As with any range trading type of market the preference is play around the edges, at range extremes.

Source Tradingview. The figures stated are as of September 9th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade