US markets have remained downbeat a couple of hours into the US session, after futures had tracked Asian and European markets lower. The short-term S&P 500 analysis appeared bearish but confirmation was needed to tip the balance in the bears’ favour.

Why are stocks falling?

While optimism about a debt deal had helped to lift sentiment on Wall Street in recent days, the pressure has been growing from other sources. Chief among them is China where economic activity is faltering. Overnight we had another poor showing from China where the manufacturing sector PMI weakened to 48.8, the lowest since December. From the US we have also had a very poor Chicago PMI, which missed expectations by a mile with a print of 40.4 vs. 47.1 eyed. This puts Thursday’s publication of the ISM manufacturing PMI into focus as concerns about global factory output continue to rise.

With the markets struggling around the world, Wall Street, which has been relatively immune to China’s weakening story so far, is starting to show a few cracks underneath the surface. Friday’s big rally seems like a distant memory already. When China sneezes, Asia tends to catch a cold and we have already seen big falls for antipodean currencies and stocks. On Tuesday, a gauge of Chinese shares traded in Hong Kong fell into a bear market. Overnight, the Hang Seng index also extended its losses to 20% below recent highs, putting it officially in a bear territory. China’s weakness has weighed heavily on European markets because of the fact the nation is a big export destination for European companies, from luxury brands to carmakers.

Until now, A.I. optimism has kept tech stocks supported while other sectors have not done so well, albeit not too poorly either thanks to optimism over a debt deal being achieved soon. However, the increasing probability of another Fed rate hike in June is something that could hold markets back here.

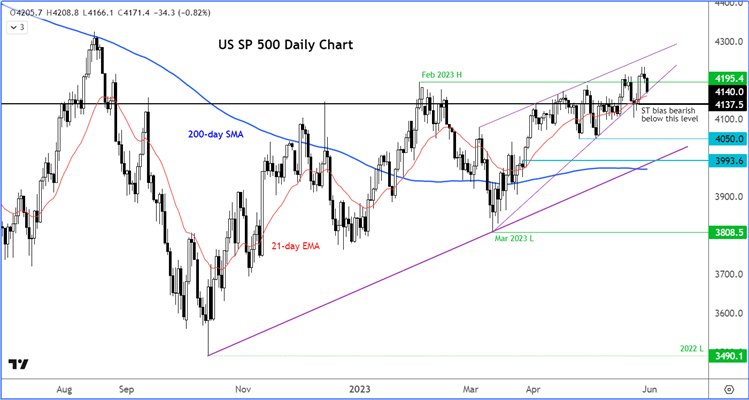

Technical outlook: S&P analysis

At the time of writing, the S&P 500 was testing a key level of potential support around 4167, resistance from Thursday of last week before it was taken out by a big rally on Friday. If that rally was genuine, then you would expect to see the bulls defend Friday’s gains. A recovery from around this level should not be ruled.

However, if support here breaks down decisively then the odds of the market going on to break Friday’s low would increase. Should we see a move below Friday’s low at 4137 then that would create our first lower low, and thus provide a key bearish reversal signal. For, if the Spoos were to move there, we will also have a breakdown from a wedge pattern to the downside.

Until such a breakdown happens, let’s remain very vigilant, as despite all the odds, the US markets have continually failed the bears this year.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade