After failing to squeeze silver shorts, participants on a popular website forum have been discussing shorting the South African Rand as their next target for a short squeeze. However, the author also notes that “this isn’t a short-term swing trade”. This may be correct from both a fundamental and/or a technical standpoint, but it would be difficult for an online forum to take on the South African Reserve Bank (SARB), ala George Soros vs the Bank of England. However, the SARB has been worried about the direction of the economy after cutting 300bps in 2020. In addition, the South African variant of the coronavirus making its way around the world, B 1351, is said to be more contagious than the original virus. In addition, vaccines may be less effective on the South African strain. THESE may be reasons to short the Rand.

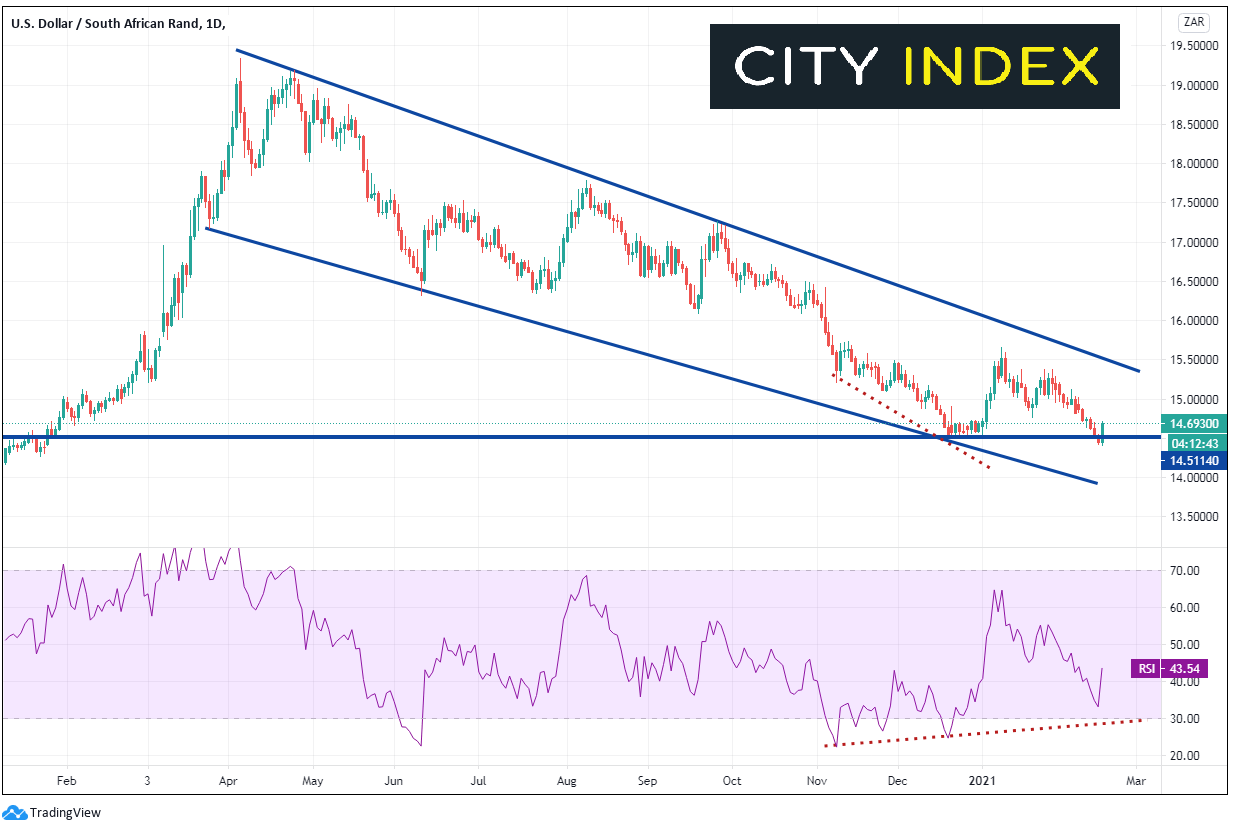

On a daily timeframe, USD/ZAR has been moving lower since putting in pandemic highs on April 6th, 2020, forming a descending wedge. Price has pulled back to pre-pandemic support, and briefly spiked to a new low today at 14.7079. In addition, the RSI has made 3 higher lows as price has put in 3 lower lows. Price is currently trading mid-range in the wedge between 13.92 and 15.50.

Source: Tradingview, City Index

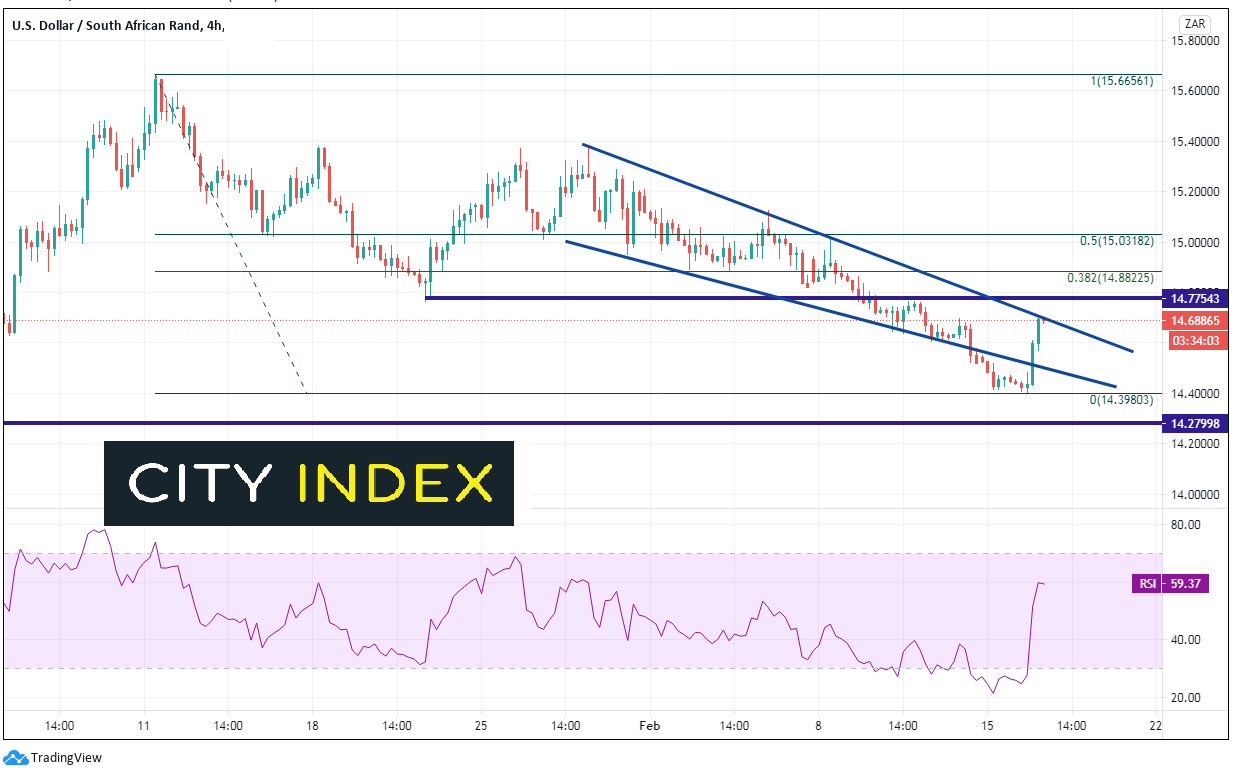

Rumors circulating that the Rand may be the next short opportunity did help lift USD/ZAR off the support area (on the daily timeframe). However, on a shorter 240-minute time frame, the pair had moved below a descending wedge of its own, only to move back into the wedge and test the upper downward sloping trendline near 14.6877. The target for a descending wedge is a 100% retracement of the move. If price does break though the upper trendline of the wedge, it must first get through horizontal resistance at 14.7754, the 38.2% Fibonacci retracement of the January 11th highs to today’s lows near 14.8822, then the 50% retracement of the same timeframe near 15.03 (the top trendline of the wedge on the daily timeframe also crosses near this level).

Source: Tradingview, City Index

First support below today's lows of 14.3980 is from January 2020 near 14.2729, then the bottom trendline on the daily timeframe near 13.9500

USD/ZAR has been in a downtrend since the March pandemic highs. Although there are both fundamental and technical reasons one may wish to buy the currency pair, do your own research. Don’t just follow a website forum. Due to the leverage traders get in the fx markets, if a trade goes against someone, that person can get carried out very quickly. Use stops and exercise good risk management.

Learn more about forex trading opportunities.