Short Term Outlook of Nikkei Index: Trading Within The Rising Wedge

The Nikkei Index opened lower and fell around 2% on Friday, following the drop of the U.S. market last night.

On the economic, Japan's industrial production fell 3.7% on month in March (-5.0% estimated), and retail sales declined 4.5% (as expected), according to the government. Housing starts dropped 7.6% on year in March (-15.9% expected) and construction orders declined 14.3% (+0.7% in February). Meanwhile, Consumer Confidence Index slid to 21.6 in April (27.6 expected) from 30.9 in March. From those economic data, we could see that Japan's economy is suffering from the effect of COVID-19.

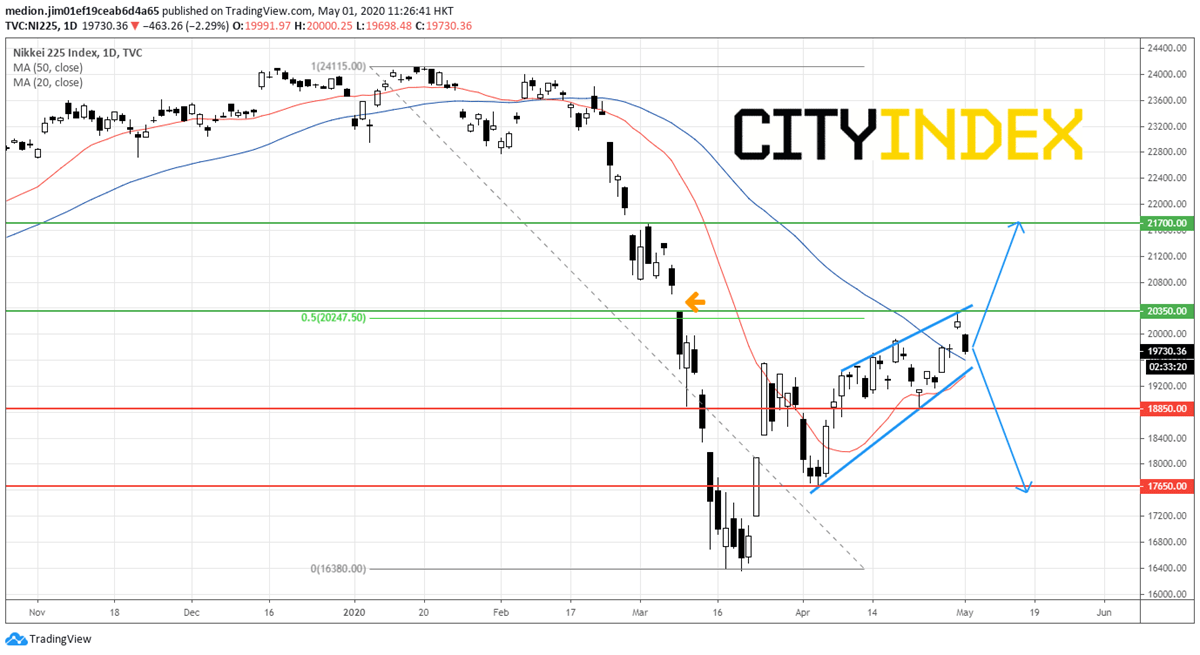

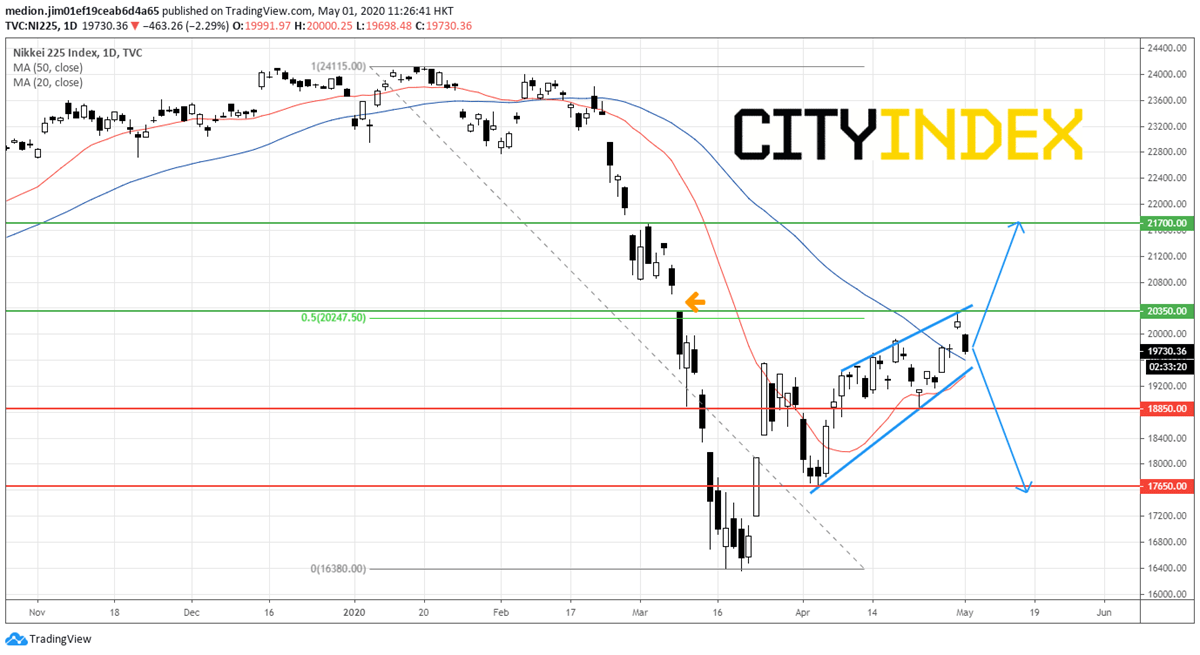

On a daily chart, the Nikkei index retreated from 20350 and filled the gap created on April 30 after touching the 50% retracement between January top and March low.

Currently, the index is trading within the "Rising Wedge". This pattern could be a reversal pattern or continuation pattern. A break below the lower support line could indicate a reversal signal. Oppositely, a break above the upper resistance line would signal the resumption of recent trend. As the prices have not validated the pattern, it is better to watch it closely and stay neutral.

On the upside, a break above the recent high at 20350, where the unfilled gap occurred on March 9 also, would bring a further advance to the resistance level at 21700 (the reaction high on March 3).

On the downside, breaking below the support line would call for a return to the previous low at 18850. Crossing below 18850 would call for a drop to the support level at 17650 (the reaction low on April 3).

Source: GAIN Capital, TradingView

On the economic, Japan's industrial production fell 3.7% on month in March (-5.0% estimated), and retail sales declined 4.5% (as expected), according to the government. Housing starts dropped 7.6% on year in March (-15.9% expected) and construction orders declined 14.3% (+0.7% in February). Meanwhile, Consumer Confidence Index slid to 21.6 in April (27.6 expected) from 30.9 in March. From those economic data, we could see that Japan's economy is suffering from the effect of COVID-19.

On a daily chart, the Nikkei index retreated from 20350 and filled the gap created on April 30 after touching the 50% retracement between January top and March low.

Currently, the index is trading within the "Rising Wedge". This pattern could be a reversal pattern or continuation pattern. A break below the lower support line could indicate a reversal signal. Oppositely, a break above the upper resistance line would signal the resumption of recent trend. As the prices have not validated the pattern, it is better to watch it closely and stay neutral.

On the upside, a break above the recent high at 20350, where the unfilled gap occurred on March 9 also, would bring a further advance to the resistance level at 21700 (the reaction high on March 3).

On the downside, breaking below the support line would call for a return to the previous low at 18850. Crossing below 18850 would call for a drop to the support level at 17650 (the reaction low on April 3).

Source: GAIN Capital, TradingView

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM