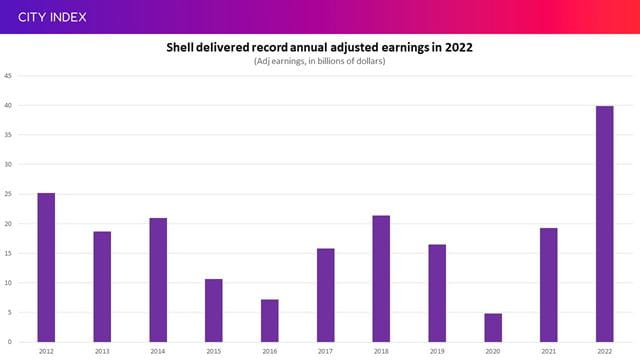

Shell delivers record profits in 2022

Shell’s adjusted earnings rose 54% from the year before in the fourth quarter to $9.8 billion, coming in higher than the $9.0 billion forecast by analysts.

That rounded-off a stellar year that saw the oil and gas giant report record annual profits of almost $40 billion. For context, that smashed past the previous record set back in 2008.

(Source: Bloomberg)

The beat was thanks to the integrated gas division that saw profits jump 47% from the year before and almost treble from the previous quarter, demonstrating that Shell’s gas traders were hugely successful in navigating volatile markets. That countered softer sequential profits from its upstream division producing oil and gas, its marketing department, and its chemicals division – although all of these saw profits improve from the year before.

Shell ups dividend and launches $4 billion buyback

Cashflow was also much stronger than anticipated, allowing more to be funnelled back to investors. It generated almost $5 billion more in operating cashflow than forecast, while free cashflow was some $6.5 billion above what markets anticipated.

That prompted Shell to launch a new $4 billion buyback programme that should be completed before the end of March while raising its quarterly dividend by 15%. It returned around $6.3 billion to investors in the quarter, which was more than covered by its cashflow.

CEO Wael Sawan, who took over at the start of the year, said Shell will remain disciplined while delivering compelling shareholder returns.

Shell’s annual returns through dividends and buybacks hit their highest level since at least this side of the millennium in 2022. Still, that comment is significant considering the cumulative returns seen by Shell shareholders have lagged its international rivals like Exxon Mobil, Chevron and Total since the start of 2020, although it has performed better on this front than its biggest domestic rival BP.

Where next for the Shell share price?

Shell shares have found it more difficult to climb after losing some steam since hitting three-year highs at the start of November, but the stock is continuing to follow a supportive uptrend that can be traced all the way back to July 2021.

This supportive line has been largely tracking the 200-day moving average for years, suggesting we could see the price fall toward 2,274p if it comes under any renewed pressure. Any move below this critical floor opens the door to a fall below 2,240p. The 50-day and 100-day moving averages could provide earlier levels of support.

On the upside, the stock needs to break above 2,446p to reclaim the peak we saw in both June 2022 and more recently this January. This needs to be taken in order to bring that three-year high of 2,557p back into play. Notably, the 24 brokers that cover Shell see even greater upside potential with their average target price currently sat at 3,111p, showing they believe there is over 32% potential upside from current levels and that it can hit new all-time record highs in the next 12 months.

How to trade Shell stock

You can trade Shell shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Shell’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can practice trading risk-free by signing up for our Demo Trading Account.